S5-4 Journalizing sales transactions Journalize the following sales transactions for Salem Sportswear. Explanations are not required. The company estimates sales returns at the end of each month. Jul. 1 Salem sold $20,000 of men's sportswear for cash. Cost of goods sold is $10,000. Salem sold $62,000 of women's sportswear on account, credit terms are 3/10, n/30. Cost of goods is $31,000. 3. Salem received a $4,500 sales return on damaged goods from the customer on July 1. Cost of goods damaged is $2,250. Salem receives payment from the customer on the amount due, less discount. 10

S5-4 Journalizing sales transactions Journalize the following sales transactions for Salem Sportswear. Explanations are not required. The company estimates sales returns at the end of each month. Jul. 1 Salem sold $20,000 of men's sportswear for cash. Cost of goods sold is $10,000. Salem sold $62,000 of women's sportswear on account, credit terms are 3/10, n/30. Cost of goods is $31,000. 3. Salem received a $4,500 sales return on damaged goods from the customer on July 1. Cost of goods damaged is $2,250. Salem receives payment from the customer on the amount due, less discount. 10

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter25: Departmental Accounting

Section: Chapter Questions

Problem 3SEA: ALLOCATING OPERATING EXPENSERELATIVE NET SALES Hayley Doll owns a car stereo store. She has divided...

Related questions

Question

Transcribed Image Text:ag Store?

earning Objective 3

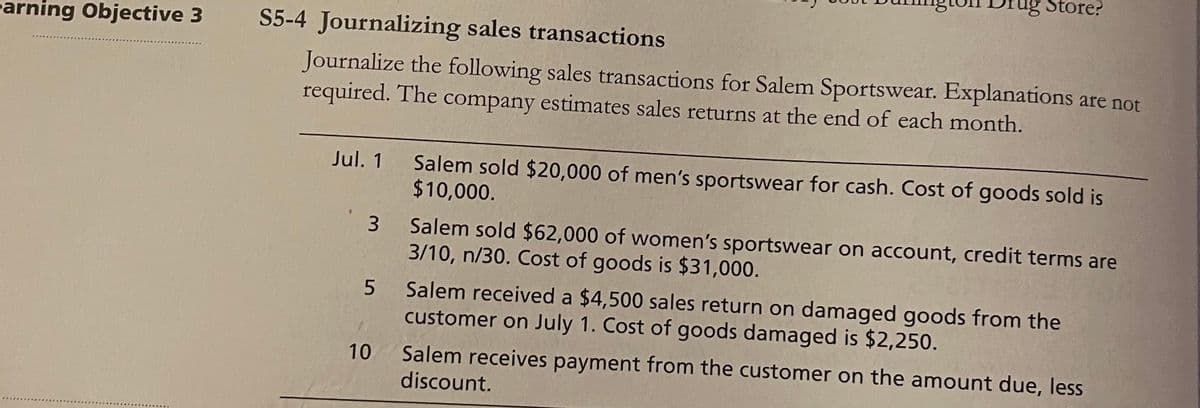

S5-4 Journalizing sales transactions

Journalize the following sales transactions for Salem Sportswear. Explanations are not

required. The company estimates sales returns at the end of each month.

Jul. 1

Salem sold $20,000 of men's sportswear for cash. Cost of goods sold is

$10,000.

Salem sold $62,000 of women's sportswear on account, credit terms are

3/10, n/30. Cost of goods is $31,000.

3

Salem received a $4,500 sales return on damaged goods from the

customer on July 1. Cost of goods damaged is $2,250.

Salem receives payment from the customer on the amount due, less

discount.

10

Expert Solution

Step 1

Journal entry: The business-related transactions are recorded in the books by the way of journal entries. The items related to the transactions are debited and credited while recording the journal entry according to the double-entry system. The balance of the debit side matches with the credit side under the double-entry system.

Periodic inventory system: In the periodic inventory system updates and records the inventory transactions either at the end of the month/ quarter/ year.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning