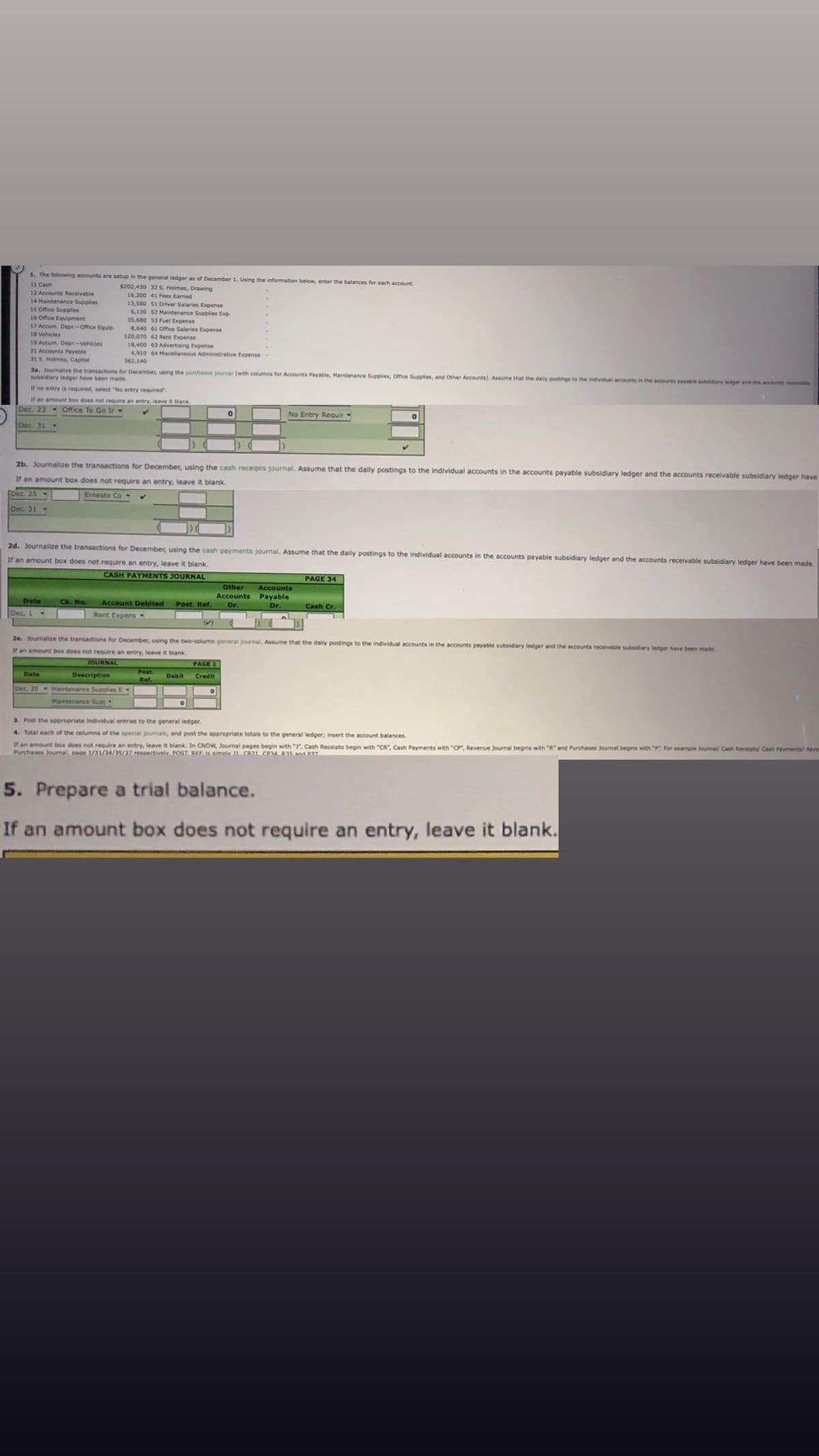

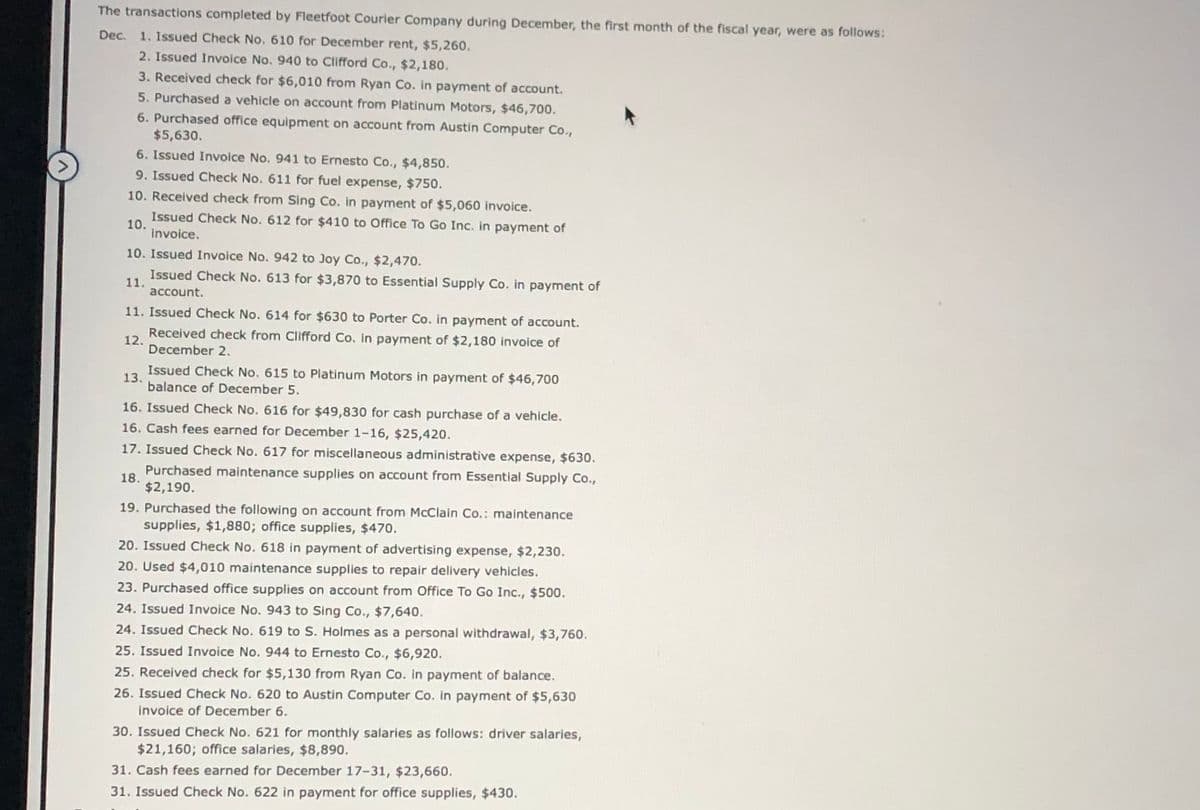

The transactions completed by Fleetfoot Courier Company during December, the first month of the fiscal year, were as follows: Dec. 1. Issued Check No. 610 for December rent, $5,260. 2. Issued Invoice No. 940 to Clifford Co., $2,180. 3. Received check for $6,010 from Ryan Co. in payment of account. 5. Purchased a vehicle on account from Platinum Motors, $46,700. 6. Purchased office equipment on account from Austin Computer Co., $5,630. 6. Issued Invoice No. 941 to Ernesto Co., $4,850. 9. Issued Check No. 611 for fuel expense, $750. 10. Received check from Sing Co. in payment of $5,060 invoice. Issued Check No. 612 for $410 to Office To Go Inc. in payment of 10. Invoice. 10. Issued Invoice No. 942 to Joy Co., $2,470. Issued Check No. 613 for $3,870 to Essential Supply Co. in payment of 11. account. 11. Issued Check No. 614 for $630 to Porter Co. in payment of account. Received check from Clifford Co. In payment of $2,180 invoice of 12. December 2. Issued Check No. 615 to Platinum Motors in payment of $46,700 13. balance of December 5. 16. Issued Check No. 616 for $49,830 for cash purchase of a vehicle. 16. Cash fees earned for December 1-16, $25,420. 17. Issued Check No. 617 for miscellaneous administrative expense, $630. Purchased maintenance supplies on account from Essential Supply Co., 18. $2,190. 19. Purchased the following on account from McClain Co.: maintenance supplies, $1,880; office supplies, $470. 20. Issued Check No. 618 in payment of advertising expense, $2,230. 20. Used $4,010 maintenance supplies to repair delivery vehicles. 23. Purchased office supplies on account from Office To Go Inc., $500. 24. Issued Invoice No. 943 to Sing Co., $7,640. 24. Issued Check No. 619 to S. Holmes as a personal withdrawal, $3,760. 25. Issued Invoice No. 944 to Ernesto Co., $6,920. 25. Received check for $5,130 from Ryan Co. in payment of balance. 26. Issued Check No. 620 to Austin Computer Co. in payment of $5,630 invoice of December 6. 30. Issued Check No. 621 for monthly salaries as follows: driver salaries, $21,160; office salaries, $8,890. 31. Cash fees earned for December 17-31, $23,660. 31. Issued Check No. 622 in payment for office supplies, $430.

Bad Debts

At the end of the accounting period, a financial statement is prepared by every company, then at that time while preparing the financial statement, the company determines among its total receivable amount how much portion of receivables is collected by the company during that accounting period.

Accounts Receivable

The word “account receivable” means the payment is yet to be made for the work that is already done. Generally, each and every business sells its goods and services either in cash or in credit. So, when the goods are sold on credit account receivable arise which means the company is going to get the payment from its customer to whom the goods are sold on credit. Usually, the credit period may be for a very short period of time and in some rare cases it takes a year.

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 9 images