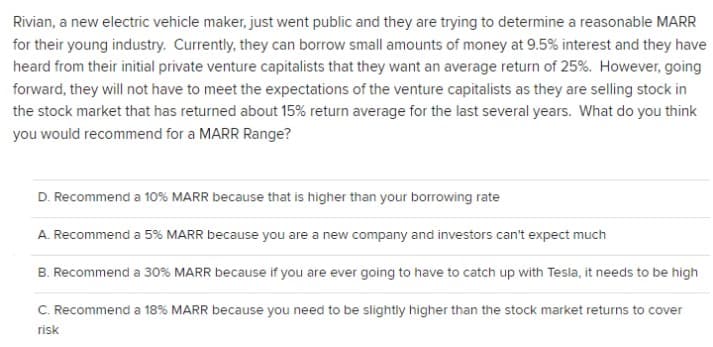

Rivian, a new electric vehicle maker, just went public and they are trying to determine a reasonable MARR for their young industry. Currently, they can borrow small amounts of money at 9.5% interest and they have heard from their initial private venture capitalists that they want an average return of 25%. However, going forward, they will not have to meet the expectations of the venture capitalists as they are selling stock in the stock market that has returned about 15% return average for the last several years. What do you think you would recommend for a MARR Range? D. Recommend a 10% MARR because that is higher than your borrowing rate A. Recommend a 5% MARR because you are a new company and investors can't expect much B. Recommend a 30% MARR because if you are ever going to have to catch up with Tesla, it needs to be high C. Recommend a 18% MARR because you need to be slightly higher than the stock market returns to cover risk

Rivian, a new electric vehicle maker, just went public and they are trying to determine a reasonable MARR for their young industry. Currently, they can borrow small amounts of money at 9.5% interest and they have heard from their initial private venture capitalists that they want an average return of 25%. However, going forward, they will not have to meet the expectations of the venture capitalists as they are selling stock in the stock market that has returned about 15% return average for the last several years. What do you think you would recommend for a MARR Range? D. Recommend a 10% MARR because that is higher than your borrowing rate A. Recommend a 5% MARR because you are a new company and investors can't expect much B. Recommend a 30% MARR because if you are ever going to have to catch up with Tesla, it needs to be high C. Recommend a 18% MARR because you need to be slightly higher than the stock market returns to cover risk

Chapter14: Property Transact Ions: Capital Gains And Losses, § 1231, And Recapture Provisions

Section: Chapter Questions

Problem 43P

Related questions

Question

Pls help

Transcribed Image Text:Rivian, a new electric vehicle maker, just went public and they are trying to determine a reasonable MARR

for their young industry. Currently, they can borrow small amounts of money at 9.5% interest and they have

heard from their initial private venture capitalists that they want an average return of 25%. However, going

forward, they will not have to meet the expectations of the venture capitalists as they are selling stock in

the stock market that has returned about 15% return average for the last several years. What do you think

you would recommend for a MARR Range?

D. Recommend a 10% MARR because that is higher than your borrowing rate

A. Recommend a 5% MARR because you are a new company and investors can't expect much

B. Recommend a 30% MARR because if you are ever going to have to catch up with Tesla, it needs to be high

C. Recommend a 18% MARR because you need to be slightly higher than the stock market returns to cover

risk

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning