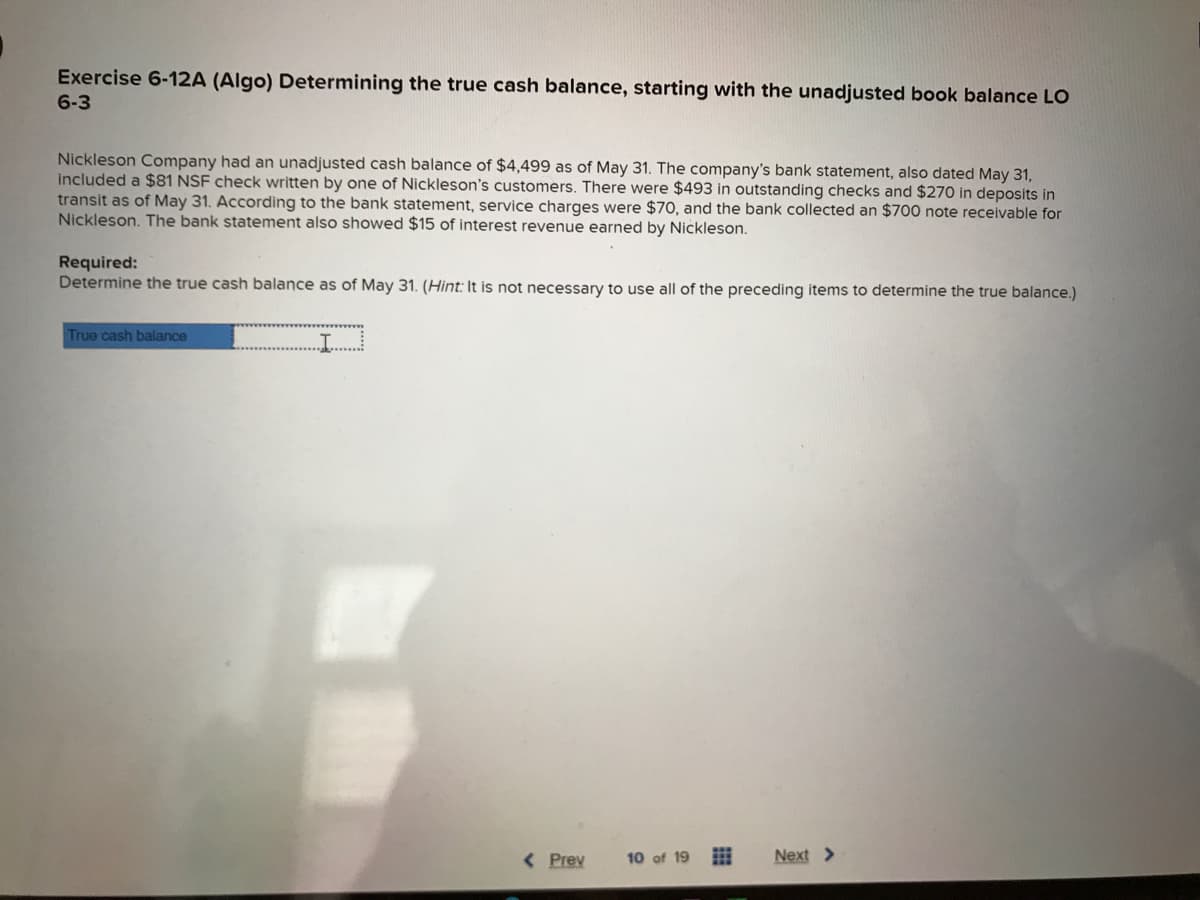

Exercise 6-12A (Algo) Determining the true cash balance, starting with the unadjusted book balance LO 6-3 Nickleson Company had an unadjusted cash balance of $4,499 as of May 31. The company's bank statement, also dated May 31, included a $81 NSF check written by one of Nickleson's customers. There were $493 in outstanding checks and $270 in deposits in transit as of May 31. According to the bank statement, service charges were $70, and the bank collected an $700 note receivable for Nickleson. The bank statement also showed $15 of interest revenue earned by Nickleson. Required: Determine the true cash balance as of May 31. (Hint: It is not necessary to use all of the preceding items to determine the true balance.) True cash balance I...

Exercise 6-12A (Algo) Determining the true cash balance, starting with the unadjusted book balance LO 6-3 Nickleson Company had an unadjusted cash balance of $4,499 as of May 31. The company's bank statement, also dated May 31, included a $81 NSF check written by one of Nickleson's customers. There were $493 in outstanding checks and $270 in deposits in transit as of May 31. According to the bank statement, service charges were $70, and the bank collected an $700 note receivable for Nickleson. The bank statement also showed $15 of interest revenue earned by Nickleson. Required: Determine the true cash balance as of May 31. (Hint: It is not necessary to use all of the preceding items to determine the true balance.) True cash balance I...

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter4: Internal Control And Cash

Section: Chapter Questions

Problem 60BPSB

Related questions

Question

Transcribed Image Text:Exercise 6-12A (Algo) Determining the true cash balance, starting with the unadjusted book balance LO

6-3

Nickleson Company had an unadjusted cash balance of $4,499 as of May 31. The company's bank statement, also dated May 31,

included a $81 NSF check written by one of Nickleson's customers. There were $493 in outstanding checks and $270 in deposits in

transit as of May 31. According to the bank statement, service charges were $70, and the bank collected an $700 note receivable for

Nickleson. The bank statement also showed $15 of interest revenue earned by Nickleson.

Required:

Determine the true cash balance as of May 31. (Hint: It is not necessary to use all of the preceding items to determine the true balance.)

True cash balance

..I.....

< Prev

10 of 19

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning