Sates Corporation reported the following information concerning its direct materials. Direct materials purchased (actual) standard cost of materials purchased standard price times actual amount of materials used Actual production standard direct materials costs per unit produced $679, 000 $700, 000 $450, 000 23, 200 units $4 18.8 Required: Compute the direct materials cost variances. (Indlcate the effect of each varlance by selecting "F unfavorable. If there is o effect, do not select elther optlon.) Direct Materials Price variance Efficiency variance Total direct materials cost variance

Sates Corporation reported the following information concerning its direct materials. Direct materials purchased (actual) standard cost of materials purchased standard price times actual amount of materials used Actual production standard direct materials costs per unit produced $679, 000 $700, 000 $450, 000 23, 200 units $4 18.8 Required: Compute the direct materials cost variances. (Indlcate the effect of each varlance by selecting "F unfavorable. If there is o effect, do not select elther optlon.) Direct Materials Price variance Efficiency variance Total direct materials cost variance

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter13: Budgeting And Standard Costs

Section: Chapter Questions

Problem 13.4P: Direct materials and direct labor variance analysis Faucet Industries Inc. manufactures faucets in a...

Related questions

Question

Transcribed Image Text:%24

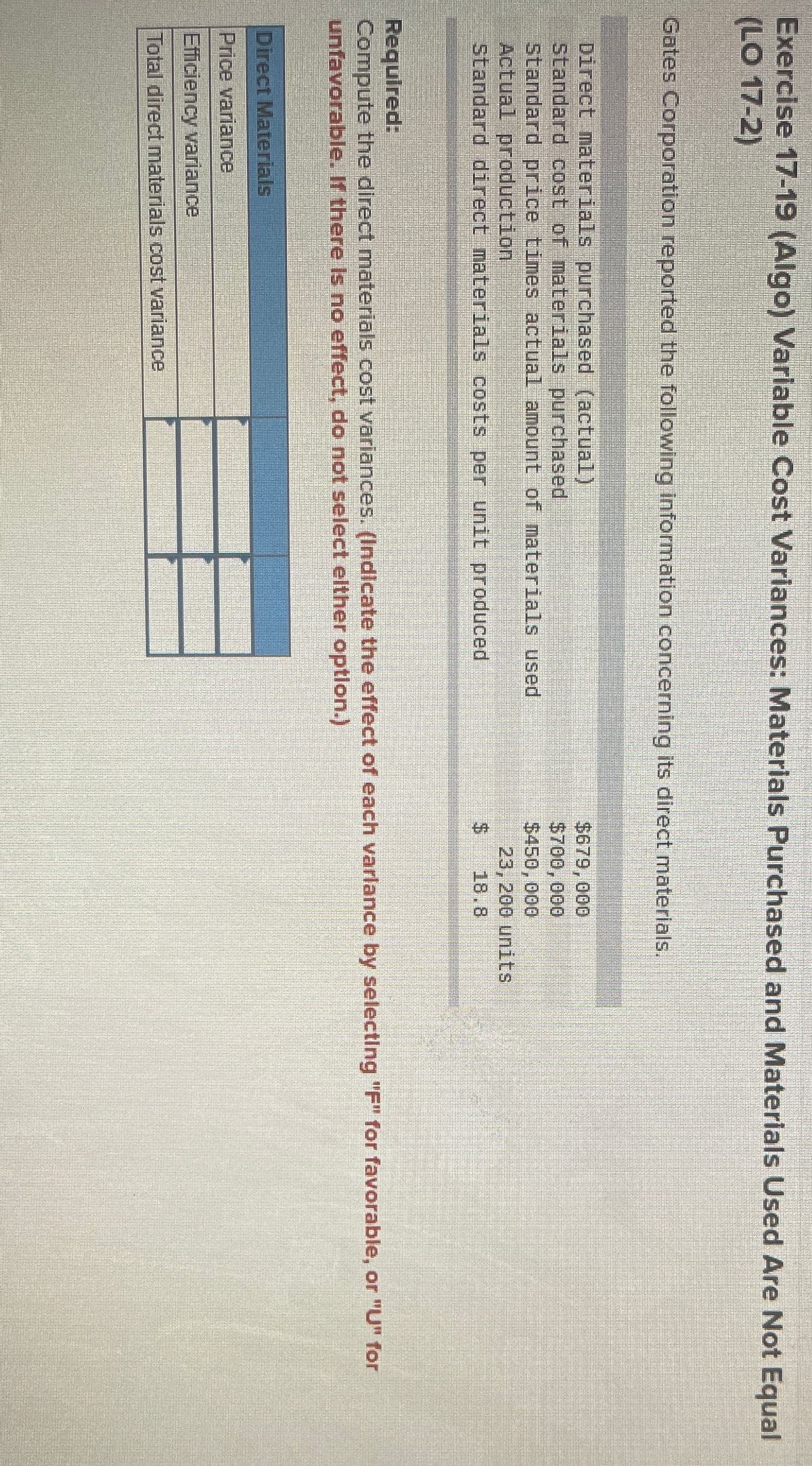

Exercise 17-19 (Algo) Variable Cost Variances: Materials Purchased and Materials Used Are Not Equal

(LO 17-2)

Gates Corporation reported the following information concerning its direct materials.

Direct materials purchased (actual)

standard cost of materials purchased

standard price times actual amount of materials used

Actual production

standard direct materials costs per unit produced

$679, 000

$700, 000

$450, 000

23, 200 units

18.8

Required:

Compute the direct materials cost variances. (Indicate the effect of each varlance by selecting "F" for favorable, or "U" for

unfavorable. If there Is no effect, do not select elther optlon.)

Direct Materials

Price variance

Efficiency variance

Total direct materials cost variance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub