Sink, Inc. had several employees working for the company. The main product line was different types of Diapers that people used to cover their faces during any type of flu outbreak. The following information was provided to you regarding the most recent payroll: Gross wages were $400,000 Medical Insurance was $35,000 in total with the employee paying 30% and

Sink, Inc. had several employees working for the company. The main product line was different types of Diapers that people used to cover their faces during any type of flu outbreak. The following information was provided to you regarding the most recent payroll: Gross wages were $400,000 Medical Insurance was $35,000 in total with the employee paying 30% and

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Liabilities: Current, Installment Notes, And Contingencies

Section: Chapter Questions

Problem 10.1EX: Current liabilities Bon Nebo Co. sold 25,000 annual subscriptions of Bjorn for 85 during December...

Related questions

Question

help

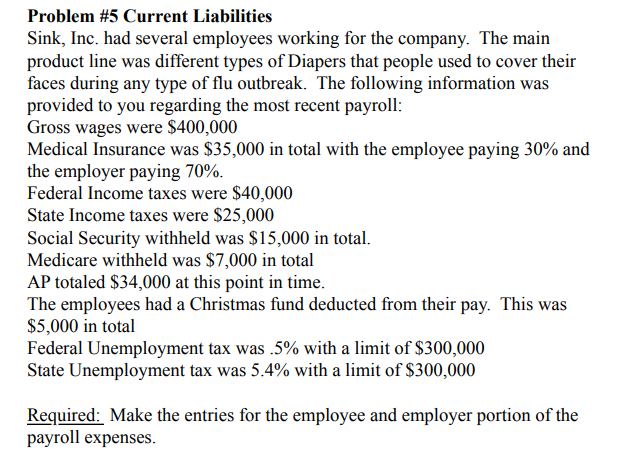

Transcribed Image Text:Problem #5 Current Liabilities

Sink, Inc. had several employees working for the company. The main

product line was different types of Diapers that people used to cover their

faces during any type of flu outbreak. The following information was

provided to you regarding the most recent payroll:

Gross wages were $400,000

Medical Insurance was $35,000 in total with the employee paying 30% and

the employer paying 70%.

Federal Income taxes were $40,000

State Income taxes were $25,000

Social Security withheld was $15,000 in total.

Medicare withheld was $7,000 in total

AP totaled $34,000 at this point in time.

The employees had a Christmas fund deducted from their pay. This was

$5,000 in total

Federal Unemployment tax was .5% with a limit of $300,000

State Unemployment tax was 5.4% with a limit of $300,000

Required: Make the entries for the employee and employer portion of the

payroll expenses.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning