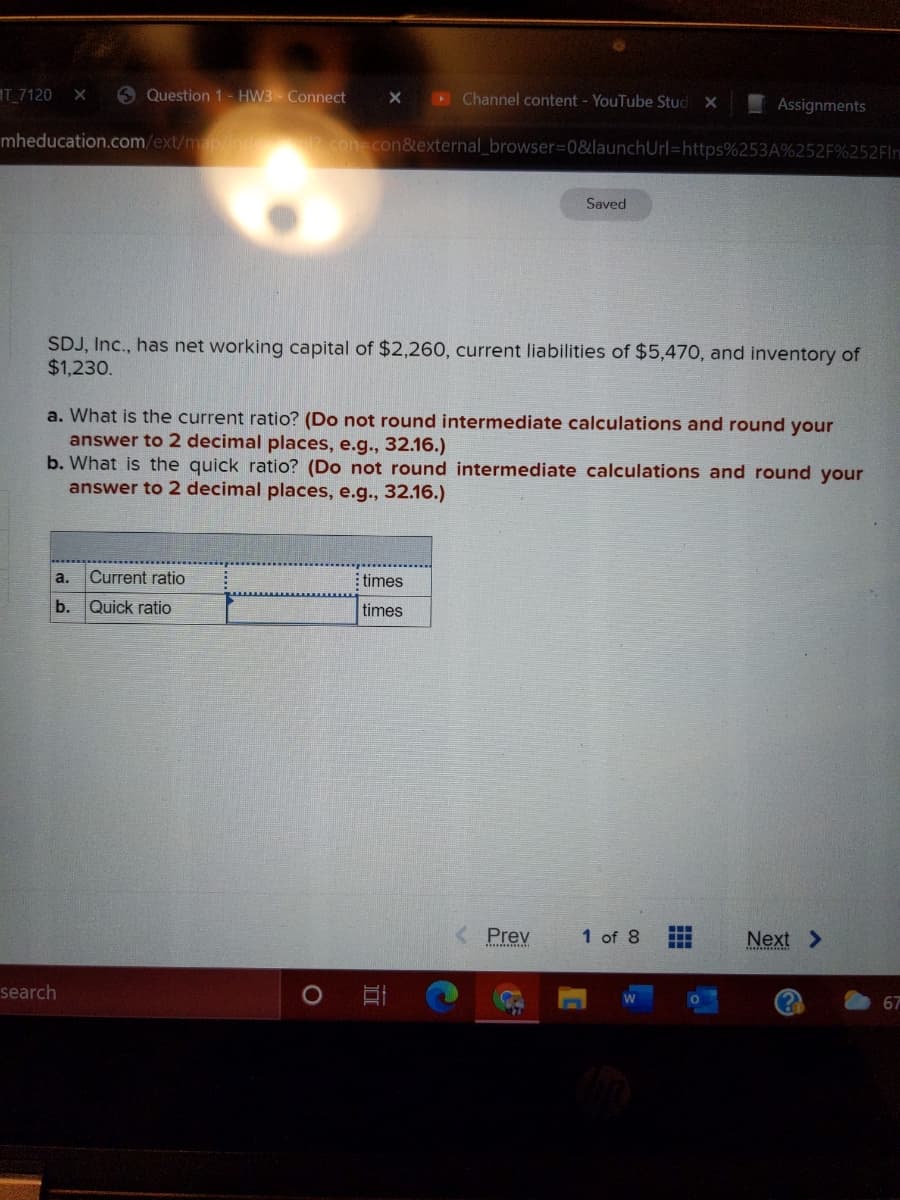

SDJ, Inc., has net working capital of $2,260, current liabilities of $5,470, and inventory of $1,230. a. What is the current ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the quick ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Current ratio times b. Quick ratio times

SDJ, Inc., has net working capital of $2,260, current liabilities of $5,470, and inventory of $1,230. a. What is the current ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the quick ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Current ratio times b. Quick ratio times

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter3: The Adjusting Process

Section: Chapter Questions

Problem 3.1ADM

Related questions

Question

100%

Practice Pack

1. Answer questions A and B

Transcribed Image Text:IT 7120 X

5 Question 1- HW3 - Connect

D Channel content - YouTube Stud

Assignments

mheducation.com/ext/map/ind .com con&external browser%3D0&launchUrl=https%253A%252F%252Flm

Saved

SDJ, Inc., has net working capital of $2,260, current liabilities of $5,470, and inventory of

$1,230.

a. What is the current ratio? (Do not round intermediate calculations and round your

answer to 2 decimal places, e.g., 32.16.)

b. What is the quick ratio? (Do not round intermediate calculations and round your

answer to 2 decimal places, e.g., 32.16.)

a.

Current ratio

: times

b.

Quick ratio

times

Prev

1 of 8

Next >

search

67

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning