rsula is employed by USA Corporation. USA Corporation provides medical and health, disability, and group term life insurance coverage for its employees. Premiums attributable to Ursula were as follows: (Click the icon to view the premiums attributable to Ursula) uring the year, Ursula suffered a heart attack and subsequently died. Before her death, Ursula collected $14,000 as a reimbursement for medical expenses and $5.000 of disability income. Upon her death, Ursula's husband collected the $40,000 face value of the life surance policy ead the requirements equirement a. What amount can USA Corporation deduct for premiums attributable to Ursula? (Enter a "0" if none of the premiums are deductible.) he premiums attributable to Ursula that USA Corporation can deduct is $ 4,100 equirement b. How much must Ursula include in income relative to the premiums paid? (Enter a "0" if none of the premiums paid should be included in income.) S he amount that Ursula must include in income relative to the premiums paid is equirement c. How much must Ursula include in income relative to the insurance benefits? (Enter a "0" of none of the insurance benefits are to be included in income.) Irsula must report income of he must report this income because none of the amounts received are taxable. relative to the disability income. relative to the disability and medical expense reimbursement. relative to the life insurance. relative to the life insurance and medical expense reimbursment. relative to the medical expense reimbursment.

rsula is employed by USA Corporation. USA Corporation provides medical and health, disability, and group term life insurance coverage for its employees. Premiums attributable to Ursula were as follows: (Click the icon to view the premiums attributable to Ursula) uring the year, Ursula suffered a heart attack and subsequently died. Before her death, Ursula collected $14,000 as a reimbursement for medical expenses and $5.000 of disability income. Upon her death, Ursula's husband collected the $40,000 face value of the life surance policy ead the requirements equirement a. What amount can USA Corporation deduct for premiums attributable to Ursula? (Enter a "0" if none of the premiums are deductible.) he premiums attributable to Ursula that USA Corporation can deduct is $ 4,100 equirement b. How much must Ursula include in income relative to the premiums paid? (Enter a "0" if none of the premiums paid should be included in income.) S he amount that Ursula must include in income relative to the premiums paid is equirement c. How much must Ursula include in income relative to the insurance benefits? (Enter a "0" of none of the insurance benefits are to be included in income.) Irsula must report income of he must report this income because none of the amounts received are taxable. relative to the disability income. relative to the disability and medical expense reimbursement. relative to the life insurance. relative to the life insurance and medical expense reimbursment. relative to the medical expense reimbursment.

Microeconomics A Contemporary Intro

10th Edition

ISBN:9781285635101

Author:MCEACHERN

Publisher:MCEACHERN

Chapter13: Capital, Interest, Entrepreneurship, And Corporate Finance

Section: Chapter Questions

Problem 6QFR

Related questions

Question

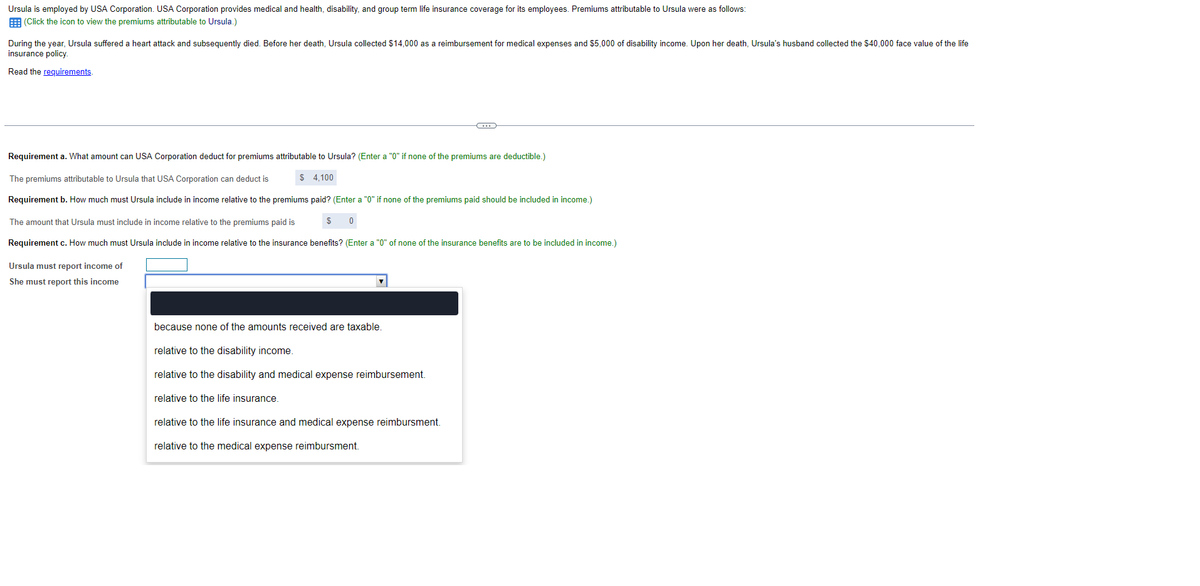

Transcribed Image Text:Ursula is employed by USA Corporation. USA Corporation provides medical and health, disability, and group term life insurance coverage for its employees. Premiums attributable to Ursula were as follows:

(Click the icon to view the premiums attributable to Ursula.)

During the year, Ursula suffered a heart attack and subsequently died. Before her death, Ursula collected $14,000 as a reimbursement for medical expenses and $5,000 of disability income. Upon her death, Ursula's husband collected the $40,000 face value of the life

insurance policy.

Read the requirements.

Requirement a. What amount can USA Corporation deduct for premiums attributable to Ursula? (Enter a "0" if none of the premiums are deductible.)

The premiums attributable to Ursula that USA Corporation can deduct is

Requirement b. How much must Ursula include in income relative to the premiums paid? (Enter a "0" if none of the premiums paid should be included in income.)

The amount that Ursula must include in income relative to the premiums paid is

0

Requirement c. How much must Ursula include in income relative to the insurance benefits? (Enter a "0" of none of the insurance benefits are to be included in income.)

Ursula must report income of

She must report this income

$ 4.100

C

because none of the amounts received are taxable.

relative to the disability income.

relative to the disability and medical expense reimbursement.

relative to the life insurance.

relative to the life insurance and medical expense reimbursment.

relative to the medical expense reimbursment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you