Round the answers to NPV (Option 1), and NPV (Option 2) to the nearest dollar. Round all other answers to two decimal places where applicable.

Round the answers to NPV (Option 1), and NPV (Option 2) to the nearest dollar. Round all other answers to two decimal places where applicable.

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 17P

Related questions

Question

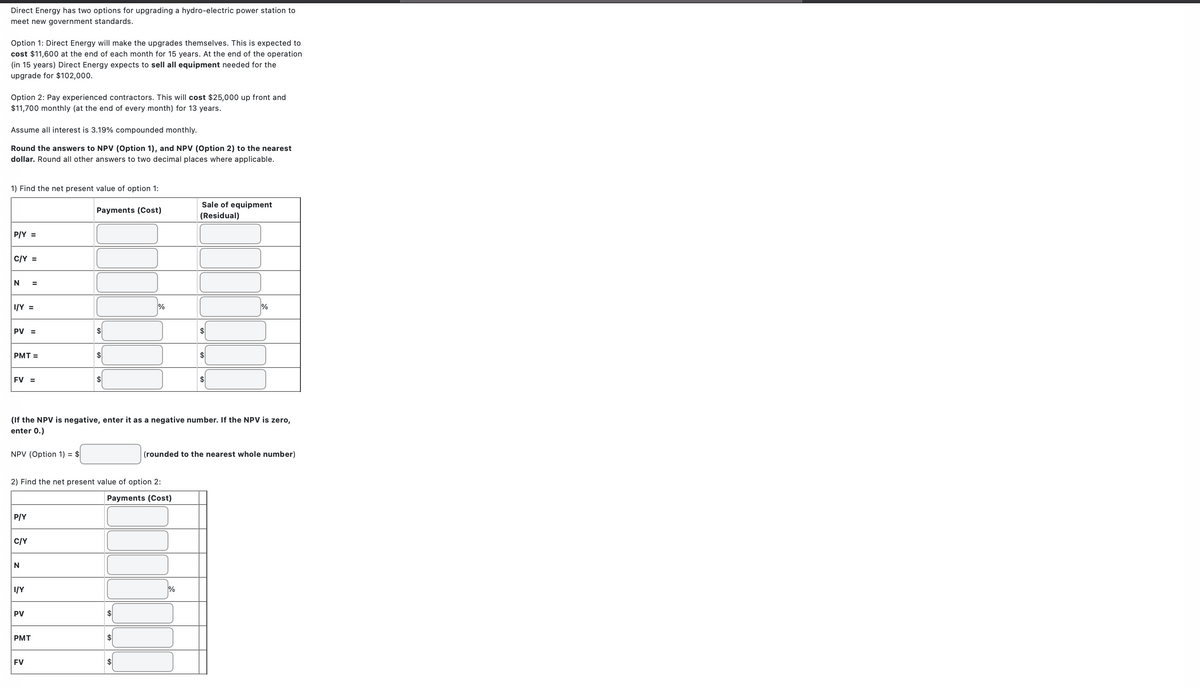

Transcribed Image Text:Direct Energy has two options for upgrading a hydro-electric power station to

meet new government standards.

Option 1: Direct Energy will make the upgrades themselves. This is expected to

cost $11,600 at the end of each month for 15 years. At the end of the operation

(in 15 years) Direct Energy expects to sell all equipment needed for the

upgrade for $102,000.

Option 2: Pay experienced contractors. This will cost $25,000 up front and

$11,700 monthly (at the end of every month) for 13 years.

Assume all interest is 3.19% compounded monthly.

Round the answers to NPV (Option 1), and NPV (Option 2) to the nearest

dollar. Round all other answers to two decimal places where applicable.

1) Find the net present value of option 1:

P/Y =

C/Y =

N =

I/Y =

PV =

PMT=

FV =

NPV (Option 1) = $

P/Y

C/Y

N

I/Y

PV

Payments (Cost)

2) Find the net present value of option 2:

Payments (Cost)

PMT

$

FV

$

(If the NPV is negative, enter it as a negative number. If the NPV is zero,

enter 0.)

$

$

%

$

$

Sale of equipment

(Residual)

$

%

$

$

%

(rounded to the nearest whole number)

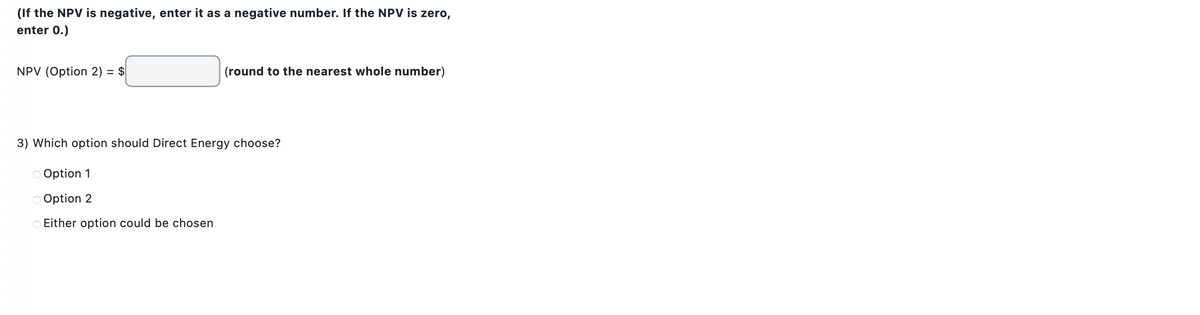

Transcribed Image Text:(If the NPV is negative, enter it as a negative number. If the NPV is zero,

enter 0.)

NPV (Option 2) = $

(round to the nearest whole number)

3) Which option should Direct Energy choose?

Option 1

Option 2

Either option could be chosen

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning