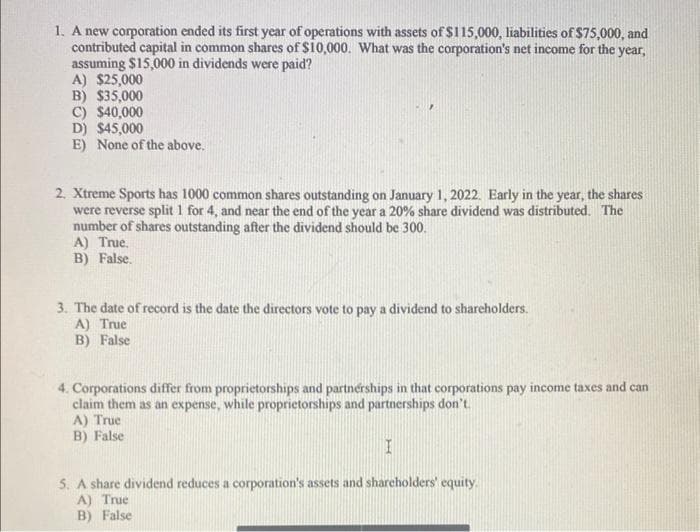

1. A new corporation ended its first year of operations with assets of $115,000, liabilities of $75,000, and contributed capital in common shares of $10,000. What was the corporation's net income for the year, assuming $15,000 in dividends were paid? A) $25,000 B) $35,000 C) $40,000 D) $45,000 E) None of the above.

1. A new corporation ended its first year of operations with assets of $115,000, liabilities of $75,000, and contributed capital in common shares of $10,000. What was the corporation's net income for the year, assuming $15,000 in dividends were paid? A) $25,000 B) $35,000 C) $40,000 D) $45,000 E) None of the above.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter14: Statement Of Cash Flows

Section: Chapter Questions

Problem 25BEB

Related questions

Question

Transcribed Image Text:1. A new corporation ended its first year of operations with assets of $115,000, liabilities of $75,000, and

contributed capital in common shares of $10,000. What was the corporation's net income for the year,

assuming $15,000 in dividends were paid?

A) $25,000

B) $35,000

C) $40,000

D) $45,000

E) None of the above.

2. Xtreme Sports has 1000 common shares outstanding on January 1, 2022. Early in the year, the shares

were reverse split 1 for 4, and near the end of the year a 20% share dividend was distributed. The

number of shares outstanding after the dividend should be 300.

A) True.

B) False.

3. The date of record is the date the directors vote to pay a dividend to shareholders.

A) True

B) False

4. Corporations differ from proprietorships and partnerships in that corporations pay income taxes and can

claim them as an expense, while proprietorships and partnerships don't.

A) True

B) False

I

5. A share dividend reduces a corporation's assets and shareholders' equity.

A) True

B) False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning