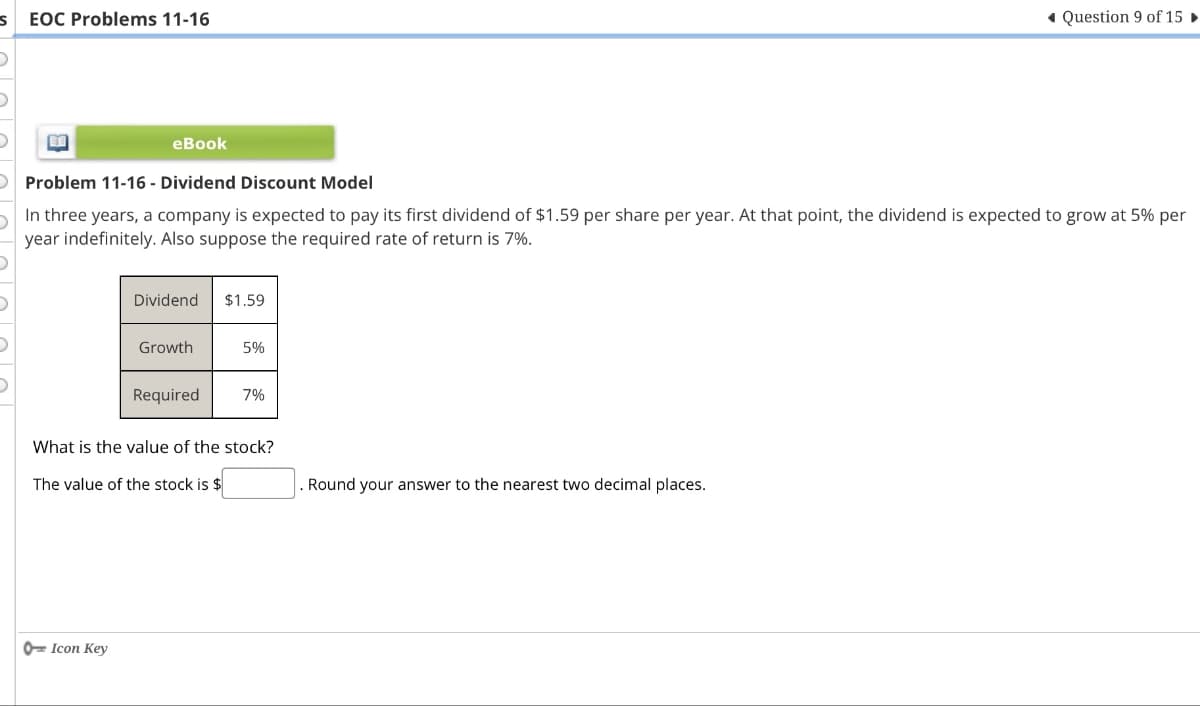

s EOC Problems 11-16 Question 9 of 15 ► eBook O Problem 11-16 - Dividend Discount Model In three years, a company is expected to pay its first dividend of $1.59 per share per year. At that point, the dividend is expected to grow at 5% per year indefinitely. Also suppose the required rate of return is 7%. Dividend $1.59 Growth 5% Required 7% What is the value of the stock? The value of the stock is $ Icon Key Round your answer to the nearest two decimal places.

s EOC Problems 11-16 Question 9 of 15 ► eBook O Problem 11-16 - Dividend Discount Model In three years, a company is expected to pay its first dividend of $1.59 per share per year. At that point, the dividend is expected to grow at 5% per year indefinitely. Also suppose the required rate of return is 7%. Dividend $1.59 Growth 5% Required 7% What is the value of the stock? The value of the stock is $ Icon Key Round your answer to the nearest two decimal places.

Case Studies In Health Information Management

3rd Edition

ISBN:9781337676908

Author:SCHNERING

Publisher:SCHNERING

Chapter6: Leadership

Section: Chapter Questions

Problem 6.19.2C

Related questions

Question

Transcribed Image Text:s EOC Problems 11-16

Question 9 of 15 ►

eBook

O Problem 11-16 - Dividend Discount Model

In three years, a company is expected to pay its first dividend of $1.59 per share per year. At that point, the dividend is expected to grow at 5% per

year indefinitely. Also suppose the required rate of return is 7%.

Dividend

$1.59

Growth

5%

Required

7%

What is the value of the stock?

The value of the stock is $

Icon Key

Round your answer to the nearest two decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Case Studies In Health Information Management

Biology

ISBN:

9781337676908

Author:

SCHNERING

Publisher:

Cengage

Case Studies In Health Information Management

Biology

ISBN:

9781337676908

Author:

SCHNERING

Publisher:

Cengage