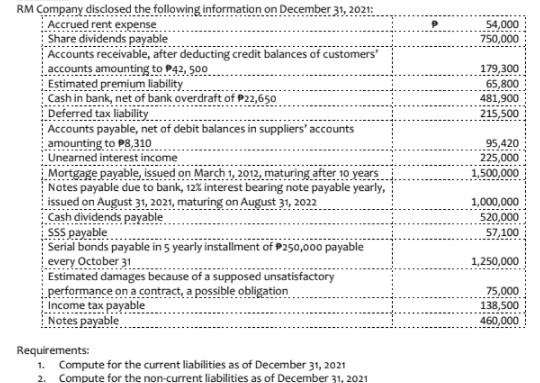

RM Company disclosed the following information on December 31, 2021: Accrued rent expense Share dividends payable Accounts receivable, after deducting credit balances of customers" accounts amounting to P42, 500 Estimated premium liability Cash in bank, net of bank overdraft of P22,650 Deferred tax liability Accounts payable, net of debit balances in suppliers' accounts amounting to P8,310 Unearned interest income Mortgage payable, issued on March 1, 2012, maturing after 10 years Notes payable due to bank, 12% interest bearing note payable yearly, issued on August 31, 2021, maturing on August 31, 2022 Cash dividends payable SSS payable Serial bonds payable in 5 yearly installment of P250,00o payable every October 31 Estimated damages because of a supposed unsatisfactory performance on a contract, a possible obligation Income tax payable Notes payable 54,000 750,000 179,300 65,800 481,900 215,500 95,420 225,000 1,500,000 1,000,000 520,000 57,100 1,250,000 75,000 138,500 460,000 Requirements: 1. Compute for the current liabilities as of December 31, 2021 2. Compute for the non-current liabilities as of December 31, 2021

Bad Debts

At the end of the accounting period, a financial statement is prepared by every company, then at that time while preparing the financial statement, the company determines among its total receivable amount how much portion of receivables is collected by the company during that accounting period.

Accounts Receivable

The word “account receivable” means the payment is yet to be made for the work that is already done. Generally, each and every business sells its goods and services either in cash or in credit. So, when the goods are sold on credit account receivable arise which means the company is going to get the payment from its customer to whom the goods are sold on credit. Usually, the credit period may be for a very short period of time and in some rare cases it takes a year.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps