Jay Company, as lessee, enters into a lease agreement on January 1, 2020, to lease equipment. The following data are relevant to the lease agreement. The term of the noncancellable lease is three years, with no renewal option. Payments o $12,000 are due on January 1, of each year. The fair value of the equipment on January 1, 2020 is $35,000. The equipment has an estimated economic life of five years, and an unguarenteed residual value of $4,000. The equipment reverts back to the lessor at the termination of the lease and is expected have use to the lessor. The lessee is aware that the lessor used an implicit rate of 6%. (Present Value & Future Value Tables are provided on pages 3 and 4) Instructions: 1. Indicate the type of lease Jay has entered into and why (include a list of the Capital Lease Criteria) (Present Value & Future Value Tables are provided on pages 3 and 4) 2. Prepare the journal entries on Jay's books related to the lease agreement for the following dates: (round all amounts to the nearest dollar. Include a partial amortization schedule) a. January 1, 2020 b. December 31, 2020 c. January 1, 2021

Jay Company, as lessee, enters into a lease agreement on January 1, 2020, to lease equipment. The following data are relevant to the lease agreement. The term of the noncancellable lease is three years, with no renewal option. Payments o $12,000 are due on January 1, of each year. The fair value of the equipment on January 1, 2020 is $35,000. The equipment has an estimated economic life of five years, and an unguarenteed residual value of $4,000. The equipment reverts back to the lessor at the termination of the lease and is expected have use to the lessor. The lessee is aware that the lessor used an implicit rate of 6%. (Present Value & Future Value Tables are provided on pages 3 and 4) Instructions: 1. Indicate the type of lease Jay has entered into and why (include a list of the Capital Lease Criteria) (Present Value & Future Value Tables are provided on pages 3 and 4) 2. Prepare the journal entries on Jay's books related to the lease agreement for the following dates: (round all amounts to the nearest dollar. Include a partial amortization schedule) a. January 1, 2020 b. December 31, 2020 c. January 1, 2021

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 1E: Determining Type of Lease and Subsequent Accounting On January 1, 2019, Caswell Company signs a...

Related questions

Question

please help answer (#2 only)

Transcribed Image Text:8:19

ull LTE

e bbhosted.cuny.edu – Private

3 of 4

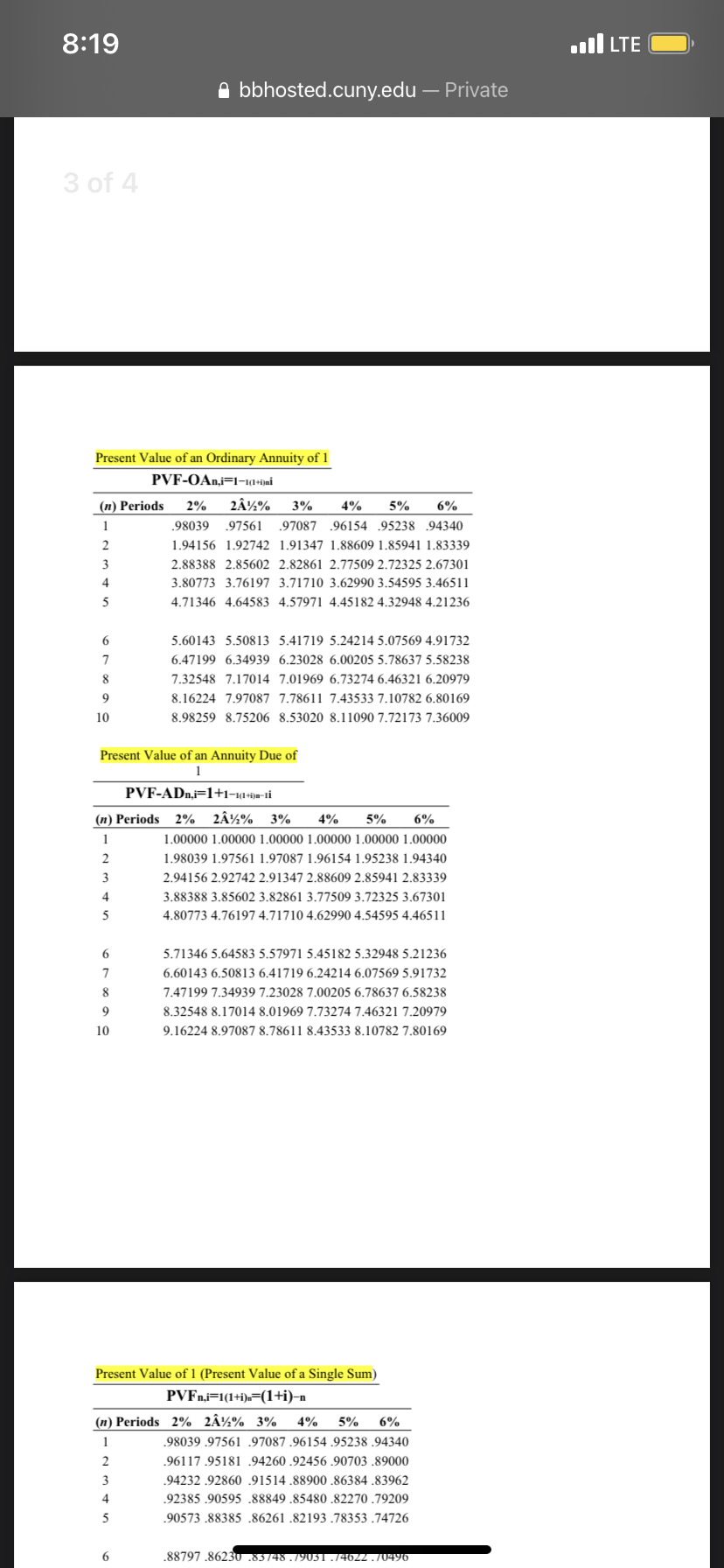

Present Value of an Ordinary Annuity of 1

PVF-OAn,i=1-14-)ni

(n) Periods

2%

2¼%

3%

4%

5%

6%

1

.98039

.97561

.97087

.96154 95238 94340

2

1.94156 1.92742 1.91347 1.88609 1.85941 1.83339

3

2.88388 2.85602 2.82861 2.77509 2.72325 2.67301

4

3.80773 3.76197 3.71710 3.62990 3.54595 3.46511

5

4.71346 4.64583 4.57971 4.45182 4.32948 4.21236

6

5.60143 5.50813 5.41719 5.24214 5.07569 4.91732

6.47199 6.34939 6.23028 6.00205 5.78637 5.58238

8

7.32548 7.17014 7.01969 6.73274 6.46321 6.20979

9

8.16224 7.97087 7.78611 7.43533 7.10782 6.80169

10

8.98259 8.75206 8.53020 8.11090 7.72173 7.36009

Present Value of an Annuity Due of

1

PVF-ADn,i=1+1-4-»-ti

(n) Periods

2%

2¼% 3%

4%

5%

6%

1

1.00000 1.00000 1.00000 1.00000 1.00000 1.00000

1.98039 1.97561 1.97087 1.96154 1.95238 1.94340

3

2.94156 2.92742 2.91347 2.88609 2.85941 2.83339

4

3.88388 3.85602 3.82861 3.77509 3.72325 3.67301

4.80773 4.76197 4.71710 4.62990 4.54595 4.46511

6

5.71346 5.64583 5.57971 5.45182 5.32948 5.21236

6.60143 6.50813 6.41719 6.24214 6.07569 5.91732

8

7.47199 7.34939 7.23028 7.00205 6.78637 6.58238

9

8.32548 8.17014 8.01969 7.73274 7.46321 7.20979

10

9.16224 8.97087 8.78611 8.43533 8.10782 7.80169

Present Value of 1 (Present Value of a Single Sum)

PVFN,i=1(1+i)«=(1+i)-n

(n) Periods 2% 2¼% 3%

4%

5%

6%

1

.98039 .97561 .97087 .96154 .95238 .94340

2

.96117.95181 .94260 .92456 .90703 .89000

3

.94232 .92860 .91514 .88900 .86384 .83962

.92385 .90595 .88849 .85480 .82270 .79209

.90573 .88385 ,86261 ,82193 ,78353 74726

88797 ,86230 83748.79031.746Z2 .70496

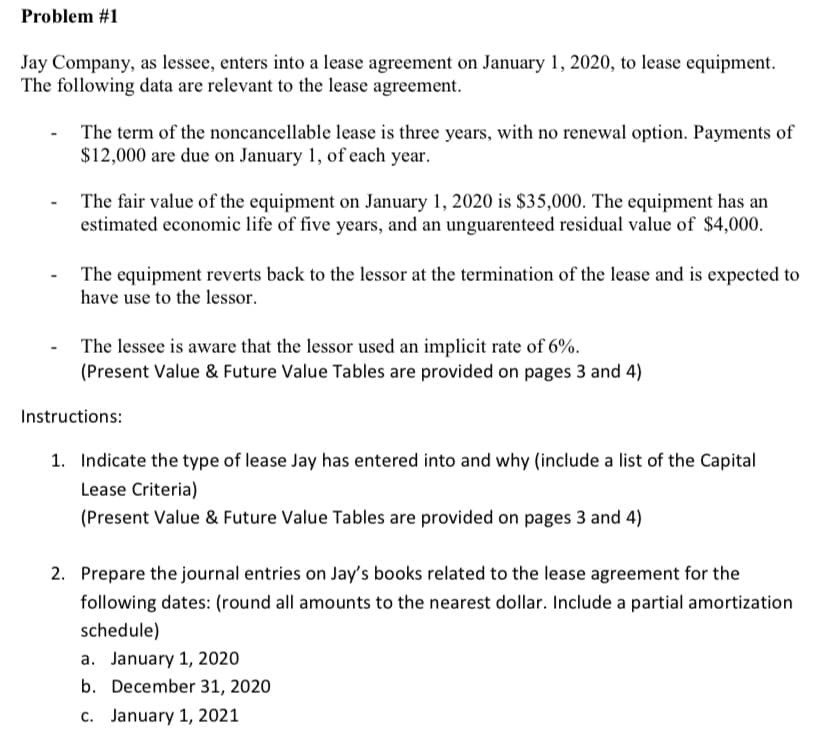

Transcribed Image Text:Problem #1

Jay Company, as lessee, enters into a lease agreement on January 1, 2020, to lease equipment.

The following data are relevant to the lease agreement.

The term of the noncancellable lease is three years, with no renewal option. Payments of

$12,000 are due on January 1, of each year.

The fair value of the equipment on January 1, 2020 is $35,000. The equipment has an

estimated economic life of five years, and an unguarenteed residual value of $4,000.

The equipment reverts back to the lessor at the termination of the lease and is expected to

have use to the lessor.

The lessee is aware that the lessor used an implicit rate of 6%.

(Present Value & Future Value Tables are provided on pages 3 and 4)

Instructions:

1. Indicate the type of lease Jay has entered into and why (include a list of the Capital

Lease Criteria)

(Present Value & Future Value Tables are provided on pages 3 and 4)

2. Prepare the journal entries on Jay's books related to the lease agreement for the

following dates: (round all amounts to the nearest dollar. Include a partial amortization

schedule)

a. January 1, 2020

b. December 31, 2020

c. January 1, 2021

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning