Show-Off, Inc., sells merchandise through three retail outlets-in Las Vegas, Reno, and Sacramento-and operates a general corporate headquarters in Reno. A review of the company's income statement indicates a record year in terms of sales and profits. Management, though, desires additional insights about the individual stores and has asked that Judson Wyatt, a newly hired intern, prepare a segmented income statement. The following information has been extracted from Show-Off's accounting records: • The sales volume, sales price, and purchase price data follow: Reno Sacramento Las Vegas 37,100 units $ 19.00 Sales volume Unit selling price Unit purchase price 41, 100 units $ 17.50 46, 040 units $ 15.25 9.75 8.75 8.75 • The following expenses were incurred for sales commissions, local advertising, property taxes, management salaries, and other noncontrollable (but traceable) costs: , 美 Las Vegas 5% Sacramento 5% Reno Sales commissions 5% Local advertising Local property taxes Sales manager salary Store manager salaries Other noncontrollable costs $16,600 6, 800 $33,500 3,050 $75, e00 9,300 49,500 59, e00 27,700 47,000 8, 800 59, 50e 6,950 Local advertising decisions are made at the store manager level. The sales manager's salary in Sacramento is determined by the Sacramento store manager, in contrast, store manager salaries are set by Show-Off's vice president. •Nontraceable fixed corporate expenses total $293,450. •The company uses a responsibility accounting system.

Show-Off, Inc., sells merchandise through three retail outlets-in Las Vegas, Reno, and Sacramento-and operates a general corporate headquarters in Reno. A review of the company's income statement indicates a record year in terms of sales and profits. Management, though, desires additional insights about the individual stores and has asked that Judson Wyatt, a newly hired intern, prepare a segmented income statement. The following information has been extracted from Show-Off's accounting records: • The sales volume, sales price, and purchase price data follow: Reno Sacramento Las Vegas 37,100 units $ 19.00 Sales volume Unit selling price Unit purchase price 41, 100 units $ 17.50 46, 040 units $ 15.25 9.75 8.75 8.75 • The following expenses were incurred for sales commissions, local advertising, property taxes, management salaries, and other noncontrollable (but traceable) costs: , 美 Las Vegas 5% Sacramento 5% Reno Sales commissions 5% Local advertising Local property taxes Sales manager salary Store manager salaries Other noncontrollable costs $16,600 6, 800 $33,500 3,050 $75, e00 9,300 49,500 59, e00 27,700 47,000 8, 800 59, 50e 6,950 Local advertising decisions are made at the store manager level. The sales manager's salary in Sacramento is determined by the Sacramento store manager, in contrast, store manager salaries are set by Show-Off's vice president. •Nontraceable fixed corporate expenses total $293,450. •The company uses a responsibility accounting system.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter10: Decentralization: Responsibility Accounting, Performance Evaluation, And Transfer Pricing

Section: Chapter Questions

Problem 31P

Related questions

Question

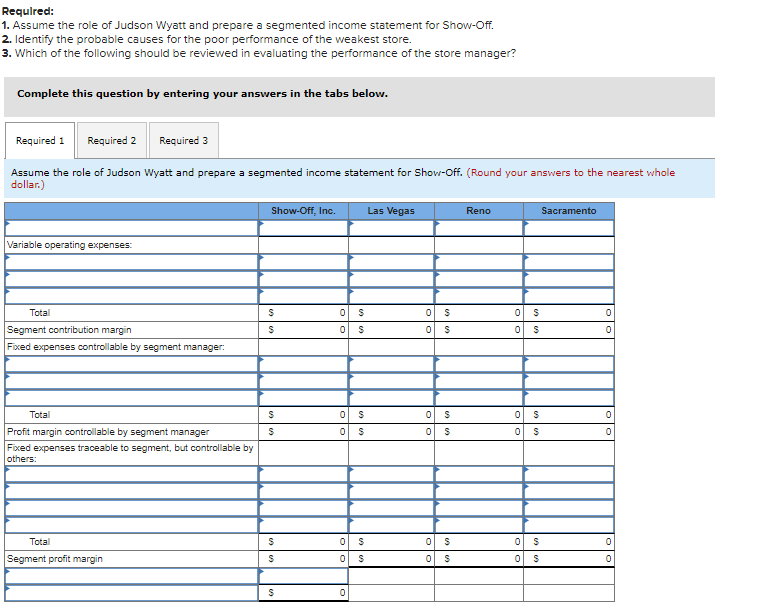

Transcribed Image Text:Requlred:

1. Assume the role of Judson Wyatt and prepare a segmented income statement for Show-Off.

2. Identify the probable causes for the poor performance of the weakest store.

3. Which of the following should be reviewed in evaluating the performance of the store manager?

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

Assume the role of Judson Wyatt and prepare a segmented income statement for Show-Off. (Round your answers to the nearest whole

dollar.)

Show-Off, Inc.

Las Vegas

Reno

Sacramento

Variable operating expenses:

Total

Segment contribution margin

Fixed expenses controllable by segment manager:

Total

Profit margin controllable by segment manager

Fixed expenses traceable to segment, but controllable by

others:

Total

Segment profit margin

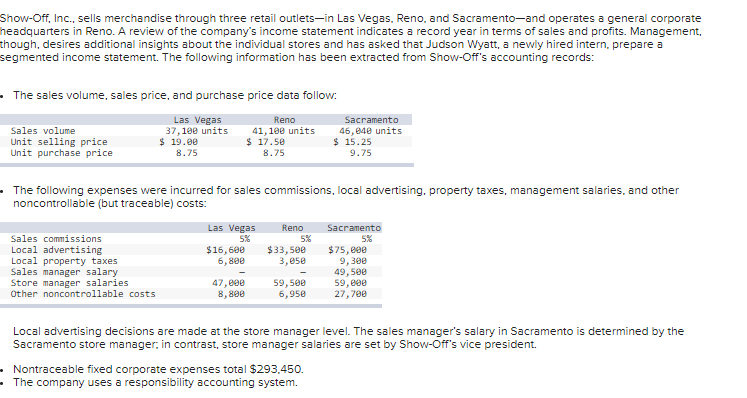

Transcribed Image Text:Show-Off, Inc., sells merchandise through three retail outlets-in Las Vegas, Reno, and Sacramento-and operates a general corporate

headquarters in Reno. A review of the company's income statement indicates a record year in terms of sales and profits. Management,

though, desires additional insights about the individual stores and has asked that Judson Wyatt, a newiy hired intern, prepare a

segmented income statement. The following information has been extracted from Show-Off's accounting records:

• The sales volume, sales price, and purchase price data follow:

Reno

Sacramento

Las Vegas

37,100 units

$ 19.00

8.75

Sales volume

Unit selling price

Unit purchase price

41, 100 units

$ 17.50

8.75

46, 040 units

$ 15.25

9.75

•The following expenses were incurred for sales commissions, local advertising, property taxes, management salaries, and other

noncontrollable (but traceable) costs:

Reno

Las Vegas

5%

Sacramento

5%

Sales commissions

5%

Local advertising

Local property taxes

Sales manager salary

Store manager salaries

Other noncontrollable costs

$75, 000

9,300

49, 500

59, 000

27,700

$16,600

6, 800

$33, 500

3,050

47, 000

8, 800

59,500

6,950

Local advertising decisions are made at the store manager level. The sales manager's salary in Sacramento is determined by the

Sacramento store manager, in contrast, store manager salaries are set by Show-Off's vice president.

Nontraceable fixed corporate expenses total $293.450.

•The company uses a responsibility accounting system.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,