Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 2RE: Akron Incorporated purchased an asset at the beginning of Year 1 for 375,000. The estimated residual...

Related questions

Question

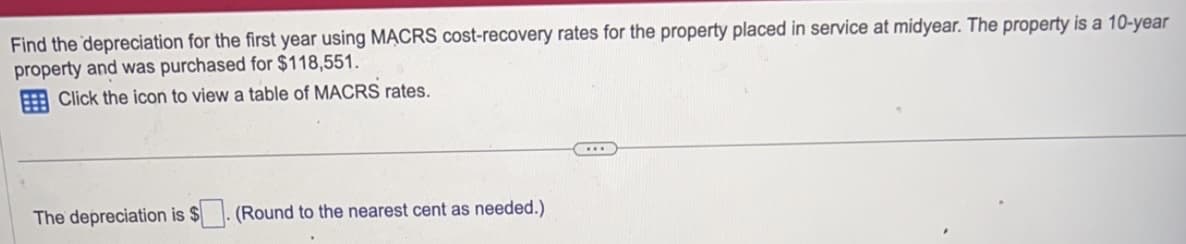

Transcribed Image Text:Find the depreciation for the first year using MACRS cost-recovery rates for the property placed in service at midyear. The property is a 10-year

property and was purchased for $118,551.

Click the icon to view a table of MACRS rates.

The depreciation is $

(Round to the nearest cent as needed.)

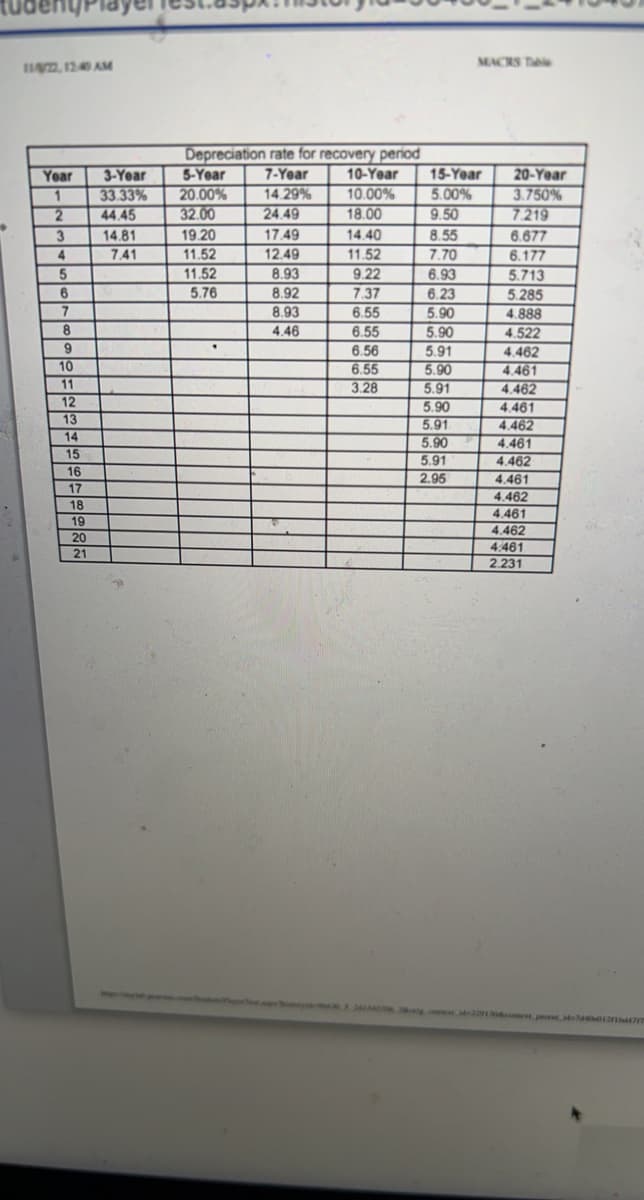

Transcribed Image Text:11/4/22, 12:40 AM

Year

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

----~~

16

17

18

19

20

21

3-Year

33.33%

44.45

14.81

7.41

Depreciation rate for recovery period

7-Year

14.29%

24.49

17.49

12.49

8.93

8.92

8.93

4.46

5-Year

20.00%

32.00

19.20

11.52

11.52

5.76

.

10-Year

10.00%

18.00

14.40

11.52

9.22

7.37

6.55

6.55

6.56

6.55

3.28

15-Year

5.00%

9.50

8.55

7.70

6.93

6.23

5.90

5.90

5.91

5.90

5.91

5.90

MACRS Table

5.91

5.90 SP

5.91

2.95

20-Year

3.750%

7.219

6.677

6.177

5.713

5.285

4.888

4.522

4.462

4.461

4.462

4.461

4.462

4.461

4.462

4.461

4.462

4.461

4.462

4:461

2.231

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College