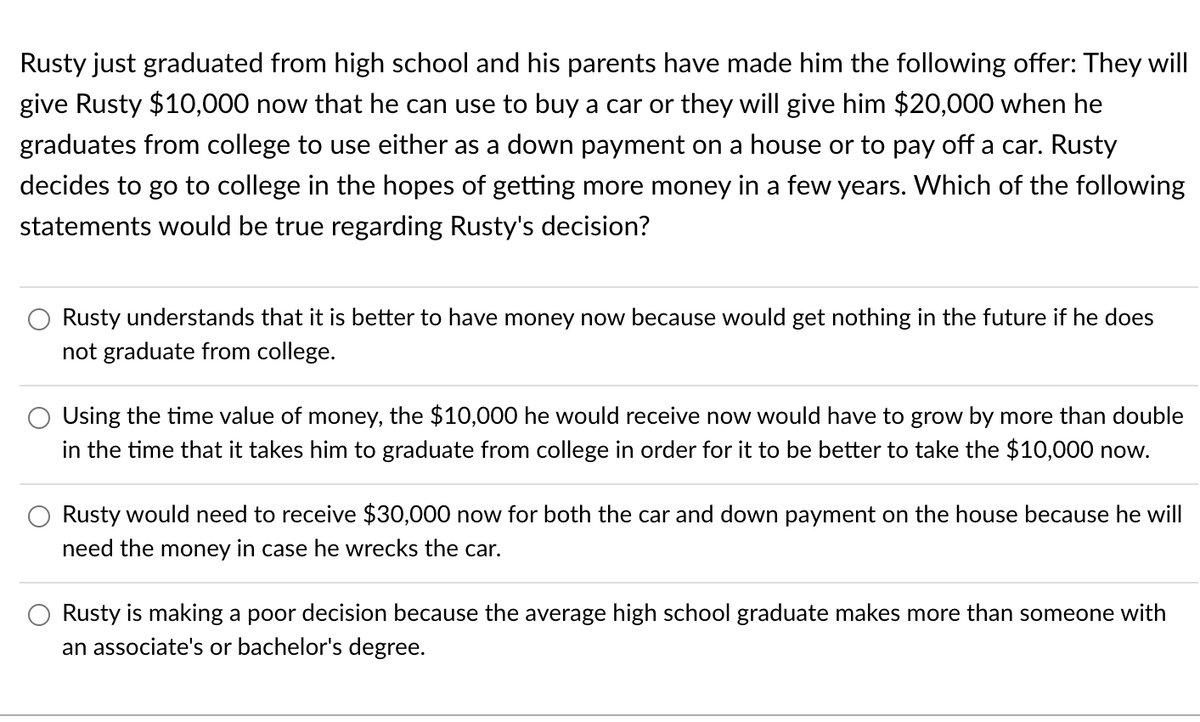

Rusty just graduated from high school and his parents have made him the following offer: They will give Rusty $10,000 now that he can use to buy a car or they will give him $20,000 when he graduates from college to use either as a down payment on a house or to pay off a car. Rusty decides to go to college in the hopes of getting more money in a few years. Which of the following statements would be true regarding Rusty's decision? Rusty understands that it is better to have money now because would get nothing in the future if he does not graduate from college. Using the time value of money, the $10,000 he would receive now would have to grow by more than double in the time that it takes him to graduate from college in order for it to be better to take the $10,000 now. Rusty would need to receive $30,000 now for both the car and down payment on the house because he will need the money in case he wrecks the car. Rusty is making a poor decision because the average high school graduate makes more than someone with an associate's or bachelor's degree.

Rusty just graduated from high school and his parents have made him the following offer: They will give Rusty $10,000 now that he can use to buy a car or they will give him $20,000 when he graduates from college to use either as a down payment on a house or to pay off a car. Rusty decides to go to college in the hopes of getting more money in a few years. Which of the following statements would be true regarding Rusty's decision? Rusty understands that it is better to have money now because would get nothing in the future if he does not graduate from college. Using the time value of money, the $10,000 he would receive now would have to grow by more than double in the time that it takes him to graduate from college in order for it to be better to take the $10,000 now. Rusty would need to receive $30,000 now for both the car and down payment on the house because he will need the money in case he wrecks the car. Rusty is making a poor decision because the average high school graduate makes more than someone with an associate's or bachelor's degree.

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter27: Time Value Of Money (compound)

Section: Chapter Questions

Problem 6E

Related questions

Question

Transcribed Image Text:Rusty just graduated from high school and his parents have made him the following offer: They will

give Rusty $10,000 now that he can use to buy a car or they will give him $20,000 when he

graduates from college to use either as a down payment on a house or to pay off a car. Rusty

decides to go to college in the hopes of getting more money in a few years. Which of the following

statements would be true regarding Rusty's decision?

Rusty understands that it is better to have money now because would get nothing in the future if he does

not graduate from college.

Using the time value of money, the $10,000 he would receive now would have to grow by more than double

in the time that it takes him to graduate from college in order for it to be better to take the $10,000 now.

Rusty would need to receive $30,000 now for both the car and down payment on the house because he will

need the money in case he wrecks the car.

Rusty is making a poor decision because the average high school graduate makes more than someone with

an associate's or bachelor's degree.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT