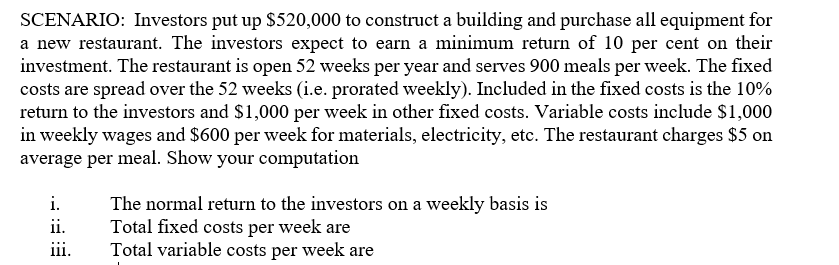

SCENARIO: Investors put up $520,000 to construct a building and purchase all equipment for a new restaurant. The investors expect to earn a minimum return of 10 per cent on their investment. The restaurant is open 52 weeks per year and serves 900 meals per week. The fixed costs are spread over the 52 weeks (i.e. prorated weekly). Included in the fixed costs is the 10% return to the investors and $1,000 per week in other fixed costs. Variable costs include $1,000 in weekly wages and $600 per week for materials, electricity, etc. The restaurant charges $5 on average per meal. Show your computation i. ii. iii. The normal return to the investors on a weekly basis is Total fixed costs per week are Total variable costs per week are

SCENARIO: Investors put up $520,000 to construct a building and purchase all equipment for a new restaurant. The investors expect to earn a minimum return of 10 per cent on their investment. The restaurant is open 52 weeks per year and serves 900 meals per week. The fixed costs are spread over the 52 weeks (i.e. prorated weekly). Included in the fixed costs is the 10% return to the investors and $1,000 per week in other fixed costs. Variable costs include $1,000 in weekly wages and $600 per week for materials, electricity, etc. The restaurant charges $5 on average per meal. Show your computation i. ii. iii. The normal return to the investors on a weekly basis is Total fixed costs per week are Total variable costs per week are

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 1E: A firm has the opportunity to invest in a project having an initial outlay of $20,000. Net cash...

Related questions

Question

Transcribed Image Text:SCENARIO: Investors put up $520,000 to construct a building and purchase all equipment for

a new restaurant. The investors expect to earn a minimum return of 10 per cent on their

investment. The restaurant is open 52 weeks per year and serves 900 meals per week. The fixed

costs are spread over the 52 weeks (i.e. prorated weekly). Included in the fixed costs is the 10%

return to the investors and $1,000 per week in other fixed costs. Variable costs include $1,000

in weekly wages and $600 per week for materials, electricity, etc. The restaurant charges $5 on

average per meal. Show your computation

i.

The normal return to the investors on a weekly basis is

Total fixed costs per week are

Total variable costs per week are

ii.

111.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning