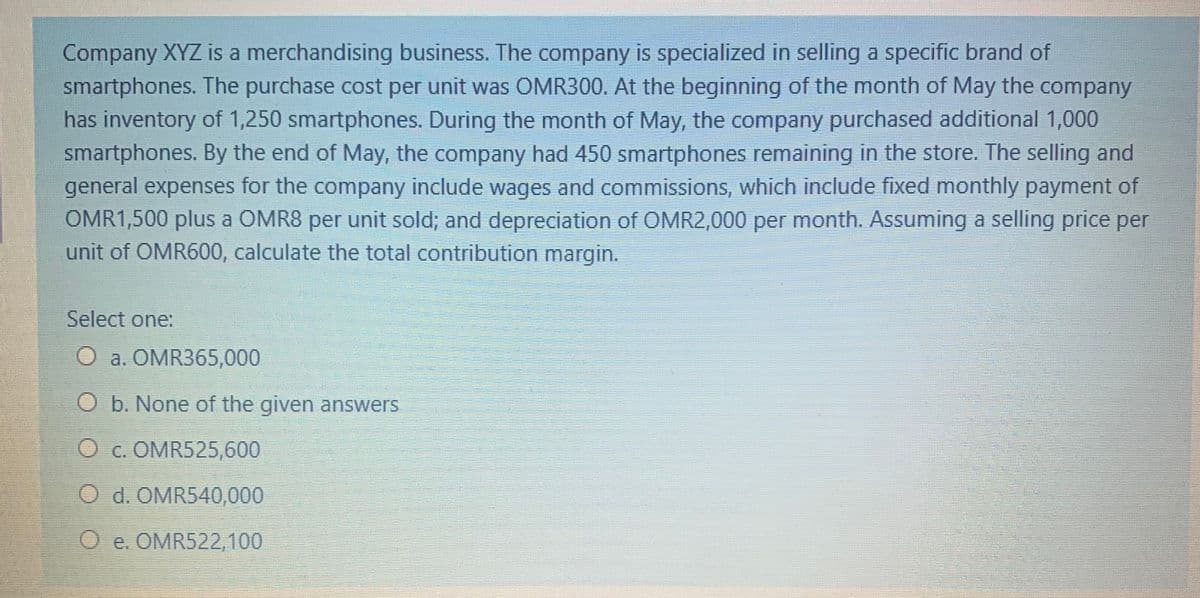

Company XYZ is a merchandising business. The company is specialized in selling a specific brand of smartphones. The purchase cost per unit was OMR300. At the beginning of the month of May the company has inventory of 1,250 smartphones. During the month of May, the company purchased additional 1,000 smartphones. By the end of May, the company had 450 smartphones remaining in the store. The selling and general expenses for the company include wages and commissions, which include fixed monthly payment of OMR1,500 plus a OMR8 per unit sold; and depreciation of OMR2,000 per month. Assuming a selling price per unit of OMR600, calculate the total contribution margin. Select one: O a. OMR365,000 O b. None of the given answers c. OMR525,600 O d. OMR540.000

Company XYZ is a merchandising business. The company is specialized in selling a specific brand of smartphones. The purchase cost per unit was OMR300. At the beginning of the month of May the company has inventory of 1,250 smartphones. During the month of May, the company purchased additional 1,000 smartphones. By the end of May, the company had 450 smartphones remaining in the store. The selling and general expenses for the company include wages and commissions, which include fixed monthly payment of OMR1,500 plus a OMR8 per unit sold; and depreciation of OMR2,000 per month. Assuming a selling price per unit of OMR600, calculate the total contribution margin. Select one: O a. OMR365,000 O b. None of the given answers c. OMR525,600 O d. OMR540.000

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter2: Basic Cost Management Concepts

Section: Chapter Questions

Problem 18E: Lakeesha Barnett owns and operates a package mailing store in a college town. Her store, Send It...

Related questions

Topic Video

Question

Transcribed Image Text:Company XYZ is a merchandising business. The company is specialized in selling a specific brand of

smartphones. The purchase cost per unit was COMR300. At the beginning of the month of May the company

has inventory of 1,250 smartphones. During the month of May, the company purchased additional 1,000

smartphones. By the end of May, the company had 450 smartphones remaining in the store. The selling and

general expenses for the company include wages and commissions, which include fixed monthly payment of

OMR1,500 plus a OMR8 per unit sold; and depreciation of OMR2,000 per month. Assuming a selling price per

unit of OMR600, calculate the total contribution margin.

Select one:

O a. OMR365,000

O b. None of the given answers

O c. OMR525,600

O d. OMR540,000

O e. OMR522,100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College