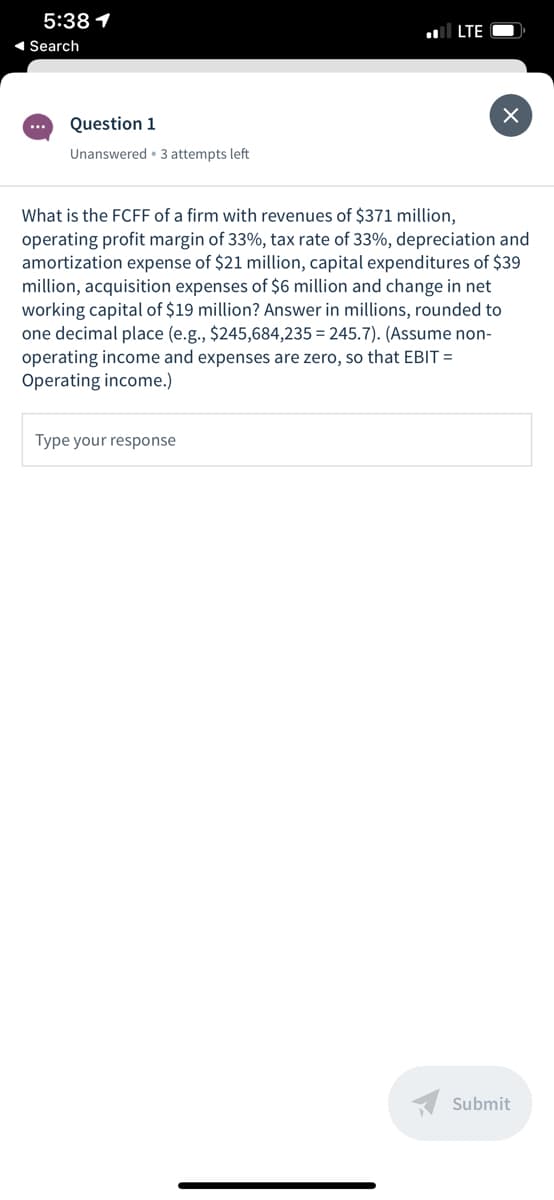

What is the FCFF of a firm with revenues of $371 million, operating profit margin of 33%, tax rate of 33%, depreciation and amortization expense of $21 million, capital expenditures of $39 million, acquisition expenses of $6 million and change in net working capital of $19 million? Answer in millions, rounded to one decimal place (e.g., $245,684,235 = 245.7). (Assume non- operating income and expenses are zero, so that EBIT = Operating income.)

What is the FCFF of a firm with revenues of $371 million, operating profit margin of 33%, tax rate of 33%, depreciation and amortization expense of $21 million, capital expenditures of $39 million, acquisition expenses of $6 million and change in net working capital of $19 million? Answer in millions, rounded to one decimal place (e.g., $245,684,235 = 245.7). (Assume non- operating income and expenses are zero, so that EBIT = Operating income.)

Accounting

27th Edition

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 15.2CP

Related questions

Question

#1

Transcribed Image Text:5:38 1

l LTE

1 Search

...

Question 1

Unanswered • 3 attempts left

What is the FCFF of a firm with revenues of $371 million,

operating profit margin of 33%, tax rate of 33%, depreciation and

amortization expense of $21 million, capital expenditures of $39

million, acquisition expenses of $6 million and change in net

working capital of $19 million? Answer in millions, rounded to

one decimal place (e.g., $245,684,235 = 245.7). (Assume non-

operating income and expenses are zero, so that EBIT =

Operating income.)

Type your response

Submit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning