Sales Cost of goods sold Gross profit Operating expenses. Salaries Income Statement For the year ended December 31, 2011 $32,000 Depreciation and depletion 4,500 Miscellaneous 12.400 $150,000 63,000 87,000 48,900

Sales Cost of goods sold Gross profit Operating expenses. Salaries Income Statement For the year ended December 31, 2011 $32,000 Depreciation and depletion 4,500 Miscellaneous 12.400 $150,000 63,000 87,000 48,900

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter4: Accounting For Retail Operations

Section: Chapter Questions

Problem 4.8.2MBA: Gross profit percent and markup percent Caterpillar Inc. (CAT) produces and sells various types of...

Related questions

Question

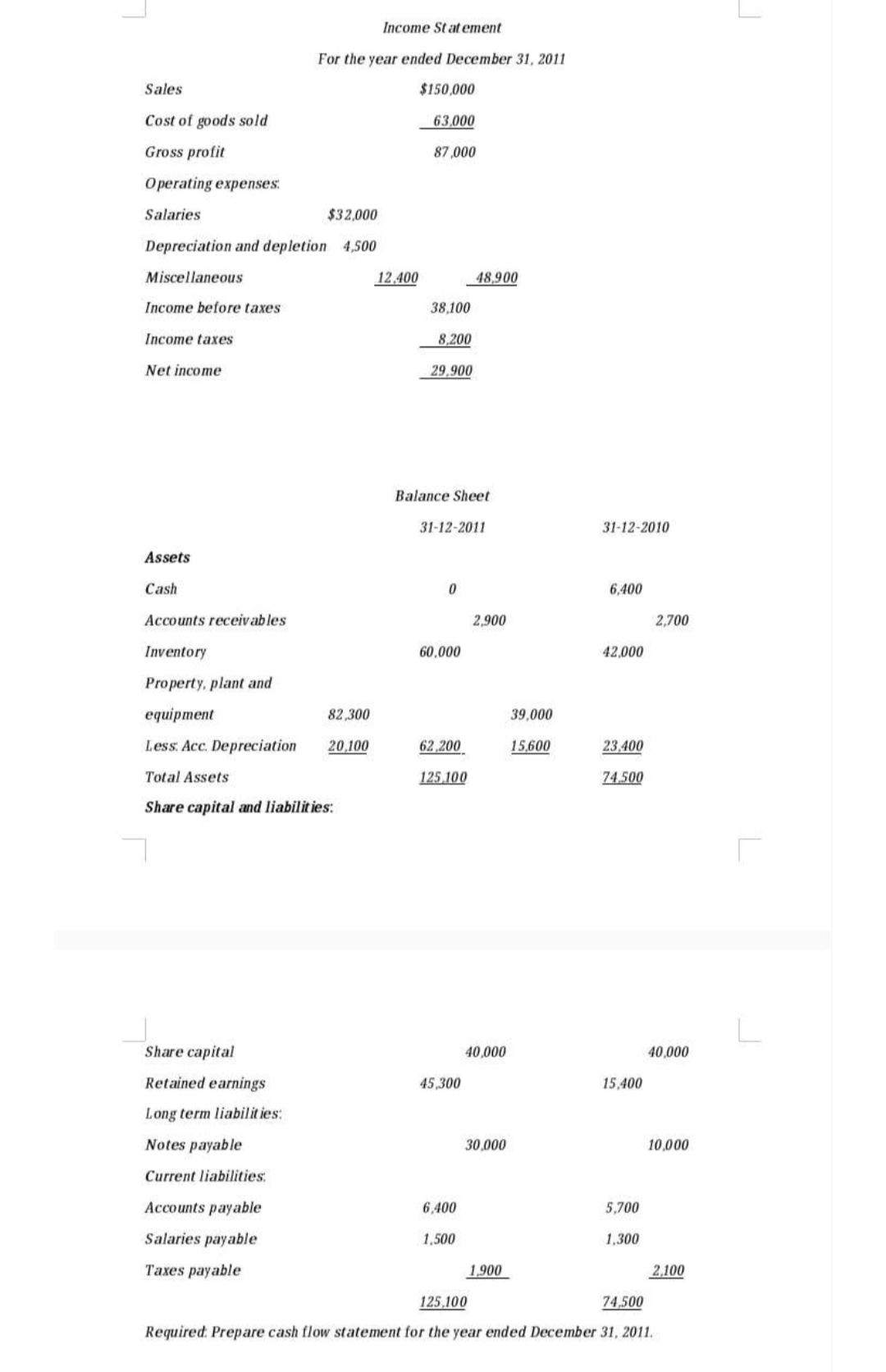

Transcribed Image Text:Sales

Cost of goods sold

Gross profit

Operating expenses:

Salaries

$32,000

Depreciation and depletion 4,500

Miscellaneous

Income before taxes

Income taxes

Net income

Assets

Cash

Accounts receivables

Inventory

Property, plant and

equipment

Income Statement

For the year ended December 31, 2011

Share capital

Retained earnings

Long term liabilities:

Notes payable

Current liabilities:

Less: Acc. Depreciation

Total Assets

Share capital and liabilities:

Accounts payable

Salaries payable

Taxes payable

82,300

20,100

12,400

$150,000

63,000

87,000

38,100

8,200

29.900

Balance Sheet

31-12-2011

0

60,000

62,200

125.100

45,300

48,900

6,400

1,500

2,900

40,000

30,000

1,900

39,000

15,600

31-12-2010

6,400

42,000

23,400

74.500

15,400

5,700

1,300

74.500

2,700

40,000

10,000

2,100

125,100

Required: Prepare cash flow statement for the year ended December 31, 2011.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning