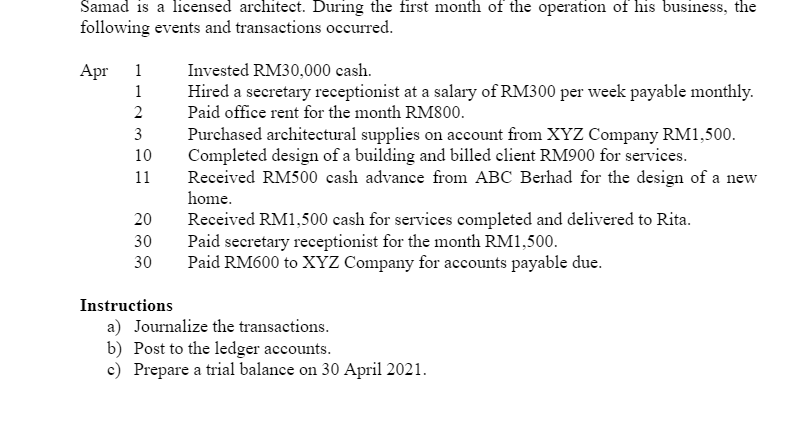

Samad is a licensed architect. During the first month of the operation of his businėss, the following events and transactions occurred. Invested RM30,000 cash. Apr 1 1 Hired a secretary receptionist at a salary of RM300 per week payable monthly. Paid office rent for the month RM800. Purchased architectural supplies on account from XYZ Company RM1,500. Completed design of a building and billed client RM900 for services. Received RM500 cash advance from ABC Berhad for the design of a new home. 2 3 10 11 Received RM1,500 cash for services completed and delivered to Rita. Paid secretary receptionist for the month RM1,500. Paid RM600 to XYZ Company for accounts payable due. 20 30 30 Instructions a) Journalize the transactions. b) Post to the ledger accounts. c) Prepare a trial balance on 30 April 2021.

Samad is a licensed architect. During the first month of the operation of his businėss, the following events and transactions occurred. Invested RM30,000 cash. Apr 1 1 Hired a secretary receptionist at a salary of RM300 per week payable monthly. Paid office rent for the month RM800. Purchased architectural supplies on account from XYZ Company RM1,500. Completed design of a building and billed client RM900 for services. Received RM500 cash advance from ABC Berhad for the design of a new home. 2 3 10 11 Received RM1,500 cash for services completed and delivered to Rita. Paid secretary receptionist for the month RM1,500. Paid RM600 to XYZ Company for accounts payable due. 20 30 30 Instructions a) Journalize the transactions. b) Post to the ledger accounts. c) Prepare a trial balance on 30 April 2021.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter1: Asset, Liability, Owner’s Equity, Revenue, And Expense Accounts

Section: Chapter Questions

Problem 3PB: P. Schwartz, Attorney at Law, opened his office on October 1. The account headings are presented...

Related questions

Topic Video

Question

Transcribed Image Text:Samad is a licensed architect. During the first month of the operation of his business, the

following events and transactions occurred.

Apr

1

Invested RM30,000 cash.

Hired a secretary receptionist at a salary of RM300 per week payable monthly.

Paid office rent for the month RM800.

1

2

Purchased architectural supplies on account from XYZ Company RM1,500.

Completed design of a building and billed elient RM900 for services.

Received RM500 cash advance from ABC Berhad for the design of a new

home.

3

10

11

Received RM1,500 cash for services completed and delivered to Rita.

Paid secretary receptionist for the month RM1,500.

Paid RM600 to XYZ Company for accounts payable due.

20

30

30

Instructions

a) Journalize the transactions.

b) Post to the ledger accounts.

c) Prepare a trial balance on 30 April 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning