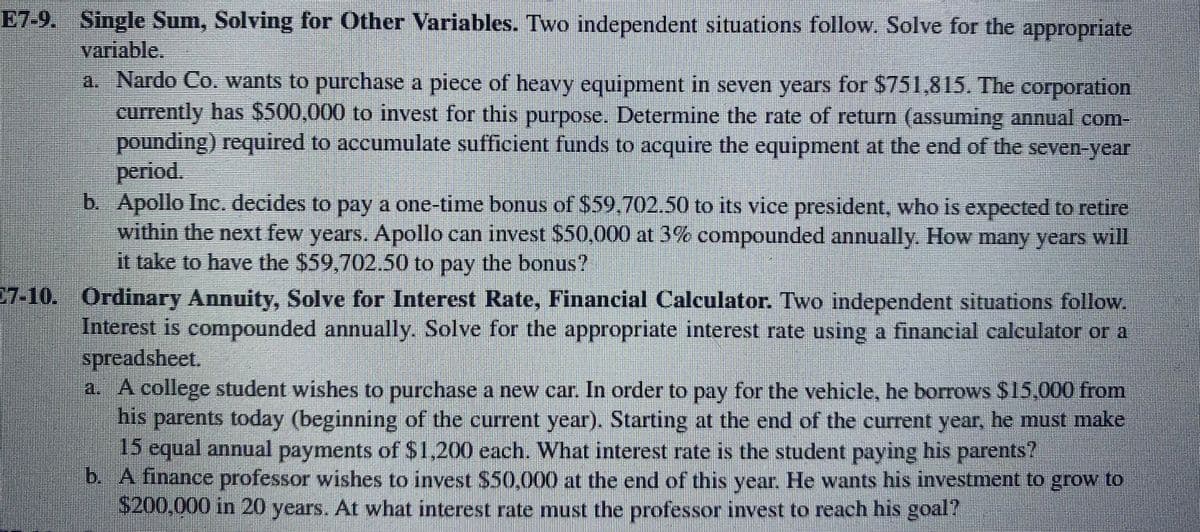

Single Sum, Solving for Other Variables. Two independent situations follow. Solve for the appropriate variable. a. Nardo Co. wants to purchase a piece of heavy equipment in seven years for $751,815. The corporation currently has $500,000 to invest for this purpose. Determine the rate of return (assuming annual com- pounding) required to accumulate sufficient funds to acquire the equipment at the end of the seven-year period. b. Apollo Inc. decides to pay a one-time bonus of $59,702.50 to its vice president, who is expected to retire within the next few years. Apollo can invest $50,000 at 3% compounded annually. How many years will it take to have the $59,702.50 to pay the bonus?

Single Sum, Solving for Other Variables. Two independent situations follow. Solve for the appropriate variable. a. Nardo Co. wants to purchase a piece of heavy equipment in seven years for $751,815. The corporation currently has $500,000 to invest for this purpose. Determine the rate of return (assuming annual com- pounding) required to accumulate sufficient funds to acquire the equipment at the end of the seven-year period. b. Apollo Inc. decides to pay a one-time bonus of $59,702.50 to its vice president, who is expected to retire within the next few years. Apollo can invest $50,000 at 3% compounded annually. How many years will it take to have the $59,702.50 to pay the bonus?

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 8P

Related questions

Question

Questions 7-9 and 7-10 attached. Answer shown in Excel formula please.

Transcribed Image Text:E7-9. Single Sum, Solving for Other Variables. Two independent situations follow. Solve for the appropriate

variable.

a. Nardo Co. wants to purchase a piece of heavy equipment in seven years for $751,815. The corporation

currently has $500,000 to invest for this purpose. Determine the rate of return (assuming annual com-

pounding) required to accumulate sufficient funds to acquire the equipment at the end of the seven-year

period.

b. Apollo Inc. decides to pay a one-time bonus of $59,702.50 to its vice president, who is expected to retire

within the next few years. Apollo can invest $50,000 at 3% compounded annually. How many years will

it take to have the $59,702.50 to pay the bonus?

7.10. Ordinary Annuity, Solve for Interest Rate, Financial Calculator. Two independent situations follow.

Interest is compounded annually. Solve for the appropriate interest rate using a financial calculator or a

spreadsheet.

a. A college student wishes to purchase a new car. In order to pay for the vehicle, he borrows $15,000 from

bis parents today (beginning of the current year). Starting at the end of the current year, he must make

15 equal annual payments of S1,200 each. What interest rate is the student paying his parents?

b. A finance professor wishes to invest $50,000 at the end of this year. He wants his investment to grow to

S200,000 in 20 years. At what interest rate must the professor invest to reach his goal?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College