3. Richard Corp has the following data for the third week of December: Employee Name Classification Hours Worked Rate per hour A. Kuhol Laborer 45 50 B. Aileen Office Secretary 46 45 C. Jose D. Jay Laborer 50 52 Factory Supervisor 55 48 Sales agent Laborer E. Richmond 52 60 F. Edward 48 45 The following are to be deducted to the gross earnings of employees: Witholding taxes 5% SSS contributions 3% Philhealth 1% Pag-ibig 1% Richard Corp paid its employees one and half times the regular rate for hours worked in excess of 40 hours. How much is the gross payroll?

3. Richard Corp has the following data for the third week of December: Employee Name Classification Hours Worked Rate per hour A. Kuhol Laborer 45 50 B. Aileen Office Secretary 46 45 C. Jose D. Jay Laborer 50 52 Factory Supervisor 55 48 Sales agent Laborer E. Richmond 52 60 F. Edward 48 45 The following are to be deducted to the gross earnings of employees: Witholding taxes 5% SSS contributions 3% Philhealth 1% Pag-ibig 1% Richard Corp paid its employees one and half times the regular rate for hours worked in excess of 40 hours. How much is the gross payroll?

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 12EB: Reference Figure 12.15 and use the following information to complete the requirements. A. Determine...

Related questions

Question

What is the answer in number 3?~

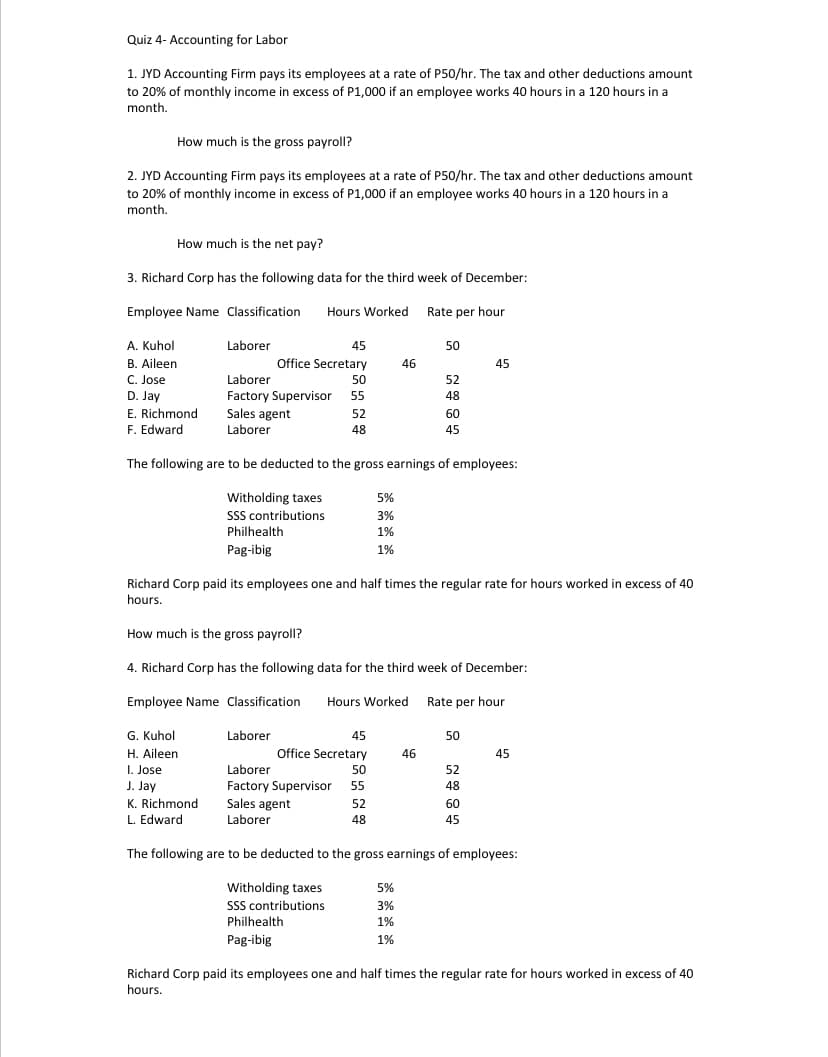

Transcribed Image Text:Quiz 4- Accounting for Labor

1. JYD Accounting Firm pays its employees at a rate of P50/hr. The tax and other deductions amount

to 20% of monthly income in excess of P1,000 if an employee works 40 hours in a 120 hours in a

month.

How much is the gross payroll?

2. JYD Accounting Firm pays its employees at a rate of P50/hr. The tax and other deductions amount

to 20% of monthly income in excess of P1,000 if an employee works 40 hours in a 120 hours in a

month.

How much is the net pay?

3. Richard Corp has the following data for the third week of December:

Employee Name Classification

Hours Worked Rate per hour

A. Kuhol

Laborer

45

50

B. Aileen

Office Secretary

46

45

C. Jose

Laborer

50

52

D. Jay

E. Richmond

Factory Supervisor

Sales agent

Laborer

55

48

52

60

F. Edward

48

45

The following are to be deducted to the gross earnings of employees:

Witholding taxes

5%

SSS contributions

Philhealth

3%

1%

Pag-ibig

1%

Richard Corp paid its employees one and half times the regular rate for hours worked in excess of 40

hours.

How much is the gross payroll?

4. Richard Corp has the following data for the third week of December:

Employee Name Classification

Hours Worked Rate per hour

G. Kuhol

Laborer

45

50

H. Aileen

Office Secretary

46

45

I. Jose

J. Jay

Laborer

50

52

Factory Supervisor 55

Sales agent

48

K. Richmond

52

60

L. Edward

Laborer

48

45

The following are to be deducted to the gross earnings of employees:

5%

Witholding taxes

SSS contributions

3%

Philhealth

1%

Pag-ibig

1%

Richard Corp paid its employees one and half times the regular rate for hours worked in excess of 40

hours.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning