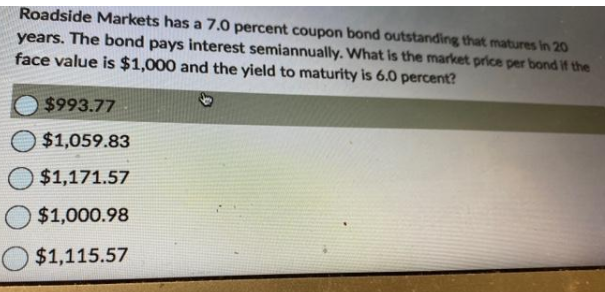

Roadside Markets has a 7.0 percent coupon bond outstanding that matures in 20 years. The bond pays interest semiannually. What is the market price per bond if the face value is $1,000 and the yield to maturity is 6.0 percent? $993.77 $1,059.83 $1,171.57 $1,000.98 $1,115.57

Q: Aggregate consumption will certainly increase if

A: Please check the solution in step 2

Q: a. The equilibrium price level and real GDP in this economy are respectively OA. 80; $10 trillion.…

A: Price level in economics refers to inflation or the purchasing power of money. In other words,…

Q: Your income increased by 20%. The resultant impact on your demand curve is Select one: No changes…

A: Introduction: The demand for a commodity depends on various factors including its own price. In the…

Q: To understand the differences in global trade operations in comparison to those carried out between…

A: In the business environment the globalization and nationalization are often considered being…

Q: 5. Assume a closed economy with exogenous investment I and government spending G. The consumption…

A: Given Consumption function C=a+bYd ......(1) Head tax = T Proportion tax = tY where…

Q: Question 19 "Calls have come from many quarters to do away with the general fuel levy, given its…

A: Opportunity Cost is defined as cost of the next best alternative or the cost that has been forgone.…

Q: Question 3. The installation costs of a battery system in a home were $5,000 in 2017. Assume that…

A:

Q: What happen to the economy of the Philippines when Filipino people mostly unemployed

A: A person is said to be unemployed when he or she is actively looking for job at prevailing market…

Q: Use one new firm diagram with ATC, MC, and AVC to show when a decrease in demand will not lead a…

A: The cost curves are drawn in the following diagram. Fig 1 If the…

Q: Given the following: C(YT) = 200 +0.75(Y-T) I(r) = 80 - 20r L(r,Y) = Y − 90r G = 200 T = 75 M = 2500…

A: Given information C=200+0.75(Y-T) I=80-20r Md=Y-90r G=200 T=75 M=2500 P=4

Q: Suppose that a lumber-producing firm had a demand for the ability to burn sawdust given by: Q = 90-…

A: Demand is an economic idea that relates to a consumer's desire to purchase goods and services and…

Q: heighborhood lawns for extra money. Suppose that he would be willing to mow one lawn for $13, a…

A: A consumer surplus happens when the price consumers pay for an item or service is not exactly the…

Q: . For a particular commodity, the supply and demands functions are given by S(q) = 2q, D(q) =…

A: The equilibrium is established where the demand and supply are equal. The consumer surplus the gap…

Q: The country of Arrakis produces only three goods, as listed in the table below. Using 2019 as the…

A: Gross domestic product (GDP) measures the market value of final goods and services produced by an…

Q: 8. Apply the Keynesian IS-LM model. Suppose the government reduces its spending but the central bank…

A: Here we are given the IS-LM model. And at the intersection of the IS & LM curves the equilibrium…

Q: Suppose the price elasticity of demand for cigarettes is 0.85 and that the government can…

A: A product's price elasticity of demand is an estimation of how sensitive the quantity demanded is to…

Q: Inverse demand functions are PA = 10 - QA and PB = 5 - 0.5QB. Under a two part tariff, fixed fee…

A: Given information Pa=10-Qa Pb=5-0.5Qb

Q: The table sets out the data for an economy when the government's budget is balanced. Real interest…

A: The real interest rate is the rate of interest an investor, saver or lender gets after permitting…

Q: Quantity Demanded 1 2 3 Mambr Quantity Supplied 7 5 Price $7 6 5 65432 4402019ub 14 stw boeromanicos…

A: The equilibrium price is established where the demand and supply are equal.

Q: Explain why the price and/or quantity changed. Refer to any supply or demand determinants that…

A: An equilibrium occurs in the market occurs at such a price where the quantity demanded is equal to…

Q: How much money should be deposited each year for 8 years starting 1 year from today, if you wish to…

A: Introduction: It is given that the interest rate is 12% and the amount of annuity that is withdrawn…

Q: As part of a market research project, you survey six random people to see how much gas per week they…

A: We show that quantity of demannded six random people per week given below

Q: The following equation relates spending on medical care in thousands of dollars on age in years:…

A: Here we are given the estimated regression line where the dependent variable is "medical spending"…

Q: 2. PR sells phones for £400 and has observed a recent drop in sales from 1,500 units a month,…

A: 2) The question states the impact of reduction in price of phones of competitor on the sales of the…

Q: Changes in the interest rate affect planned investment spending and income level. This change in…

A: The relationship between the money market and the goods market is explained by the IS-LM model. The…

Q: The model of national economy is characterised by the following da Household consumption C-400+0.9…

A: In economics, the marginal propensity to consume is a metric that quantifies induced consumption,…

Q: With fixed costs of $400, a firm has average total costs of $3 and average variable costs of $2.50.…

A: Here, given information is: Fixed cost: $400 ATC: $3 AVC: $2.50 To find: output

Q: inflation rises from 10 to 14 percent, explain what happens to real and nominal interest rates…

A: Inflation refers to the chronic rise in the general price level. Inflation affects the real returns…

Q: Please take your time to help me because so many answers are wrong. Help with b, c and d Consider an…

A: To determine economic health, numerous measures and formulas are used to find the output, GDP,…

Q: The price of milk increases from $2.85 per gallon to $3.15 per gallon and the quantity supplied…

A: Elasticity is the concept used by economists to measure the responsiveness of supply to changes in…

Q: What event raises the equilibrium real interest rate and decreases the equilibrium quantity of…

A: Leftward shift in supply curve = Increase in price level and decrease in quantity. Rightward…

Q: Mr Sam had invested dollar 1,000 now and it answer 6% interest rate how much it would be worth after…

A: Introduction: It is given that Sam invested the amount of 1000 that earns a 6% interest rate and we…

Q: How much is accumulated over two years in each of the following savings plans? a.$40at the end of…

A: Given data for the part (a) of the question is as below, Deposited amount at end of the month:…

Q: 3. Determine the annual worth (AW) of a project, where it requires capital investment of BD 50,000,…

A: A minimum acceptable rate of return (MARR) is the minimum profit an investor expects to make from an…

Q: Using below information answer questions 12, 13 and 14 Suppose there is a market that has market…

A: tax levied on goods increased the price. as we know that price is set by the market mechanism demand…

Q: Which of the following production functions does NOT exhibit constant returns to scale? a. Y =…

A: Constant returns to scale occurs when we increase the inputs by a constant, say t, and output…

Q: Which of these economic variables is procyclical and coincident? the government bond spread stock…

A: Business Cycle: The business cycle implies the economic cycle. It is the upward and downward…

Q: For each of the following goods, explain why a free-rider problem arises or how it is avoided.…

A: Introduction When a person enjoys the benefit of goods and services without paying the price,…

Q: Next to each of the following items indicate in the table which items belongs to GDP and which to…

A: Introduction Gross domestic product is defined as the market value of all final goods and services…

Q: Economists in Funlandia, a closed economy, have collected the following information about the…

A: Private savings are the total of household and business savings.

Q: The principal goal of the aggregate demand and aggregate supply model is to explain the

A: We know, Equilibrium is where demand curve equals supply curve. And At equilibrium condition, the…

Q: 4. Consider a Stackelberg game where firm 2's reaction function is given by R₂(9₁) = (a — 91-c)/2.…

A: Here we are given the reaction function of firm 2 which provides the profit maximization level of…

Q: a. What do the the three reg b. What do the unemploym- c. Do these nur force particip

A: The unemployment rate tells that for a fast-growing economy the unemployment rate decreases…

Q: Suppose that business travelers and vacationers have the following demand for airline tickets from…

A: Meaning of Price Elasticity of Demand: The price elasticity of demand refers to the situation…

Q: if money is worth 10% compounded monthly, compute the present value of a perpetuity of P2500 payable…

A: The concept of perpetuity refers to an infinite series of identical flow of cash. The present value…

Q: 3. In a Stackelberg game, what do we call the firm that moves first? What do we call the firm that…

A: Game theory is the game of strategy. Payoff matrix shows the payoffs of the players.

Q: The economy is depicted in the graph to the right. a. Suppose, there are new discoveries of key raw…

A: Both short-run supply (SRAS) curve and long-run supply (LRAS) curve can be shifted by changes caused…

Q: One criticism of GDP as a measure of welfare is that it fails to account for reductions in leisure…

A: GDP is the value of all final goods and services produced within the domestic territory of a country…

Q: Please help with this from c and d. Please make it make sense because I have seen answers that dont…

A: Dear Student as you have asked for solution of Part C and D only, kindly find the images attached…

Q: If Starbucks’s data analytics department estimates the income elasticity of demand for its coffee to…

A: Income elasticity of demand measures the responsiveness of change in demand to change in income.…

Step by step

Solved in 2 steps with 2 images

- The adjacent table presents annuity factors for various discount rates and payment periods up to 10 years. The present value of $80,000 per year for 10 years at a discount rate of 4 percent is $A bond with a face value of $1,000 has 8 years until maturity, has a coupon rate of 8%, and sells for $1,100. What is the yield to maturity if interest is paid once a year? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 4 decimal places. What is the yield to maturity if interest is paid semiannually? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 4 decimal places.What is the market price of a zero-coupon bond (that is, a bond that will not pay any coupon payments) that will mature in 20 years and has the face value of $1,000? Assume the yield to maturity is 6.2%, and that it will compound semiannually. Group of answer choices $372.53 $350.24 $300.27 $294.89

- Which of the following has the highest future value? A. $100 saved for 2 years at 10 percent interest B. $130 saved for 2 years at 7 percent interest C. $120 saved for 2 years at 8 percent interest D. $110 saved for 2 years at 9 percent interestWhich of the following $1,000 face-value securities has the highest yield to maturity? A) a 5 percent coupon bond with a price of $600 B) a 5 percent coupon bond with a price of $800 C) a 5.25 percent coupon bond with a price of $1,200 D) a 5 percent coupon bond with a price of $120Henry has a five-year 1,000,000 bond with coupons at 6% convertible semi-annually. Fiona buys a 10-year bond with face amount X and coupons at 6% convertible semi-annually. Both bonds are redeemable at par. Henry and Fiona both buy their bonds to yield 4% compounded semi-annually and immediately sell them to an investor who will yield 2% compounded semi-annually. Fiona earns the same amount of profit as Henry. Calculate X.

- Two treasury bonds (with semi-annual coupons) are traded. The first bond matures in six months, has coupon rate 4% per annum, and has dirty price $96.42. The second bond matures in twelve months, has coupon rate 11% per annum, and has dirty price $97.79. What is the twelve month spot rate with semi-annual compounding? 13.49% 13.08% 13.94% 13.44%You invest $200 in a savings account paying an annual interest rate of 2 percent. How much will your investment be worth at the end of five year, assuming all interest earned remains in the account? Multiple Choice 400.00 $220.82 $202.00 $243.33A 2-year maturity bond with face value of $1,000 makes annual coupon payments of $80 and is selling at face value. What will be the rate of return on the bond if its yield to maturity at the end of the year is: Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. 1. 6% - 2. 8% - 3. 10% -

- Suppose a bank grants a loan to one customer for a term of five years. The customer promises the bank an annual interest payment of 10 percent. The face (par) value of the loan is $1,000 which is also the current market value as the loan’s current YTM is 10 percent. What is the loan’s duration?Find the limiting value of Macaulay duration as maturity is increased to infinity of an 8% coupon bond that is trading at a yield of 8% and pays coupons every 6 months. Please round your numerical answer to the nearest integer.Please expalin the right answer A 10-year, annual payment corporate coupon bond has an expected return of 11 percent and a required return of 10 percent. The bond's market price is: A) greater than its present value. B) less than par. C) less than its expected rate or return. D) less than its present value. E) $1,000.00.