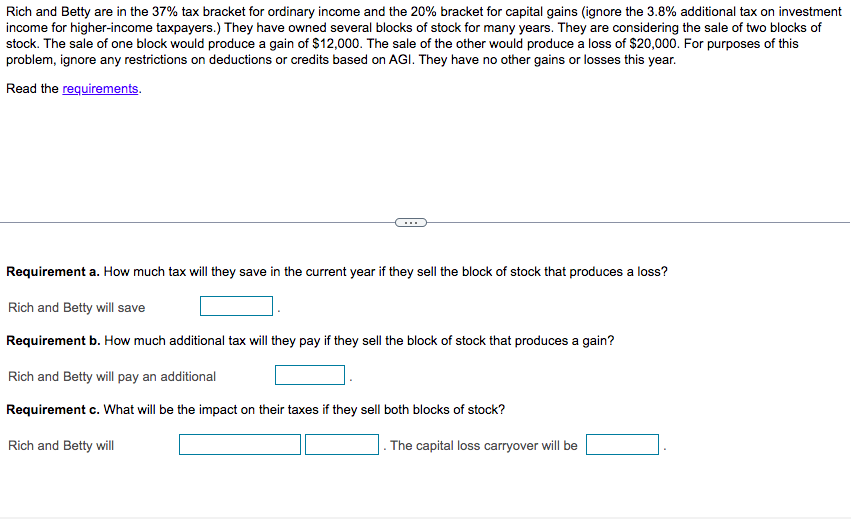

Rich and Betty are in the 37% tax bracket for ordinary income and the 20% bracket for capital gains (ignore the 3.8% additional tax on investme income for higher-income taxpayers.) They have owned several blocks of stock for many years. They are considering the sale of two blocks of stock. The sale of one block would produce a gain of $12,000. The sale of the other would produce a loss of $20,000. For purposes of this problem, ignore any restrictions on deductions or credits based on AGI. They have no other gains or losses this year. Read the requirements. Requirement a. How much tax will they save in the current year if they sell the block of stock that produces a loss? Rich and Betty will save Requirement b. How much additional tax will they pay if they sell the block of stock that produces a gain? Rich and Betty will pay an additional Requirement c. What will be the impact on their taxes if they sell both blocks of stock? Rich and Betty will The capital loss carryover will be

Rich and Betty are in the 37% tax bracket for ordinary income and the 20% bracket for capital gains (ignore the 3.8% additional tax on investme income for higher-income taxpayers.) They have owned several blocks of stock for many years. They are considering the sale of two blocks of stock. The sale of one block would produce a gain of $12,000. The sale of the other would produce a loss of $20,000. For purposes of this problem, ignore any restrictions on deductions or credits based on AGI. They have no other gains or losses this year. Read the requirements. Requirement a. How much tax will they save in the current year if they sell the block of stock that produces a loss? Rich and Betty will save Requirement b. How much additional tax will they pay if they sell the block of stock that produces a gain? Rich and Betty will pay an additional Requirement c. What will be the impact on their taxes if they sell both blocks of stock? Rich and Betty will The capital loss carryover will be

Chapter7: Losses—deductions And Limitations

Section: Chapter Questions

Problem 57P

Related questions

Question

100%

Hw.12.

Transcribed Image Text:Rich and Betty are in the 37% tax bracket for ordinary income and the 20% bracket for capital gains (ignore the 3.8% additional tax on investment

income for higher-income taxpayers.) They have owned several blocks of stock for many years. They are considering the sale of two blocks of

stock. The sale of one block would produce a gain of $12,000. The sale of the other would produce a loss of $20,000. For purposes of this

problem, ignore any restrictions on deductions or credits based on AGI. They have no other gains or losses this year.

Read the requirements.

Requirement a. How much tax will they save in the current year if they sell the block of stock that produces a loss?

Rich and Betty will save

Requirement b. How much additional tax will they pay if they sell the block of stock that produces a gain?

Rich and Betty will pay an additional

Requirement c. What will be the impact on their taxes if they sell both blocks of stock?

Rich and Betty will

The capital loss carryover will be

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you