Sept. Dec. 30 31 31 9.2%. Received interest on the Trust bond. Received interest on the Hanna and Trust bonds. The fair values of the bonds on this date equalled the fair values. Required: . For each of the bond investments, prepare an amortization schedule showing only 2020 and 2021. (Round your intermediate and final answers to the earest whole dollar amount. Enter all the amounts as positive values.) 2. Prepare the entries to record the transactions described above. (Enter all the amounts as positive values. Do not round intermediate calculations and round your final answers to the nearest dollar.)

Sept. Dec. 30 31 31 9.2%. Received interest on the Trust bond. Received interest on the Hanna and Trust bonds. The fair values of the bonds on this date equalled the fair values. Required: . For each of the bond investments, prepare an amortization schedule showing only 2020 and 2021. (Round your intermediate and final answers to the earest whole dollar amount. Enter all the amounts as positive values.) 2. Prepare the entries to record the transactions described above. (Enter all the amounts as positive values. Do not round intermediate calculations and round your final answers to the nearest dollar.)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 1E

Related questions

Question

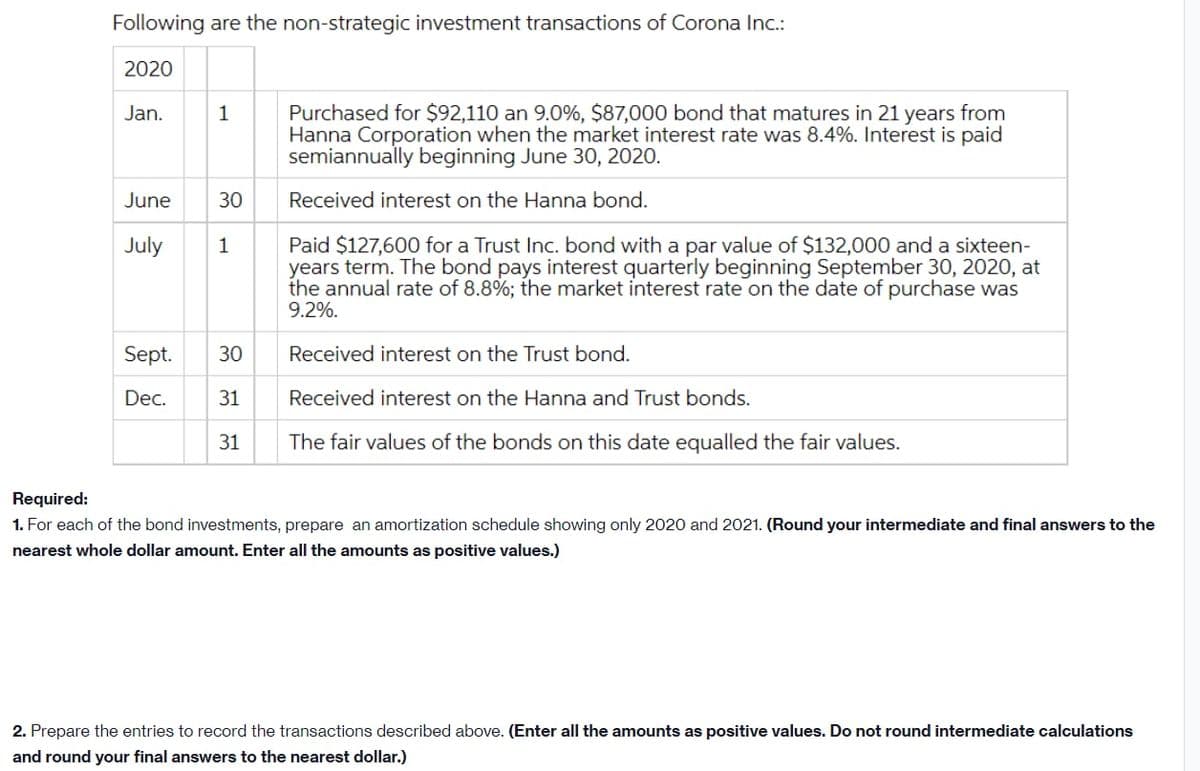

Transcribed Image Text:Following are the non-strategic investment transactions of Corona Inc.:

2020

Jan.

June

July

Sept.

Dec.

1 Purchased for $92,110 an 9.0%, $87,000 bond that matures in 21 years from

Hanna Corporation when the market interest rate was 8.4%. Interest is paid

semiannually beginning June 30, 2020.

Received interest on the Hanna bond.

30

1

30

31

31

Paid $127,600 for a Trust Inc. bond with a par value of $132,000 and a sixteen-

years term. The bond pays interest quarterly beginning September 30, 2020, at

the annual rate of 8.8%; the market interest rate on the date of purchase was

9.2%.

Received interest on the Trust bond.

Received interest on the Hanna and Trust bonds.

The fair values of the bonds on this date equalled the fair values.

Required:

1. For each of the bond investments, prepare an amortization schedule showing only 2020 and 2021. (Round your intermediate and final answers to the

nearest whole dollar amount. Enter all the amounts as positive values.)

2. Prepare the entries to record the transactions described above. (Enter all the amounts as positive values. Do not round intermediate calculations

and round your final answers to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning