Sheffield Inc. received dividends from its common share investments during the year ended December 31, 2020, as follows: A cash dividend of $10,100 is received from Peel Corporation. Sheffield owns a 3% interest in Peel. A cash dividend of $53,500 is received from Vonna Corporation. Sheffield owns a 29% interest in Vonna and a majority of Sheffield's directors are also directors of Vonna Corporation. • Acash dividend of $67,700 is received from Express Inc., a subsidiary of Sheffield. Determine how much dividend income Sheffield should report on its 2020 consolidated statement of comprehensive income. Dividend income to be reported by Sheffield Inc. %24

Sheffield Inc. received dividends from its common share investments during the year ended December 31, 2020, as follows: A cash dividend of $10,100 is received from Peel Corporation. Sheffield owns a 3% interest in Peel. A cash dividend of $53,500 is received from Vonna Corporation. Sheffield owns a 29% interest in Vonna and a majority of Sheffield's directors are also directors of Vonna Corporation. • Acash dividend of $67,700 is received from Express Inc., a subsidiary of Sheffield. Determine how much dividend income Sheffield should report on its 2020 consolidated statement of comprehensive income. Dividend income to be reported by Sheffield Inc. %24

Chapter18: Corporations: Organization And Capital Structure

Section: Chapter Questions

Problem 26P

Related questions

Question

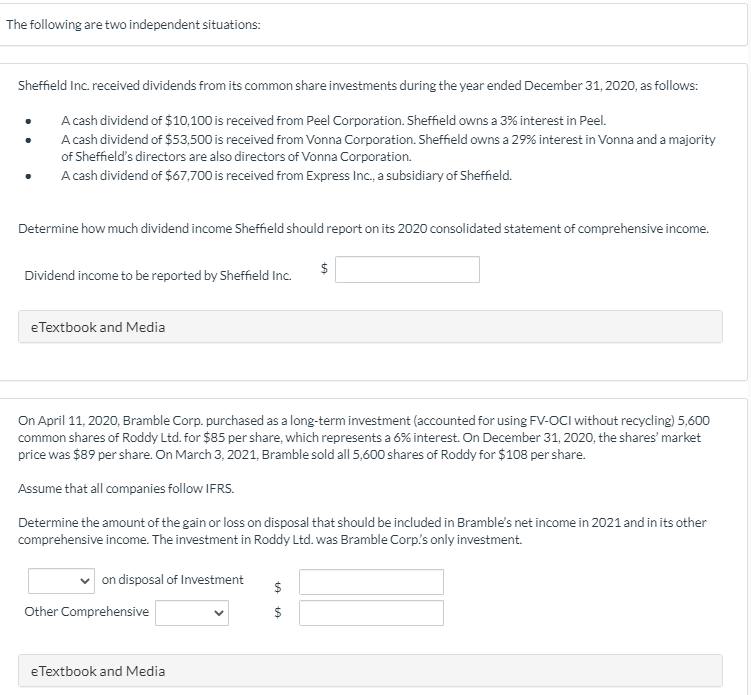

Transcribed Image Text:The following are two independent situations:

Sheffield Inc. received dividends from its common share investments during the year ended December 31, 2020, as follows:

A cash dividend of $10,100 is received from Peel Corporation. Sheffield owns a 3% interest in Peel.

A cash dividend of $53,500 is received from Vonna Corporation. Sheffield owns a 29% interest in Vonna and a majority

of Sheffield's directors are also directors of Vonna Corporation.

A cash dividend of $67,700 is received from Express Inc., a subsidiary of Sheffield.

Determine how much dividend income Sheffield should report on its 2020 consolidated statement of comprehensive income.

$

Dividend income to be reported by Sheffield Inc.

eTextbook and Media

On April 11, 2020, Bramble Corp. purchased as a long-term investment (accounted for using FV-OCI without recycling) 5,600

common shares of Roddy Ltd. for $85 per share, which represents a 6% interest. On December 31, 2020, the shares' market

price was $89 per share. On March 3, 2021, Bramble sold all 5,600 shares of Roddy for $108 per share.

Assume that all companies follow IFRS.

Determine the amount of the gain or loss on disposal that should be included in Bramble's net income in 2021 and in its other

comprehensive income. The investment in Roddy Ltd. was Bramble Corp's only investment.

on disposal of Investment

$

Other Comprehensive

eTextbook and Media

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning