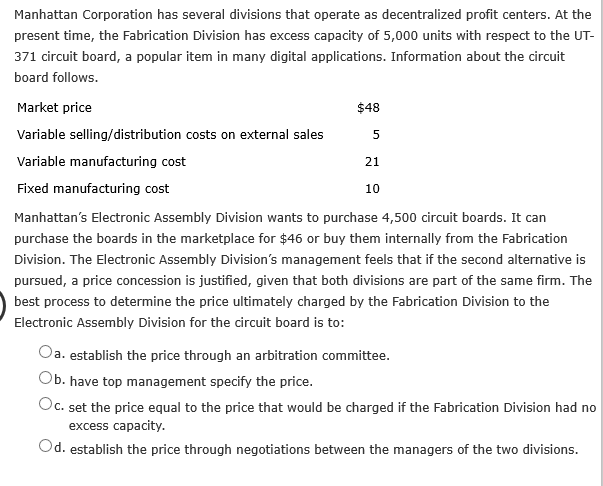

Manhattan Corporation has several divisions that operate as decentralized profit centers. At the present time, the Fabrication Division has excess capacity of 5,000 units with respect to the UT- 371 circuit board, a popular item in many digital applications. Information about the circuit board follows. Market price $48 Variable selling/distribution costs on external sales Variable manufacturing cost 21 Fixed manufacturing cost 10 Manhattan's Electronic Assembly Division wants to purchase 4,500 circuit boards. It can purchase the boards in the marketplace for $46 or buy them internally from the Fabrication Division. The Electronic Assembly Division's management feels that if the second alternative is pursued, a price concession is justified, given that both divisions are part of the same firm. The best process to determine the price ultimately charged by the Fabrication Division to the Electronic Assembly Division for the circuit board is to: Oa. establish the price through an arbitration committee. Ob. have top management specify the price. Oc. set the price equal to the price that would be charged if the Fabrication Division had no excess capacity. Od. establish the price through negotiations between the managers of the two divisions.

Manhattan Corporation has several divisions that operate as decentralized profit centers. At the present time, the Fabrication Division has excess capacity of 5,000 units with respect to the UT- 371 circuit board, a popular item in many digital applications. Information about the circuit board follows. Market price $48 Variable selling/distribution costs on external sales Variable manufacturing cost 21 Fixed manufacturing cost 10 Manhattan's Electronic Assembly Division wants to purchase 4,500 circuit boards. It can purchase the boards in the marketplace for $46 or buy them internally from the Fabrication Division. The Electronic Assembly Division's management feels that if the second alternative is pursued, a price concession is justified, given that both divisions are part of the same firm. The best process to determine the price ultimately charged by the Fabrication Division to the Electronic Assembly Division for the circuit board is to: Oa. establish the price through an arbitration committee. Ob. have top management specify the price. Oc. set the price equal to the price that would be charged if the Fabrication Division had no excess capacity. Od. establish the price through negotiations between the managers of the two divisions.

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter24: Evaluating Decentralized Operations

Section: Chapter Questions

Problem 3CMA

Related questions

Question

Manhattan Corp

Transcribed Image Text:Manhattan Corporation has several divisions that operate as decentralized profit centers. At the

present time, the Fabrication Division has excess capacity of 5,000 units with respect to the UT-

371 circuit board, a popular item in many digital applications. Information about the circuit

board follows.

Market price

$48

Variable selling/distribution costs on external sales

Variable manufacturing cost

21

Fixed manufacturing cost

10

Manhattan's Electronic Assembly Division wants to purchase 4,500 circuit boards. It can

purchase the boards in the marketplace for $46 or buy them internally from the Fabrication

Division. The Electronic Assembly Division's management feels that if the second alternative is

pursued, a price concession is justified, given that both divisions are part of the same firm. The

best process to determine the price ultimately charged by the Fabrication Division to the

Electronic Assembly Division for the circuit board is to:

Oa. establish the price through an arbitration committee.

Ob. have top management specify the price.

Oc. set the price equal to the price that would be charged if the Fabrication Division had no

excess capacity.

Od. establish the price through negotiations between the managers of the two divisions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning