Rubin Enterprises had the following sales-related transactions on a recent day: a. Billed customer $28,600 on account for services already provided. b. Collected $5,715 in cash for services to be provided in the future. c. The customer complained about aspects of the services provided in Transaction a. To maintain a good relationship with this customer, Rubin granted an allowance of $1,500 off the list price. The customer had not yet paid for the services. d. Rubin provided the services for the customer in Transaction b. Additionally, Rubin granted an allowance of $480 because the services were provided after the promised date. Because the customer had already paid, Rubin paid the $480 allowance in cash. Required: Prepare the necessary journal entry (or entries) for each of these transactions. PAGE 1 IMPACT ON FINANCIAL STATEMENTS JOURNAL BALANCE SHEET INCOME STATEMENT DATE DESCRIPTION POST. REF. DEBIT ASSETS LIABILITIES REVENUE EXPENSES NET INCOME CREDIT EQUITY 2 3 4 8

Rubin Enterprises had the following sales-related transactions on a recent day: a. Billed customer $28,600 on account for services already provided. b. Collected $5,715 in cash for services to be provided in the future. c. The customer complained about aspects of the services provided in Transaction a. To maintain a good relationship with this customer, Rubin granted an allowance of $1,500 off the list price. The customer had not yet paid for the services. d. Rubin provided the services for the customer in Transaction b. Additionally, Rubin granted an allowance of $480 because the services were provided after the promised date. Because the customer had already paid, Rubin paid the $480 allowance in cash. Required: Prepare the necessary journal entry (or entries) for each of these transactions. PAGE 1 IMPACT ON FINANCIAL STATEMENTS JOURNAL BALANCE SHEET INCOME STATEMENT DATE DESCRIPTION POST. REF. DEBIT ASSETS LIABILITIES REVENUE EXPENSES NET INCOME CREDIT EQUITY 2 3 4 8

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 18PA: Post the following July transactions to T-accounts for Accounts Receivable, Sales Revenue, and Cash,...

Related questions

Question

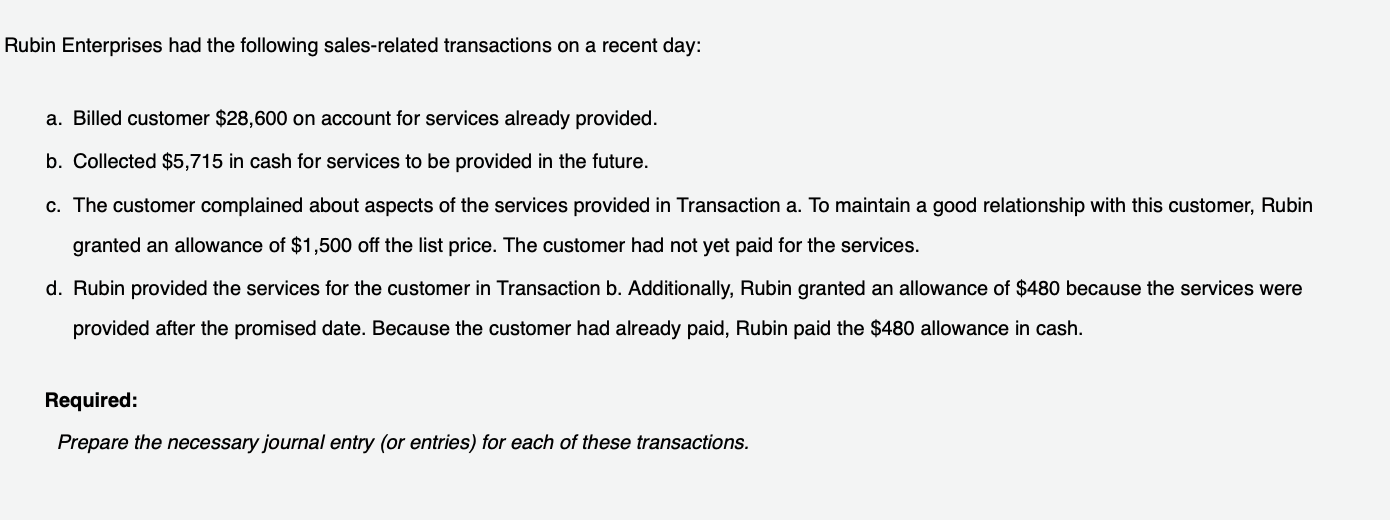

Transcribed Image Text:Rubin Enterprises had the following sales-related transactions on a recent day:

a. Billed customer $28,600 on account for services already provided.

b. Collected $5,715 in cash for services to be provided in the future.

c. The customer complained about aspects of the services provided in Transaction a. To maintain a good relationship with this customer, Rubin

granted an allowance of $1,500 off the list price. The customer had not yet paid for the services.

d. Rubin provided the services for the customer in Transaction b. Additionally, Rubin granted an allowance of $480 because the services were

provided after the promised date. Because the customer had already paid, Rubin paid the $480 allowance in cash.

Required:

Prepare the necessary journal entry (or entries) for each of these transactions.

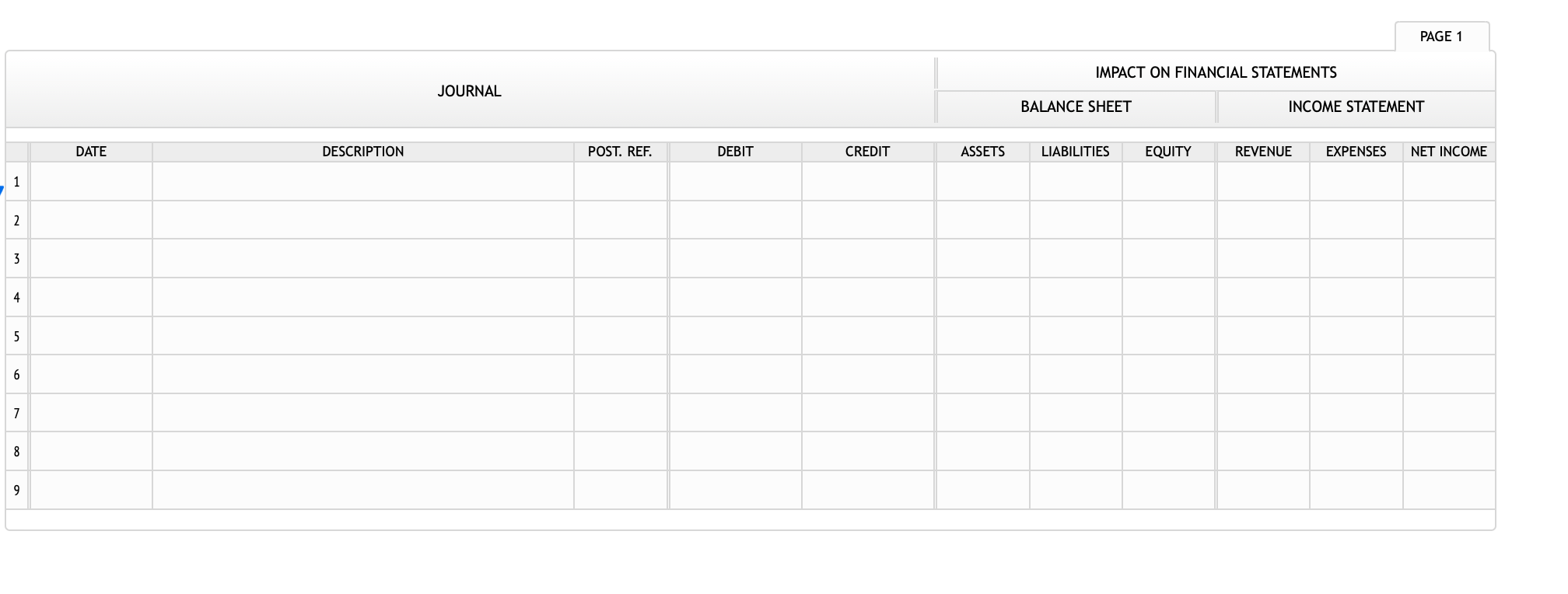

Transcribed Image Text:PAGE 1

IMPACT ON FINANCIAL STATEMENTS

JOURNAL

BALANCE SHEET

INCOME STATEMENT

DATE

DESCRIPTION

POST. REF.

DEBIT

ASSETS

LIABILITIES

REVENUE

EXPENSES

NET INCOME

CREDIT

EQUITY

2

3

4

8

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning