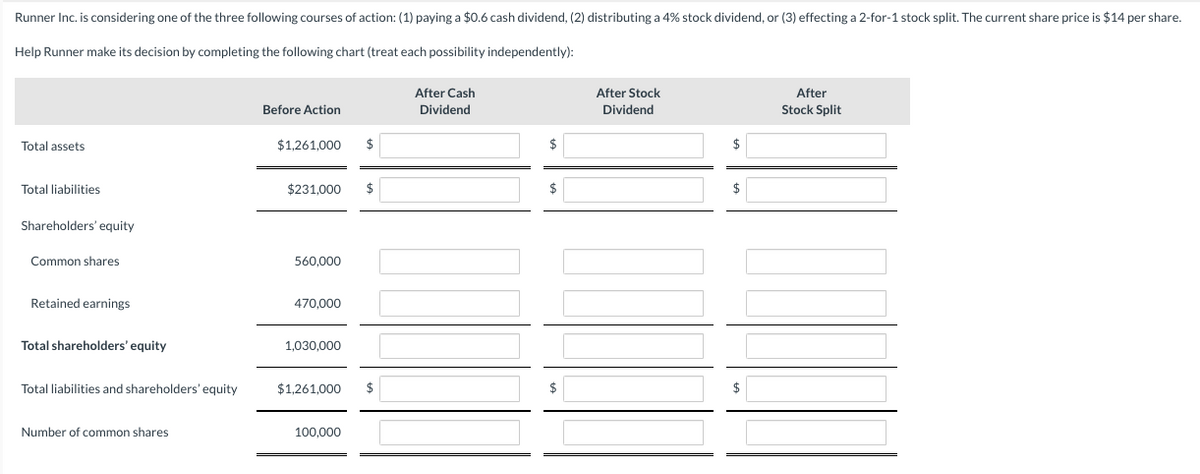

Runner Inc. is considering one of the three following courses of action: (1) paying a $0.6 cash dividend, (2) distributing a 4% stock dividend, or (3) effecting a 2-for-1 stock split. The current share price is $14 per share. Help Runner make its decision by completing the following chart (treat each possibility independently): Total assets Total liabilities Shareholders' equity Common shares Retained earnings Total shareholders' equity Total liabilities and shareholders' equity Number of common shares Before Action $1,261,000 $ $231,000 $ 560,000 470,000 1,030,000 $1,261,000 100,000 $ After Cash Dividend $ After Stock Dividend After Stock Split

Runner Inc. is considering one of the three following courses of action: (1) paying a $0.6 cash dividend, (2) distributing a 4% stock dividend, or (3) effecting a 2-for-1 stock split. The current share price is $14 per share. Help Runner make its decision by completing the following chart (treat each possibility independently): Total assets Total liabilities Shareholders' equity Common shares Retained earnings Total shareholders' equity Total liabilities and shareholders' equity Number of common shares Before Action $1,261,000 $ $231,000 $ 560,000 470,000 1,030,000 $1,261,000 100,000 $ After Cash Dividend $ After Stock Dividend After Stock Split

Chapter15: Dividend Policy

Section: Chapter Questions

Problem 12P

Related questions

Question

Hi there,

How do i calculate the missing values?

Transcribed Image Text:Runner Inc. is considering one of the three following courses of action: (1) paying a $0.6 cash dividend, (2) distributing a 4% stock dividend, or (3) effecting a 2-for-1 stock split. The current share price is $14 per share.

Help Runner make its decision by completing the following chart (treat each possibility independently):

Total assets

Total liabilities

Shareholders' equity

Common shares

Retained earnings

Total shareholders' equity

Total liabilities and shareholders' equity

Number of common shares

Before Action

$1,261,000

$231,000

560,000

470,000

1,030,000

$1,261,000

100,000

$

$

$

After Cash

Dividend

$

$

After Stock

Dividend

$

After

Stock Split

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning