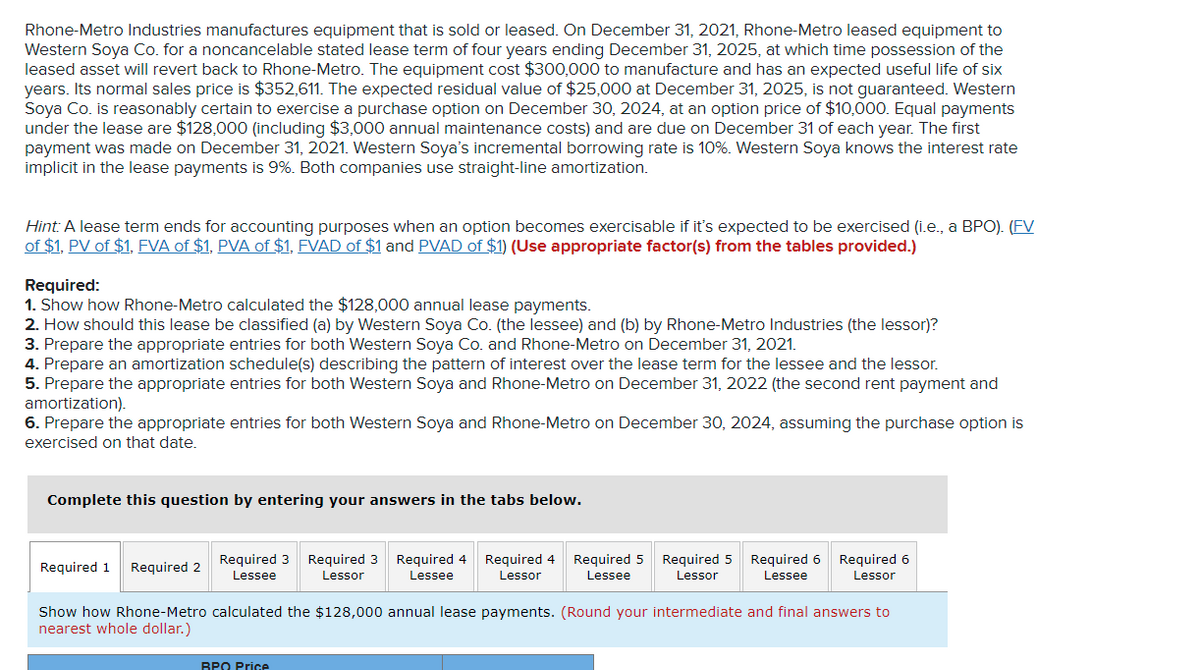

Rhone-Metro Industries manufactures equipment that is sold or leased. On December 31, 2021, Rhone-Metro leased equipment to Western Soya Co. for a noncancelable stated lease term of four years ending December 31, 2025, at which time possession of the leased asset will revert back to Rhone-Metro. The equipment cost $300,000 to manufacture and has an expected useful life of six years. Its normal sales price is $352,611. The expected residual value of $25,000 at December 31, 2025, is not guaranteed. Western Soya Co. is reasonably certain to exercise a purchase option on December 3O, 2024, at an option price of $10,000. Equal payments under the lease are $128,000 (including $3,000 annual maintenance costs) and are due on December 31 of each year. The first payment was made on December 31, 2021. Western Soya's incremental borrowing rate is 10%. Western Soya knows the interest rate implicit in the lease payments is 9%. Both companies use straight-line amortization. Hint: A lease term ends for accounting purposes when an option becomes exercisable if it's expected to be exercised (i.e., a BPO). (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Show how Rhone-Metro calculated the $128,000 annual lease payments. 2. How should this lease be classified (a) by Western Soya Co. (the lessee) and (b) by Rhone-Metro Industries (the lessor)? 3. Prepare the appropriate entries for both Western Soya Co. and Rhone-Metro on December 31, 2021. 4. Prepare an amortization schedule(s) describing the pattern of interest over the lease term for the lessee and the lessor. 5. Prepare the appropriate entries for both Western Soya and Rhone-Metro on December 31, 2022 (the second rent payment and amortization). 6. Prepare the appropriate entries for both Western Soya and Rhone-Metro on December 30, 2024, assuming the purchase option is exercised on that date. Complete this question by entering your answers in the tabs below. Required 2 Required 3 Lessee Required 3 Required 4 Lessor Required 4 Lessor Required 5 Lessee Required 5 Lessor Required 6 Lessee Required 6 Lessor Required 1 Lessee Show how Rhone-Metro calculated the $128,000 annual lease payments. (Round your intermediate and final answers to arest whele dellar)

Rhone-Metro Industries manufactures equipment that is sold or leased. On December 31, 2021, Rhone-Metro leased equipment to Western Soya Co. for a noncancelable stated lease term of four years ending December 31, 2025, at which time possession of the leased asset will revert back to Rhone-Metro. The equipment cost $300,000 to manufacture and has an expected useful life of six years. Its normal sales price is $352,611. The expected residual value of $25,000 at December 31, 2025, is not guaranteed. Western Soya Co. is reasonably certain to exercise a purchase option on December 3O, 2024, at an option price of $10,000. Equal payments under the lease are $128,000 (including $3,000 annual maintenance costs) and are due on December 31 of each year. The first payment was made on December 31, 2021. Western Soya's incremental borrowing rate is 10%. Western Soya knows the interest rate implicit in the lease payments is 9%. Both companies use straight-line amortization. Hint: A lease term ends for accounting purposes when an option becomes exercisable if it's expected to be exercised (i.e., a BPO). (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Show how Rhone-Metro calculated the $128,000 annual lease payments. 2. How should this lease be classified (a) by Western Soya Co. (the lessee) and (b) by Rhone-Metro Industries (the lessor)? 3. Prepare the appropriate entries for both Western Soya Co. and Rhone-Metro on December 31, 2021. 4. Prepare an amortization schedule(s) describing the pattern of interest over the lease term for the lessee and the lessor. 5. Prepare the appropriate entries for both Western Soya and Rhone-Metro on December 31, 2022 (the second rent payment and amortization). 6. Prepare the appropriate entries for both Western Soya and Rhone-Metro on December 30, 2024, assuming the purchase option is exercised on that date. Complete this question by entering your answers in the tabs below. Required 2 Required 3 Lessee Required 3 Required 4 Lessor Required 4 Lessor Required 5 Lessee Required 5 Lessor Required 6 Lessee Required 6 Lessor Required 1 Lessee Show how Rhone-Metro calculated the $128,000 annual lease payments. (Round your intermediate and final answers to arest whele dellar)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 1E: Determining Type of Lease and Subsequent Accounting On January 1, 2019, Caswell Company signs a...

Related questions

Question

100%

NEED ASSISTANCE WITH REQUIRED 4 LESSEE, REQUIRED 4 LESSOR, REQUIRED 5 LESSEE

Transcribed Image Text:Rhone-Metro Industries manufactures equipment that is sold or leased. On December 31, 2021, Rhone-Metro leased equipment to

Western Soya Co. for a noncancelable stated lease term of four years ending December 31, 2025, at which time possession of the

leased asset will revert back to Rhone-Metro. The equipment cost $300,000 to manufacture and has an expected useful life of six

years. Its normal sales price is $352,611. The expected residual value of $25,000 at December 31, 2025, is not guaranteed. Western

Soya Co. is reasonably certain to exercise a purchase option on December 30, 2024, at an option price of $10,000. Equal payments

under the lease are $128,000 (including $3,000 annual maintenance costs) and are due on December 31 of each year. The first

payment was made on December 31, 2021. Western Soya's incremental borrowing rate is 10%. Western Soya knows the interest rate

implicit in the lease payments is 9%. Both companies use straight-line amortization.

Hint: A lease term ends for accounting purposes when an option becomes exercisable if it's expected to be exercised (i.e., a BPO). (FV

of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)

Required:

1. Show how Rhone-Metro calculated the $128,000 annual lease payments.

2. How should this lease be classified (a) by Western Soya Co. (the lessee) and (b) by Rhone-Metro Industries (the lessor)?

3. Prepare the appropriate entries for both Western Soya Co. and Rhone-Metro on December 31, 2021.

4. Prepare an amortization schedule(s) describing the pattern of interest over the lease term for the lessee and the lessor.

5. Prepare the appropriate entries for both Western Soya and Rhone-Metro on December 31, 2022 (the second rent payment and

amortization).

6. Prepare the appropriate entries for both Western Soya and Rhone-Metro on December 30, 2024, assuming the purchase option is

exercised on that date.

Complete this question by entering your answers in the tabs below.

Required 3

Required 3

Required 4

Lessor

Required 4

Required 5

Required 5

Required 6

Required 6

Required 1

Required 2

Lessee

Lessor

Lessee

Lessee

Lessor

Lessee

Lessor

Show how Rhone-Metro calculated the $128,000 annual lease payments. (Round your intermediate and final answers to

nearest whole dollar.)

BPO Price

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT