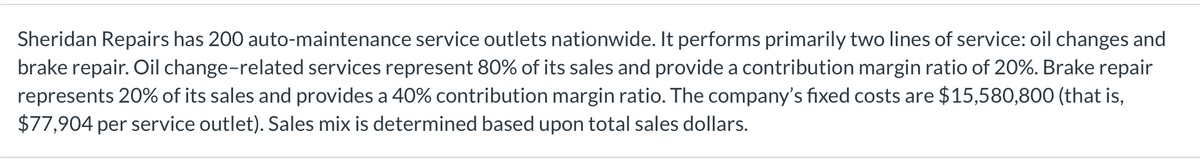

Sheridan Repairs has 200 auto-maintenance service outlets nationwide. It performs primarily two lines of service: oil changes and brake repair. Oil change-related services represent 80% of its sales and provide a contribution margin ratio of 20%. Brake repair represents 20% of its sales and provides a 40% contribution margin ratio. The company's fixed costs are $15,580,800 (that is, $77,904 per service outlet). Sales mix is determined based upon total sales dollars.

Sheridan Repairs has 200 auto-maintenance service outlets nationwide. It performs primarily two lines of service: oil changes and brake repair. Oil change-related services represent 80% of its sales and provide a contribution margin ratio of 20%. Brake repair represents 20% of its sales and provides a 40% contribution margin ratio. The company's fixed costs are $15,580,800 (that is, $77,904 per service outlet). Sales mix is determined based upon total sales dollars.

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 12EB: Power Corp. makes 2 products: blades for table saws and blades for handsaws. Each product passes...

Related questions

Question

Transcribed Image Text:Sheridan Repairs has 200 auto-maintenance service outlets nationwide. It performs primarily two lines of service: oil changes and

brake repair. Oil change-related services represent 80% of its sales and provide a contribution margin ratio of 20%. Brake repair

represents 20% of its sales and provides a 40% contribution margin ratio. The company's fixed costs are $15,580,800 (that is,

$77,904 per service outlet). Sales mix is determined based upon total sales dollars.

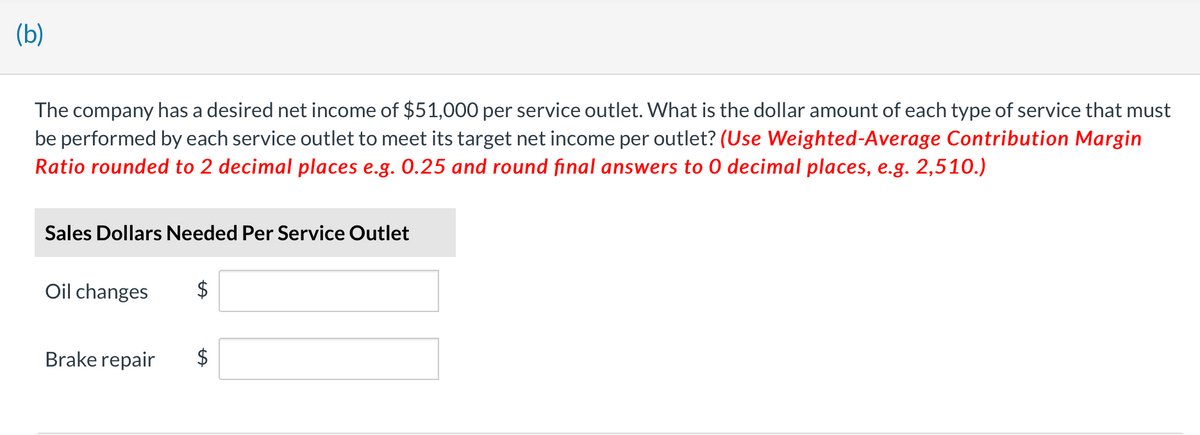

Transcribed Image Text:(b)

The company has a desired net income of $51,000 per service outlet. What is the dollar amount of each type of service that must

be performed by each service outlet to meet its target net income per outlet? (Use Weighted-Average Contribution Margin

Ratio rounded to 2 decimal places e.g. 0.25 and round final answers to 0 decimal places, e.g. 2,510.)

Sales Dollars Needed Per Service Outlet

Oil changes

Brake repair

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub