Samsung latronks Co, Lad. and Subsidiaries CONSOLIDATED STATEMENTS OF FINANCIAL PCSITION (In millions of Korean n) Dece mber 31, 20N7 December 3I, 016 Asets KRW KRW Current asets Cash and cash equivaents Short-term financial instruments Short-term aailable-for-sae finuncial assets Trade rcevables Non-trade eceivables 30,545,130 49,447,696 3,191,75 32,111,442 52432,411 3638,40 24,279,211 3,521,197 1,439,938 3,502OK3 18,353,503 1315,653 835,06 27 695.995 4,1OK.961 Advance puyments Prepuid expenses Imeniories Oter current ass Assets held-ir sule 1,753,63 3,835,219 24,983,355 1421,00 Taal current sts 146,244 141429,704 Nam-current ases Long-lem available-or-sale financial sts Held-o-maturity financial zsds Imestment in asociales and joint ventures 7,752,180 106,751 6,02351 6,804,276 Property, plant and equipment Intangibie assets Long-em prepuidexpenses Net defined benelit assets Deered income ta e Oder non-curent assets 111,665,648 14,760,483 3,434,375 825,892 5,061.7 4,360,259 5,837,884 91,473041 5,344020 3,834,831 557091 5,321,450 1,572027 Tdal asets 301,752,090 52174324 LabR nd Equky Current lab ks Trade puyables Short term borOWings Oder payahles Advances eceivad Withholdings Acruedex penes Income tax payable Cument portion 9,083.907 6,485039 12746,789 11,525,910 1,358,878 15,761,619 13,899,633 1,249,174 793,S82 13,996,23 7,408,348 ZI8,619 12527,00 2837,353 of long-kerm labilities 1232,817 4,294N0 403,139 Provisions Oter current liabiliies Labilities held-ke-sale 4,597,417 351,176 356,388 Tda current ab mlk ,75,114 5470495 Nan-current IabIkles Debentures S8,542 Long-lem borrowings Long-em other payables Net delined benefrit liabilities 953,361 1,814,446 2,043,729 389.922 1,244,238 3,317054 173,656 Deered income tax liabilities 11,710,781 464,324 2,DR,985 7,293,514 358,126 Provisions Oder non-curent liabililies Taa Iubke 69211291 Equly atiributable o ownen of the parent Preeene shuES 119.467 Ordnary shares share premium Retainedearnings Oder components of equity Acumulaled ocher comprehensive income atributable to asets held for-sale 119,467 778047 4,403,893 193p86,317 (11,934,586) (28,810) 4,403,893 215,811,00 (13,899,191) 200,213,416 86424328 Nan-controlling inter ess 7,78012 6,538,705 T equity 214,B128 192963033 Ta IabEke and equity 301,752,90 262174324 The above consolidated statemnt of finuncial position should be mal in conjunction with the accompuny ing noles. Samsung Electronia Co, Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF PROFTT OR LOSS For the year en ded December 31 2017 206 (Ie millions af Korean won) KRW KRW Revenue 239,575,376 201,,745 Cost of sales 129.20,661 120,271,715 Gres profl 110284,715 Selling and administrative espenses 56,639,67 52,348,358 Operating prof 53645,038 Other non-operting income 3010,657 3,238,261 Other non-operating espense 1,419,648 2,463814 Share of profit of associales and joint ventures 201,442 19,01 Financial income 9,731,391 11,385,645 Financial ex pee 8,978,913 10,706,613 Prot belore noome tax 56195,967 30,73,652 Income tax expene 14,009,2D 7,987 560 Proft far the per kad 22,7 2 421%,747 Profit attributable to owners of the parent 41,344,569 22,415,655 Profil atributahle to non-controlling inkerests 842,178 310,437 Eamings per share 299, RN 157 967 299,B68 157,967 The above consolidated stake ment of financial position should be read in conjunction with the accompanying noles. Sams ung Electronies Co., Ltd. and Suhsidiaries CONSOLIDATED STATEMENTS OF COMPREHENSIVEINCOME For the year en ded December 31 2017 2016 (Ie millions of Korean won) KRW KRW Prof for the per lad 42,186,747 22,726092 Oher comprethen she noome (las) Ilemsna to be redassed lo prot or loss sutsoque nily: Remeasurment of net defined beefit liabilities, net of ta 414,247 963,602 Shares of other compehensive income (los) of associales and joint venturs, net of tax (6,347) 50,438 Ilemsto be redassined lo prft or loss sutesoque nily: Changes in value of aailahke-Sor-sale financial assets, et of tax Share of other comprhensive income (loss)of associales and joint venturs, net of tax 511,200 (23,839) (49,256) (130,) (6,334,97) Forign currency tranlalion, net of ta Gain (loss) on valualion of derivatives Other comprehen she moome (las) far the perlad, net of tax 1,131,536 (31,121) (5,257) 1991400 Total comprehenshe Income or the pered 36684,490 24717492 Comprehenshe income tr butable toc Owes of the pamnt 35,887,505 24,310,814 Non-controlling interests 796,985 406,678 The above consolidaked stakement of finuncial position should be read in conjunction with the accompanying noles.

Samsung latronks Co, Lad. and Subsidiaries CONSOLIDATED STATEMENTS OF FINANCIAL PCSITION (In millions of Korean n) Dece mber 31, 20N7 December 3I, 016 Asets KRW KRW Current asets Cash and cash equivaents Short-term financial instruments Short-term aailable-for-sae finuncial assets Trade rcevables Non-trade eceivables 30,545,130 49,447,696 3,191,75 32,111,442 52432,411 3638,40 24,279,211 3,521,197 1,439,938 3,502OK3 18,353,503 1315,653 835,06 27 695.995 4,1OK.961 Advance puyments Prepuid expenses Imeniories Oter current ass Assets held-ir sule 1,753,63 3,835,219 24,983,355 1421,00 Taal current sts 146,244 141429,704 Nam-current ases Long-lem available-or-sale financial sts Held-o-maturity financial zsds Imestment in asociales and joint ventures 7,752,180 106,751 6,02351 6,804,276 Property, plant and equipment Intangibie assets Long-em prepuidexpenses Net defined benelit assets Deered income ta e Oder non-curent assets 111,665,648 14,760,483 3,434,375 825,892 5,061.7 4,360,259 5,837,884 91,473041 5,344020 3,834,831 557091 5,321,450 1,572027 Tdal asets 301,752,090 52174324 LabR nd Equky Current lab ks Trade puyables Short term borOWings Oder payahles Advances eceivad Withholdings Acruedex penes Income tax payable Cument portion 9,083.907 6,485039 12746,789 11,525,910 1,358,878 15,761,619 13,899,633 1,249,174 793,S82 13,996,23 7,408,348 ZI8,619 12527,00 2837,353 of long-kerm labilities 1232,817 4,294N0 403,139 Provisions Oter current liabiliies Labilities held-ke-sale 4,597,417 351,176 356,388 Tda current ab mlk ,75,114 5470495 Nan-current IabIkles Debentures S8,542 Long-lem borrowings Long-em other payables Net delined benefrit liabilities 953,361 1,814,446 2,043,729 389.922 1,244,238 3,317054 173,656 Deered income tax liabilities 11,710,781 464,324 2,DR,985 7,293,514 358,126 Provisions Oder non-curent liabililies Taa Iubke 69211291 Equly atiributable o ownen of the parent Preeene shuES 119.467 Ordnary shares share premium Retainedearnings Oder components of equity Acumulaled ocher comprehensive income atributable to asets held for-sale 119,467 778047 4,403,893 193p86,317 (11,934,586) (28,810) 4,403,893 215,811,00 (13,899,191) 200,213,416 86424328 Nan-controlling inter ess 7,78012 6,538,705 T equity 214,B128 192963033 Ta IabEke and equity 301,752,90 262174324 The above consolidated statemnt of finuncial position should be mal in conjunction with the accompuny ing noles. Samsung Electronia Co, Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF PROFTT OR LOSS For the year en ded December 31 2017 206 (Ie millions af Korean won) KRW KRW Revenue 239,575,376 201,,745 Cost of sales 129.20,661 120,271,715 Gres profl 110284,715 Selling and administrative espenses 56,639,67 52,348,358 Operating prof 53645,038 Other non-operting income 3010,657 3,238,261 Other non-operating espense 1,419,648 2,463814 Share of profit of associales and joint ventures 201,442 19,01 Financial income 9,731,391 11,385,645 Financial ex pee 8,978,913 10,706,613 Prot belore noome tax 56195,967 30,73,652 Income tax expene 14,009,2D 7,987 560 Proft far the per kad 22,7 2 421%,747 Profit attributable to owners of the parent 41,344,569 22,415,655 Profil atributahle to non-controlling inkerests 842,178 310,437 Eamings per share 299, RN 157 967 299,B68 157,967 The above consolidated stake ment of financial position should be read in conjunction with the accompanying noles. Sams ung Electronies Co., Ltd. and Suhsidiaries CONSOLIDATED STATEMENTS OF COMPREHENSIVEINCOME For the year en ded December 31 2017 2016 (Ie millions of Korean won) KRW KRW Prof for the per lad 42,186,747 22,726092 Oher comprethen she noome (las) Ilemsna to be redassed lo prot or loss sutsoque nily: Remeasurment of net defined beefit liabilities, net of ta 414,247 963,602 Shares of other compehensive income (los) of associales and joint venturs, net of tax (6,347) 50,438 Ilemsto be redassined lo prft or loss sutesoque nily: Changes in value of aailahke-Sor-sale financial assets, et of tax Share of other comprhensive income (loss)of associales and joint venturs, net of tax 511,200 (23,839) (49,256) (130,) (6,334,97) Forign currency tranlalion, net of ta Gain (loss) on valualion of derivatives Other comprehen she moome (las) far the perlad, net of tax 1,131,536 (31,121) (5,257) 1991400 Total comprehenshe Income or the pered 36684,490 24717492 Comprehenshe income tr butable toc Owes of the pamnt 35,887,505 24,310,814 Non-controlling interests 796,985 406,678 The above consolidaked stakement of finuncial position should be read in conjunction with the accompanying noles.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Refer to Samsung’s financial statements. Compute its cost of goods available for sale for the year ended December 31, 2017.

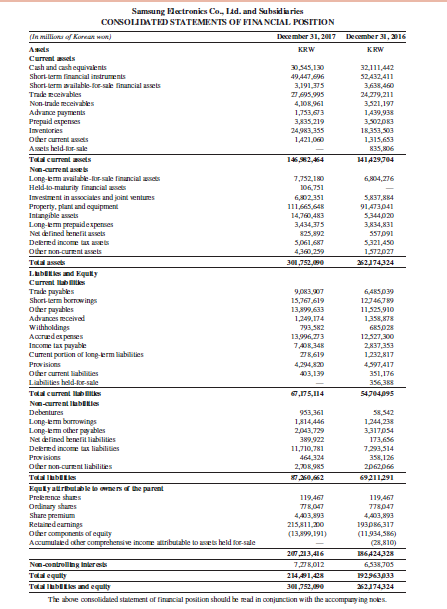

Transcribed Image Text:Samsung latronks Co, Lad. and Subsidiaries

CONSOLIDATED STATEMENTS OF FINANCIAL PCSITION

(In millions of Korean n)

Dece mber 31, 20N7 December 3I, 016

Asets

KRW

KRW

Current asets

Cash and cash equivaents

Short-term financial instruments

Short-term aailable-for-sae finuncial assets

Trade rcevables

Non-trade eceivables

30,545,130

49,447,696

3,191,75

32,111,442

52432,411

3638,40

24,279,211

3,521,197

1,439,938

3,502OK3

18,353,503

1315,653

835,06

27 695.995

4,1OK.961

Advance puyments

Prepuid expenses

Imeniories

Oter current ass

Assets held-ir sule

1,753,63

3,835,219

24,983,355

1421,00

Taal current sts

146,244

141429,704

Nam-current ases

Long-lem available-or-sale financial sts

Held-o-maturity financial zsds

Imestment in asociales and joint ventures

7,752,180

106,751

6,02351

6,804,276

Property, plant and equipment

Intangibie assets

Long-em prepuidexpenses

Net defined benelit assets

Deered income ta e

Oder non-curent assets

111,665,648

14,760,483

3,434,375

825,892

5,061.7

4,360,259

5,837,884

91,473041

5,344020

3,834,831

557091

5,321,450

1,572027

Tdal asets

301,752,090

52174324

LabR nd Equky

Current lab ks

Trade puyables

Short term borOWings

Oder payahles

Advances eceivad

Withholdings

Acruedex penes

Income tax payable

Cument portion

9,083.907

6,485039

12746,789

11,525,910

1,358,878

15,761,619

13,899,633

1,249,174

793,S82

13,996,23

7,408,348

ZI8,619

12527,00

2837,353

of long-kerm labilities

1232,817

4,294N0

403,139

Provisions

Oter current liabiliies

Labilities held-ke-sale

4,597,417

351,176

356,388

Tda current ab mlk

,75,114

5470495

Nan-current IabIkles

Debentures

S8,542

Long-lem borrowings

Long-em other payables

Net delined benefrit liabilities

953,361

1,814,446

2,043,729

389.922

1,244,238

3,317054

173,656

Deered income tax liabilities

11,710,781

464,324

2,DR,985

7,293,514

358,126

Provisions

Oder non-curent liabililies

Taa Iubke

69211291

Equly atiributable o ownen of the parent

Preeene shuES

119.467

Ordnary shares

share premium

Retainedearnings

Oder components of equity

Acumulaled ocher comprehensive income atributable to asets held for-sale

119,467

778047

4,403,893

193p86,317

(11,934,586)

(28,810)

4,403,893

215,811,00

(13,899,191)

200,213,416

86424328

Nan-controlling inter ess

7,78012

6,538,705

T equity

214,B128

192963033

Ta IabEke and equity

301,752,90

262174324

The above consolidated statemnt of finuncial position should be mal in conjunction with the accompuny ing noles.

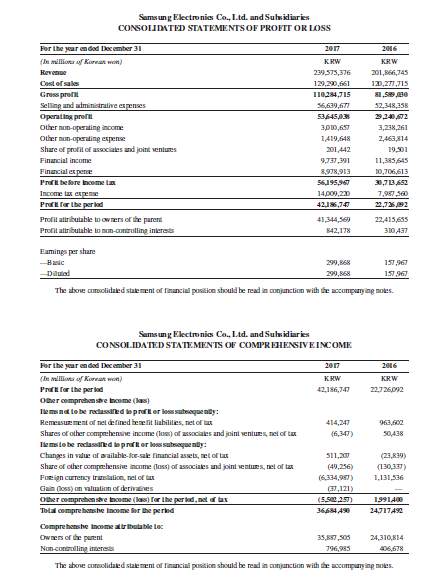

Transcribed Image Text:Samsung Electronia Co, Ltd. and Subsidiaries

CONSOLIDATED STATEMENTS OF PROFTT OR LOSS

For the year en ded December 31

2017

206

(Ie millions af Korean won)

KRW

KRW

Revenue

239,575,376

201,,745

Cost of sales

129.20,661

120,271,715

Gres profl

110284,715

Selling and administrative espenses

56,639,67

52,348,358

Operating prof

53645,038

Other non-operting income

3010,657

3,238,261

Other non-operating espense

1,419,648

2,463814

Share of profit of associales and joint ventures

201,442

19,01

Financial income

9,731,391

11,385,645

Financial ex pee

8,978,913

10,706,613

Prot belore noome tax

56195,967

30,73,652

Income tax expene

14,009,2D

7,987 560

Proft far the per kad

22,7 2

421%,747

Profit attributable to owners of the parent

41,344,569

22,415,655

Profil atributahle to non-controlling inkerests

842,178

310,437

Eamings per share

299, RN

157 967

299,B68

157,967

The above consolidated stake ment of financial position should be read in conjunction with the accompanying noles.

Sams ung Electronies Co., Ltd. and Suhsidiaries

CONSOLIDATED STATEMENTS OF COMPREHENSIVEINCOME

For the year en ded December 31

2017

2016

(Ie millions of Korean won)

KRW

KRW

Prof for the per lad

42,186,747

22,726092

Oher comprethen she noome (las)

Ilemsna to be redassed lo prot or loss sutsoque nily:

Remeasurment of net defined beefit liabilities, net of ta

414,247

963,602

Shares of other compehensive income (los) of associales and joint venturs, net of tax

(6,347)

50,438

Ilemsto be redassined lo prft or loss sutesoque nily:

Changes in value of aailahke-Sor-sale financial assets, et of tax

Share of other comprhensive income (loss)of associales and joint venturs, net of tax

511,200

(23,839)

(49,256)

(130,)

(6,334,97)

Forign currency tranlalion, net of ta

Gain (loss) on valualion of derivatives

Other comprehen she moome (las) far the perlad, net of tax

1,131,536

(31,121)

(5,257)

1991400

Total comprehenshe Income or the pered

36684,490

24717492

Comprehenshe income tr butable toc

Owes of the pamnt

35,887,505

24,310,814

Non-controlling interests

796,985

406,678

The above consolidaked stakement of finuncial position should be read in conjunction with the accompanying noles.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education