RON T PAGE alifornians Vote to Triple Cigarette Tax acramento, CA-Californians voted to more than triple the state tax on cigarettes from $0.87 a ck to $2.87 a pack, beginning April 1, 2017. hti-smoking groups say the higher price will reduce smoking in the state. They foresee the oportion of smokers falling from the current 11.6 percent of the population to as low as 7.1 percent 2020. e state treasurer is also applauding the higher price, but for different reasons. According to the

RON T PAGE alifornians Vote to Triple Cigarette Tax acramento, CA-Californians voted to more than triple the state tax on cigarettes from $0.87 a ck to $2.87 a pack, beginning April 1, 2017. hti-smoking groups say the higher price will reduce smoking in the state. They foresee the oportion of smokers falling from the current 11.6 percent of the population to as low as 7.1 percent 2020. e state treasurer is also applauding the higher price, but for different reasons. According to the

Principles of Microeconomics (MindTap Course List)

8th Edition

ISBN:9781305971493

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter6: Supply, Demand And Government Policies

Section: Chapter Questions

Problem 4PA

Related questions

Question

Was able to get the first two, but having trouble figure out the answers to one decimal place on the following:

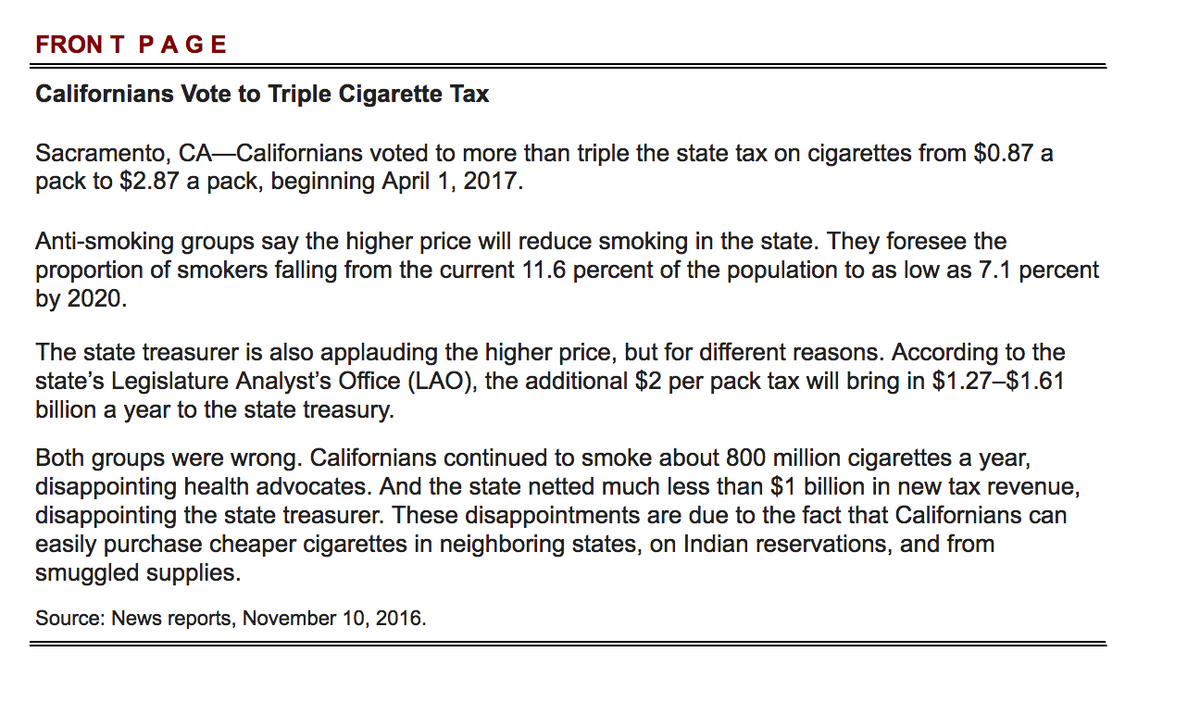

Transcribed Image Text:FRON T PAGE

Californians Vote to Triple Cigarette Tax

Sacramento, CA-Californians voted to more than triple the state tax on cigarettes from $0.87 a

pack to $2.87 a pack, beginning April 1, 2017.

Anti-smoking groups say the higher price will reduce smoking in the state. They foresee the

proportion of smokers falling from the current 11.6 percent of the population to as low as 7.1 percent

by 2020.

The state treasurer is also applauding the higher price, but for different reasons. According to the

state's Legislature Analyst's Office (LAO), the additional $2 per pack tax will bring in $1.27-$1.61

billion a year to the state treasury.

Both groups were wrong. Californians continued to smoke about 800 million cigarettes a year,

disappointing health advocates. And the state netted much less than $1 billion in new tax revenue,

disappointing the state treasurer. These disappointments are due to the fact that Californians can

easily purchase cheaper cigarettes in neighboring states, on Indian reservations, and from

smuggled supplies.

Source: News reports, November 10, 2016.

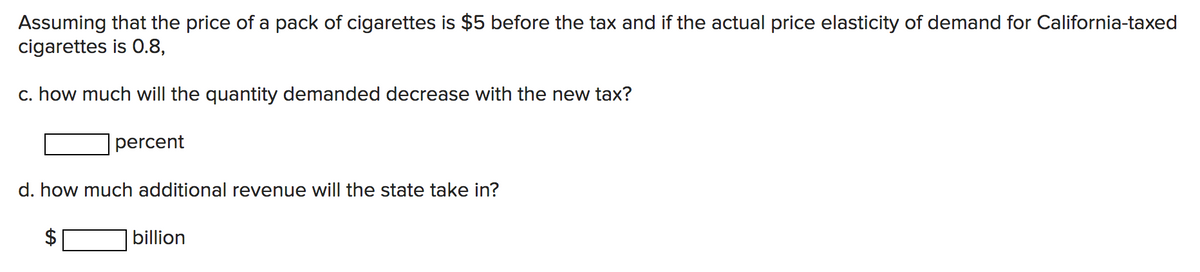

Transcribed Image Text:Assuming that the price of a pack of cigarettes is $5 before the tax and if the actual price elasticity of demand for California-taxed

cigarettes is 0.8,

c. how much will the quantity demanded decrease with the new tax?

percent

d. how much additional revenue will the state take in?

billion

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax