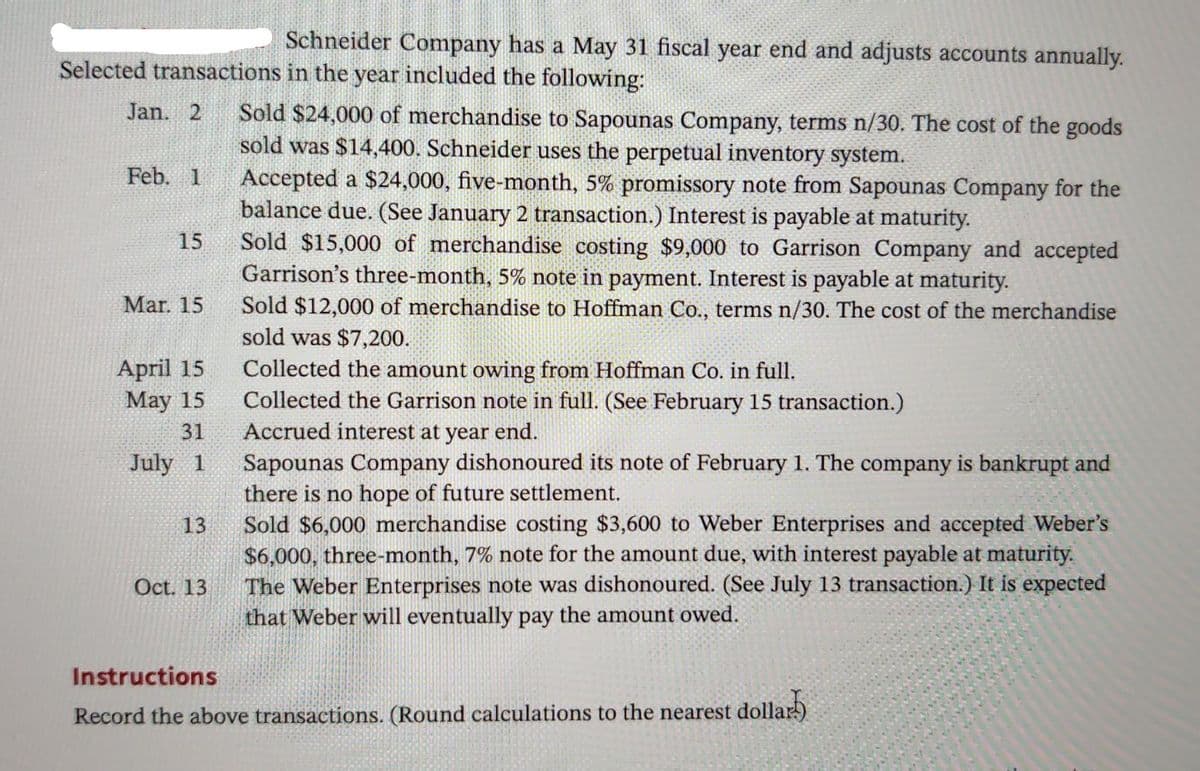

Schneider Company has a May 31 fiscal year end and adjusts accounts annually. Selected transactions in the year included the following: Jan. 2 Sold $24,000 of merchandise to Sapounas Company, terms n/30. The cost of the goods sold was $14,400. Schneider uses the perpetual inventory system. Accepted a $24,000, five-month, 5% promissory note from Sapounas Company for the balance due. (See January 2 transaction.) Interest is payable at maturity. Sold $15,000 of merchandise costing $9,000 to Garrison Company and accepted Garrison's three-month, 5% note in payment. Interest is payable at maturity. Sold $12,000 of merchandise to Hoffman Co., terms n/30. The cost of the merchandise sold was $7,200. Feb. 1 15 Mar. 15 April 15 May 15 Collected the amount owing from Hoffman Co. in full. Collected the Garrison note in full. (See February 15 transaction.) Accrued interest at year end. Sapounas Company dishonoured its note of February 1. The company is bankrupt and there is no hope of future settlement. Sold $6,000 merchandise costing $3,600 to Weber Enterprises and accepted Weber's $6,000, three-month, 7% note for the amount due, with interest payable at maturity. The Weber Enterprises note was dishonoured. (See July 13 transaction.) It is expected that Weber will eventually pay the amount owed. 31 July 1 13 Oct. 13 Instructions Record the above transactions. (Round calculations to the nearest dollar)

Schneider Company has a May 31 fiscal year end and adjusts accounts annually. Selected transactions in the year included the following: Jan. 2 Sold $24,000 of merchandise to Sapounas Company, terms n/30. The cost of the goods sold was $14,400. Schneider uses the perpetual inventory system. Accepted a $24,000, five-month, 5% promissory note from Sapounas Company for the balance due. (See January 2 transaction.) Interest is payable at maturity. Sold $15,000 of merchandise costing $9,000 to Garrison Company and accepted Garrison's three-month, 5% note in payment. Interest is payable at maturity. Sold $12,000 of merchandise to Hoffman Co., terms n/30. The cost of the merchandise sold was $7,200. Feb. 1 15 Mar. 15 April 15 May 15 Collected the amount owing from Hoffman Co. in full. Collected the Garrison note in full. (See February 15 transaction.) Accrued interest at year end. Sapounas Company dishonoured its note of February 1. The company is bankrupt and there is no hope of future settlement. Sold $6,000 merchandise costing $3,600 to Weber Enterprises and accepted Weber's $6,000, three-month, 7% note for the amount due, with interest payable at maturity. The Weber Enterprises note was dishonoured. (See July 13 transaction.) It is expected that Weber will eventually pay the amount owed. 31 July 1 13 Oct. 13 Instructions Record the above transactions. (Round calculations to the nearest dollar)

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 9PB: On June 30, 2019, the balances of the accounts appearing in the ledger of Simkins Company are as...

Related questions

Question

Transcribed Image Text:Schneider Company has a May 31 fiscal year end and adjusts accounts annually.

Selected transactions in the year included the following:

Sold $24,000 of merchandise to Sapounas Company, terms n/30. The cost of the goods

sold was $14,400. Schneider uses the perpetual inventory system.

Accepted a $24,000, five-month, 5% promissory note from Sapounas Company for the

balance due. (See January 2 transaction.) Interest is payable at maturity.

Sold $15,000 of merchandise costing $9,000 to Garrison Company and accepted

Garrison's three-month, 5% note in payment. Interest is payable at maturity.

Sold $12,000 of merchandise to Hoffman Co., terms n/30. The cost of the merchandise

sold was $7,200.

Jan. 2

Feb. 1

15

Mar. 15

April 15

May 15

Collected the amount owing from Hoffman Co. in full.

Collected the Garrison note in full. (See February 15 transaction.)

Accrued interest at year end.

Sapounas Company dishonoured its note of February 1. The company is bankrupt and

there is no hope of future settlement.

Sold $6,000 merchandise costing $3,600 to Weber Enterprises and accepted Weber's

$6,000, three-month, 7% note for the amount due, with interest payable at maturity.

The Weber Enterprises note was dishonoured. (See July 13 transaction.) It is expected

that Weber will eventually pay the amount owed.

31

July 1

13

Oct. 13

Instructions

Record the above transactions. (Round calculations to the nearest dollar)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT