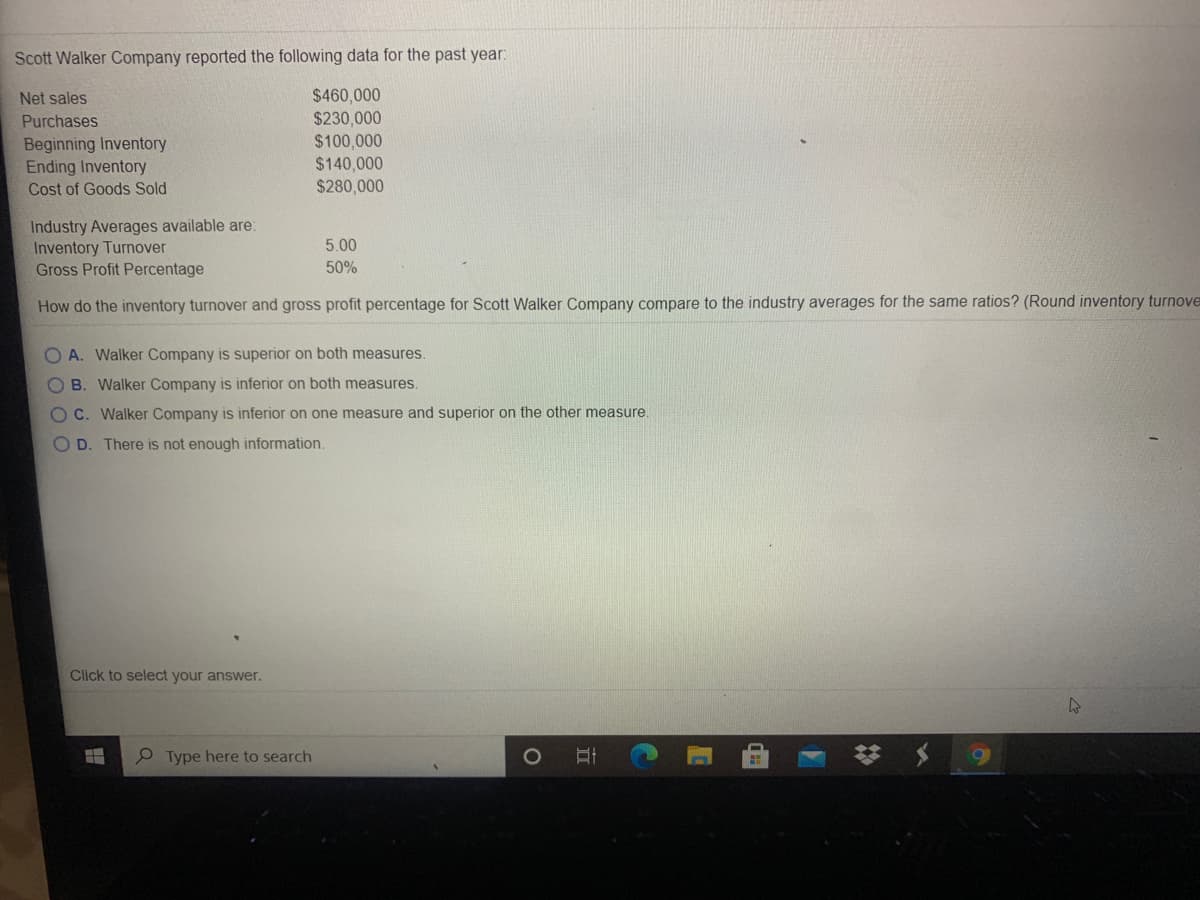

Scott Walker Company reported the following data for the past year: $460,000 $230,000 $100,000 $140,000 $280,000 Net sales Purchases Beginning Inventory Ending Inventory Cost of Goods Sold Industry Averages available are: Inventory Turnover Gross Profit Percentage 5.00 50% How do the inventory turnover and gross profit percentage for Scott Walker Company compare to the industry averages for the same ratios? (Round inventory turnow O A. Walker Company is superior on both measures. OB. Walker Company is inferior on both measures. OC. Walker Company is inferior on one measure and superior on the other measure. O D. There is not enough information.

Scott Walker Company reported the following data for the past year: $460,000 $230,000 $100,000 $140,000 $280,000 Net sales Purchases Beginning Inventory Ending Inventory Cost of Goods Sold Industry Averages available are: Inventory Turnover Gross Profit Percentage 5.00 50% How do the inventory turnover and gross profit percentage for Scott Walker Company compare to the industry averages for the same ratios? (Round inventory turnow O A. Walker Company is superior on both measures. OB. Walker Company is inferior on both measures. OC. Walker Company is inferior on one measure and superior on the other measure. O D. There is not enough information.

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 67P

Related questions

Question

PLEASE HELP ME SOLVE!! 27

Transcribed Image Text:Scott Walker Company reported the following data for the past year:

$460,000

$230,000

Net sales

Purchases

Beginning Inventory

Ending Inventory

$100,000

$140,000

$280,000

Cost of Goods Sold

Industry Averages available are:

Inventory Turnover

Gross Profit Percentage

5.00

50%

How do the inventory turnover and gross profit percentage for Scott Walker Company compare to the industry averages for the same ratios? (Round inventory turnove

O A. Walker Company is superior on both measures.

B. Walker Company is inferior on both measures.

OC. Walker Company is inferior on one measure and superior on the other measure.

OD. There is not enough information.

Click to select your answer.

Type here to search

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning