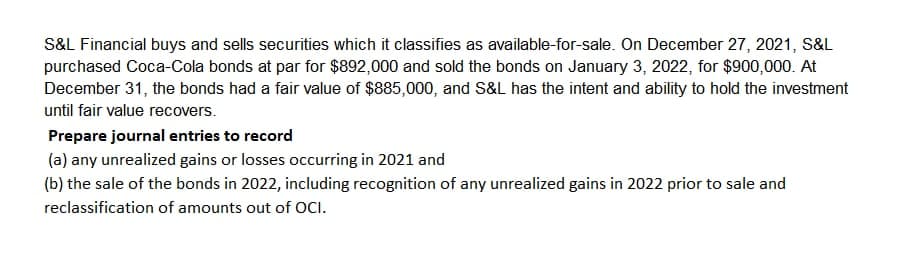

S&L Financial buys and sells securities which it classifies as available-for-sale. On December 27, 2021, S&L purchased Coca-Cola bonds at par for $892,000 and sold the bonds on January 3, 2022, for $900,000. At December 31, the bonds had a fair value of $885,000, and S&L has the intent and ability to hold the investment until fair value recovers. Prepare journal entries to record (a) any unrealized gains or losses occurring in 2021 and (b) the sale of the bonds in 2022, including recognition of any unrealized gains in 2022 prior to sale and reclassification of amounts out of OCI.

S&L Financial buys and sells securities which it classifies as available-for-sale. On December 27, 2021, S&L purchased Coca-Cola bonds at par for $892,000 and sold the bonds on January 3, 2022, for $900,000. At December 31, the bonds had a fair value of $885,000, and S&L has the intent and ability to hold the investment until fair value recovers. Prepare journal entries to record (a) any unrealized gains or losses occurring in 2021 and (b) the sale of the bonds in 2022, including recognition of any unrealized gains in 2022 prior to sale and reclassification of amounts out of OCI.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 15E: Investments On October 4, 2019, Collins Company purchased 100 bonds of Steph Company for 6,400 as a...

Related questions

Question

pleas help

Transcribed Image Text:S&L Financial buys and sells securities which it classifies as available-for-sale. On December 27, 2021, S&L

purchased Coca-Cola bonds at par for $892,000 and sold the bonds on January 3, 2022, for $900,000. At

December 31, the bonds had a fair value of $885,000, and S&L has the intent and ability to hold the investment

until fair value recovers.

Prepare journal entries to record

(a) any unrealized gains or losses occurring in 2021 and

(b) the sale of the bonds in 2022, including recognition of any unrealized gains in 2022 prior to sale and

reclassification of amounts out of OCI.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning