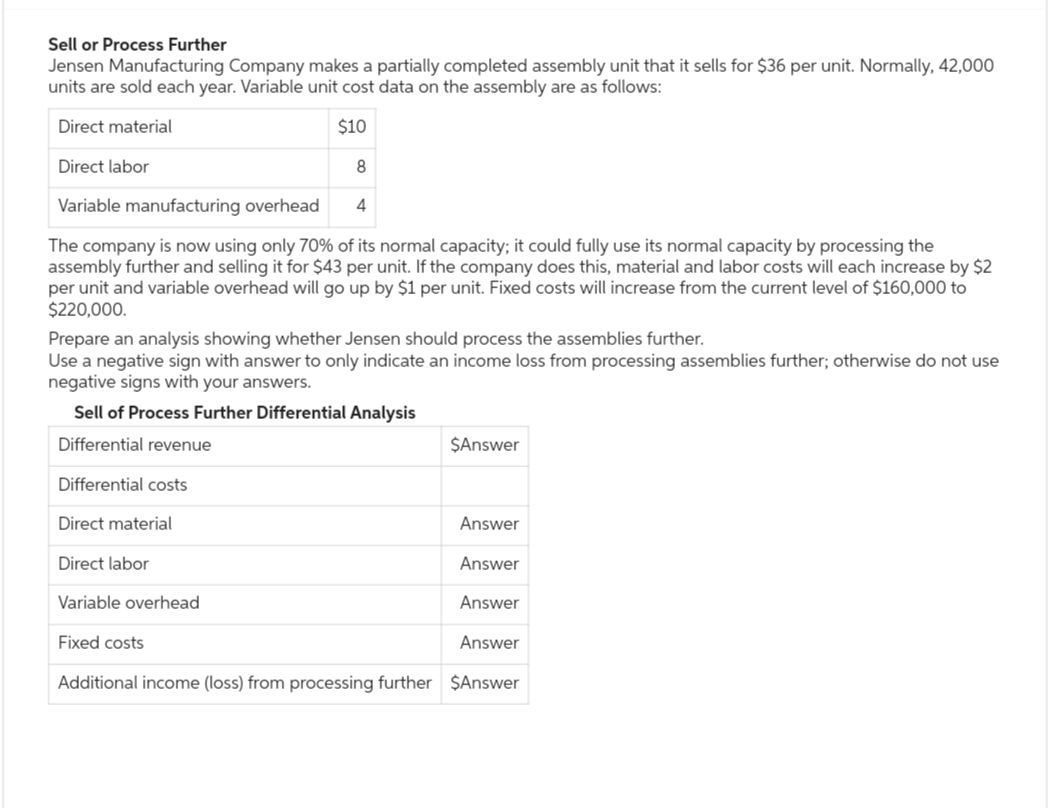

Sell or Process Further Jensen Manufacturing Company makes a partially completed assembly unit that it sells for $36 per unit. Normally, 42,000 units are sold each year. Variable unit cost data on the assembly are as follows: Direct material Direct labor $10 8 Variable manufacturing overhead 4 The company is now using only 70% of its normal capacity; it could fully use its normal capacity by processing the assembly further and selling it for $43 per unit. If the company does this, material and labor costs will each increase by $2 per unit and variable overhead will go up by $1 per unit. Fixed costs will increase from the current level of $160,000 to $220,000. Prepare an analysis showing whether Jensen should process the assemblies further. Use a negative sign with answer to only indicate an income loss from processing assemblies further; otherwise do not use negative signs with your answers. Sell of Process Further Differential Analysis Differential revenue Differential costs Direct material Direct labor Variable overhead Fixed costs $Answer Answer Answer Answer Answer Additional income (loss) from processing further $Answer

Sell or Process Further Jensen Manufacturing Company makes a partially completed assembly unit that it sells for $36 per unit. Normally, 42,000 units are sold each year. Variable unit cost data on the assembly are as follows: Direct material Direct labor $10 8 Variable manufacturing overhead 4 The company is now using only 70% of its normal capacity; it could fully use its normal capacity by processing the assembly further and selling it for $43 per unit. If the company does this, material and labor costs will each increase by $2 per unit and variable overhead will go up by $1 per unit. Fixed costs will increase from the current level of $160,000 to $220,000. Prepare an analysis showing whether Jensen should process the assemblies further. Use a negative sign with answer to only indicate an income loss from processing assemblies further; otherwise do not use negative signs with your answers. Sell of Process Further Differential Analysis Differential revenue Differential costs Direct material Direct labor Variable overhead Fixed costs $Answer Answer Answer Answer Answer Additional income (loss) from processing further $Answer

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 7PB: Remarkable Enterprises requires four units of part A for every unit of Al that it produces....

Related questions

Question

Please do not give solution in image format

Transcribed Image Text:Sell or Process Further

Jensen Manufacturing Company makes a partially completed assembly unit that it sells for $36 per unit. Normally, 42,000

units are sold each year. Variable unit cost data on the assembly are as follows:

Direct material

Direct labor

$10

8

Variable manufacturing overhead

4

The company is now using only 70% of its normal capacity; it could fully use its normal capacity by processing the

assembly further and selling it for $43 per unit. If the company does this, material and labor costs will each increase by $2

per unit and variable overhead will go up by $1 per unit. Fixed costs will increase from the current level of $160,000 to

$220,000.

Prepare an analysis showing whether Jensen should process the assemblies further.

Use a negative sign with answer to only indicate an income loss from processing assemblies further; otherwise do not use

negative signs with your answers.

Sell of Process Further Differential Analysis

Differential revenue

Differential costs

Direct material

Direct labor

Variable overhead

Fixed costs

$Answer

Answer

Answer

Answer

Answer

Additional income (loss) from processing further $Answer

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning