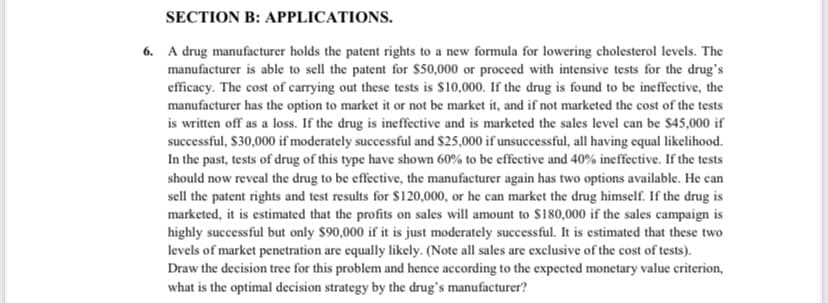

SECTION B: APPLICATIONS. 6. A drug manufacturer holds the patent rights to a new formula for lowering cholesterol levels. The manufacturer is able to sell the patent for $50,000 or proceed with intensive tests for the drug's efficacy. The cost of carrying out these tests is $10,000. If the drug is found to be ineffective, the manufacturer has the option to market it or not be market it, and if not marketed the cost of the tests is written off as a loss. If the drug is ineffective and is marketed the sales level can be $45,000 if successful, $30,000 if moderately successful and $25,000 if unsuccessful, all having equal likelihood. In the past, tests of drug of this type have shown 60% to be effective and 40% ineffective. If the tests should now reveal the drug to be effective, the manufacturer again has two options available. He can sell the patent rights and test results for $120,000, or he can market the drug himself. If the drug is marketed, it is estimated that the profits on sales will amount to $180,000 if the sales campaign is highly successful but only $90,000 if it is just moderately successful. It is estimated that these two levels of market penetration are equally likely. (Note all sales are exclusive of the cost of tests). Draw the decision tree for this problem and hence according to the expected monetary value criterion, what is the optimal decision strategy by the drug's manufacturer?

SECTION B: APPLICATIONS. 6. A drug manufacturer holds the patent rights to a new formula for lowering cholesterol levels. The manufacturer is able to sell the patent for $50,000 or proceed with intensive tests for the drug's efficacy. The cost of carrying out these tests is $10,000. If the drug is found to be ineffective, the manufacturer has the option to market it or not be market it, and if not marketed the cost of the tests is written off as a loss. If the drug is ineffective and is marketed the sales level can be $45,000 if successful, $30,000 if moderately successful and $25,000 if unsuccessful, all having equal likelihood. In the past, tests of drug of this type have shown 60% to be effective and 40% ineffective. If the tests should now reveal the drug to be effective, the manufacturer again has two options available. He can sell the patent rights and test results for $120,000, or he can market the drug himself. If the drug is marketed, it is estimated that the profits on sales will amount to $180,000 if the sales campaign is highly successful but only $90,000 if it is just moderately successful. It is estimated that these two levels of market penetration are equally likely. (Note all sales are exclusive of the cost of tests). Draw the decision tree for this problem and hence according to the expected monetary value criterion, what is the optimal decision strategy by the drug's manufacturer?

Chapter7: Matrices And Determinants

Section7.2: Operations With Matrices

Problem 12ECP

Related questions

Topic Video

Question

Transcribed Image Text:SECTION B: APPLICATIONS.

6. A drug manufacturer holds the patent rights to a new formula for lowering cholesterol levels. The

manufacturer is able to sell the patent for $50,000 or proceed with intensive tests for the drug's

efficacy. The cost of carrying out these tests is $10,000. If the drug is found to be ineffective, the

manufacturer has the option to market it or not be market it, and if not marketed the cost of the tests

is written off as a loss. If the drug is ineffective and is marketed the sales level can be $45,000 if

successful, $30,000 if moderately successful and $25,000 if unsuccessful, all having equal likelihood.

In the past, tests of drug of this type have shown 60% to be effective and 40% ineffective. If the tests

should now reveal the drug to be effective, the manufacturer again has two options available. He can

sell the patent rights and test results for $120,000, or he can market the drug himself. If the drug is

marketed, it is estimated that the profits on sales will amount to $180,000 if the sales campaign is

highly successful but only $90,000 if it is just moderately successful. It is estimated that these two

levels of market penetration are equally likely. (Note all sales are exclusive of the cost of tests).

Draw the decision tree for this problem and hence according to the expected monetary value criterion,

what is the optimal decision strategy by the drug's manufacturer?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Recommended textbooks for you