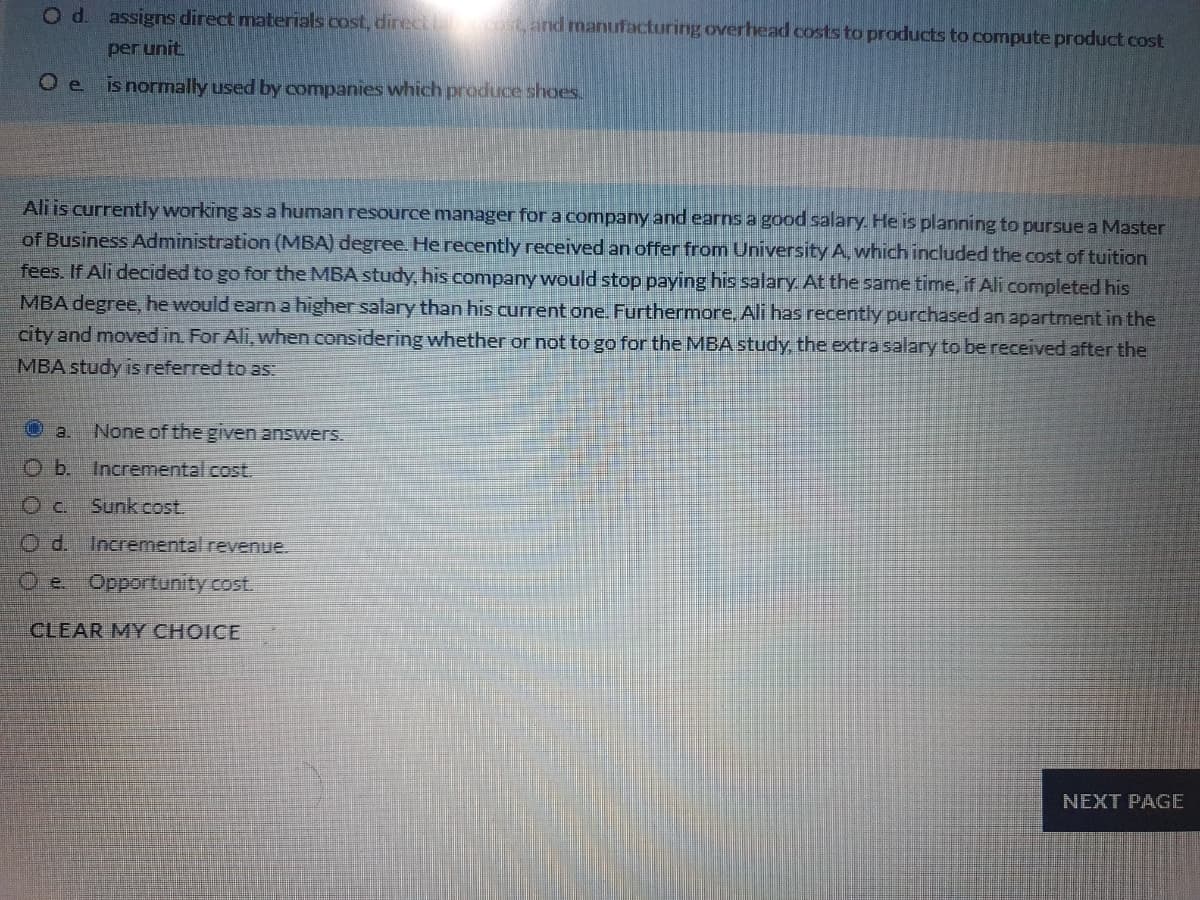

Ali is currently working as a human resource manager for a company and earns a good salary. He is planning to pursue a Master of Business Administration (MBA) degree. He recently received an offer from University A, which included the cost of tuition fees. If Ali decided to go for the MBA study, his company would stop paying his salary. At the same time, if Ali completed his MBA degree, he would earn a higher salary than his current one. Furthermore, Ali has recently purchased an apartment in the city and moved in. For Ali, when considering whether or not to go for the MBA study, the extra salary to be received after the MBA study is referred to as: Oa. None of the given answers. O b. Incremental cost. Oc. Sunk cost. Od. Incremental revenue. O e. Opportunity cost.

Ali is currently working as a human resource manager for a company and earns a good salary. He is planning to pursue a Master of Business Administration (MBA) degree. He recently received an offer from University A, which included the cost of tuition fees. If Ali decided to go for the MBA study, his company would stop paying his salary. At the same time, if Ali completed his MBA degree, he would earn a higher salary than his current one. Furthermore, Ali has recently purchased an apartment in the city and moved in. For Ali, when considering whether or not to go for the MBA study, the extra salary to be received after the MBA study is referred to as: Oa. None of the given answers. O b. Incremental cost. Oc. Sunk cost. Od. Incremental revenue. O e. Opportunity cost.

Chapter8: Standard Costs And Variances

Section: Chapter Questions

Problem 2EB: Salley is developing material and labor standards for her company. She finds that it costs $0.55 per...

Related questions

Question

٢٦

Transcribed Image Text:Od. assigns direct materials cost, direci

st and manufacturing overhead costs to products to compute product cost

per unit

O e isnormally used by companies which produce shoes.

Ali is currently working asa human resource manager for a company and earns a good salary. He is planning to pursue a Master

of Business Administration (MBA) degree. He recently received an offer from University A, which included the cost of tuition

fees. If Ali decided to go for the MBA study, his company would stop paying his salary. At the same time, if Ali completed his

MBA degree, he would earn a higher salary than his current one. Furthermore, Ali has recently purchased an apartment in the

city and moved in. For Ali, when considering whether or not to go for the MBA study, the extra salary to be received after the

MBA study is referred to as:

O a.

None of the given answers.

O b. Incremental.cost.

Oc.

Sunk cost.

Od. Incremental revenue.

O e. Opportunity cost.

CLEAR MY CHOICE

NEXT PAGE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning