's target capital structure debt, preferred stock, and common equity plans ise funds for its future projects. The target proportions of debt, preferred stock, and common equity, along with the cost of these components are used to calculate the firm's weighted average cost of capital (WACC). If the firm will not have to issue new common stock then the cost of retained earnings is used in the firm's WACC calculation. However, if the firm will have to issue new common stock, the cost of new common stock should be used in the firm's WACC calculation. Quantitative Problem: Barton Industries expects that its target capital structure for raising funds in the future for its capital budget will consist of 40% debt, 5% preferred stock, and 55% common equity. Note that the firm's marginal tax rate is 25%. Assume that the firm's cost of debt, ra, is 9.5%, the firm's cost of preferred stock, rp, is 8.7% and the firm's cost of equity is 12.1% for old equity, rs, and 12.5% for new equity, re. What is the firm's weighted average cost of capital (WACC1) if it uses retained earnings as its source of common equity? Do not round intermediate calculations. Round your answer to two decimal places. What is the firm's weighted average cost of capital (WACC2) if it has to issue new common stock? Do not round intermediate calculations. Round your answer to two decimal places. %

's target capital structure debt, preferred stock, and common equity plans ise funds for its future projects. The target proportions of debt, preferred stock, and common equity, along with the cost of these components are used to calculate the firm's weighted average cost of capital (WACC). If the firm will not have to issue new common stock then the cost of retained earnings is used in the firm's WACC calculation. However, if the firm will have to issue new common stock, the cost of new common stock should be used in the firm's WACC calculation. Quantitative Problem: Barton Industries expects that its target capital structure for raising funds in the future for its capital budget will consist of 40% debt, 5% preferred stock, and 55% common equity. Note that the firm's marginal tax rate is 25%. Assume that the firm's cost of debt, ra, is 9.5%, the firm's cost of preferred stock, rp, is 8.7% and the firm's cost of equity is 12.1% for old equity, rs, and 12.5% for new equity, re. What is the firm's weighted average cost of capital (WACC1) if it uses retained earnings as its source of common equity? Do not round intermediate calculations. Round your answer to two decimal places. What is the firm's weighted average cost of capital (WACC2) if it has to issue new common stock? Do not round intermediate calculations. Round your answer to two decimal places. %

Fundamentals of Financial Management, Concise Edition (MindTap Course List)

9th Edition

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter10: The Cost Of Capital

Section: Chapter Questions

Problem 1DQ: As a first step, we need to estimate what percentage of MMMs capital comes from debt, preferred...

Related questions

Question

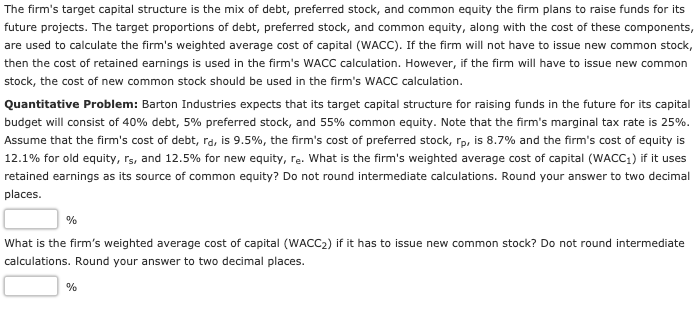

Transcribed Image Text:The firm's target capital structure is the mix of debt, preferred stock, and common equity the firm plans to raise funds for its

future projects. The target proportions of debt, preferred stock, and common equity, along with the cost of these components,

are used to calculate the firm's weighted average cost of capital (WACC). If the firm will not have to issue new common stock,

then the cost of retained earnings is used in the firm's WACC calculation. However, if the firm will have to issue new common

stock, the cost of new common stock should be used in the firm's WACC calculation.

Quantitative Problem: Barton Industries expects that its target capital structure for raising funds in the future for its capital

budget will consist of 40% debt, 5% preferred stock, and 55% common equity. Note that the firm's marginal tax rate is 25%.

Assume that the firm's cost of debt, ra, is 9.5%, the firm's cost of preferred stock, rp, is 8.7% and the firm's cost of equity is

12.1% for old equity, rs, and 12.5% for new equity, re. What is the firm's weighted average cost of capital (WACC1) if it uses

retained earnings as its source of common equity? Do not round intermediate calculations. Round your answer to two decimal

places.

%

What is the firm's weighted average cost of capital (WACC2) if it has to issue new common stock? Do not round intermediate

calculations. Round your answer to two decimal places.

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning