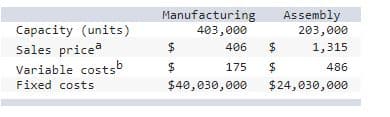

San Jose Company operates a Manufacturing Division and an Assembly Division. Both divisions are evaluated as profit centers. Assembly buys components from Manufacturing and assembles them for sale. Manufacturing sells many components to third parties in addition to Assembly. Selected data from the two operations follow. Manufacturing Assembly Capacity (units) 403,000 203,000 Sales pricea $ 406 $ 1,315 Variable costsb $ 175 $ 486 Fixed costs $ 40,030,000 $ 24,030,000 a For Manufacturing, this is the price to third parties. b For Assembly, this does not include the transfer price paid to Manufacturing. Required: a. Current production levels in Manufacturing are 203,000 units. Assembly requests an additional 43,000 units to produce a special order. What transfer price would you recommend? b. Suppose Manufacturing is operating at full capacity. What transfer price would you recommend? c. Suppose Manufacturing is operating at 381,500 units. What transfer price would you recommend? (Round your answer to 2 decimal places.)

San Jose Company operates a Manufacturing Division and an Assembly Division. Both divisions are evaluated as profit centers. Assembly buys components from Manufacturing and assembles them for sale. Manufacturing sells many components to third parties in addition to Assembly. Selected data from the two operations follow.

| Manufacturing | Assembly | |||||

| Capacity (units) | 403,000 | 203,000 | ||||

| Sales pricea | $ | 406 | $ | 1,315 | ||

| Variable costsb | $ | 175 | $ | 486 | ||

| Fixed costs | $ | 40,030,000 | $ | 24,030,000 | ||

a For Manufacturing, this is the price to third parties.

b For Assembly, this does not include the transfer price paid to Manufacturing.

Required:

a. Current production levels in Manufacturing are 203,000 units. Assembly requests an additional 43,000 units to produce a special order. What transfer price would you recommend?

b. Suppose Manufacturing is operating at full capacity. What transfer price would you recommend?

c. Suppose Manufacturing is operating at 381,500 units. What transfer price would you recommend? (Round your answer to 2 decimal places.)

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images