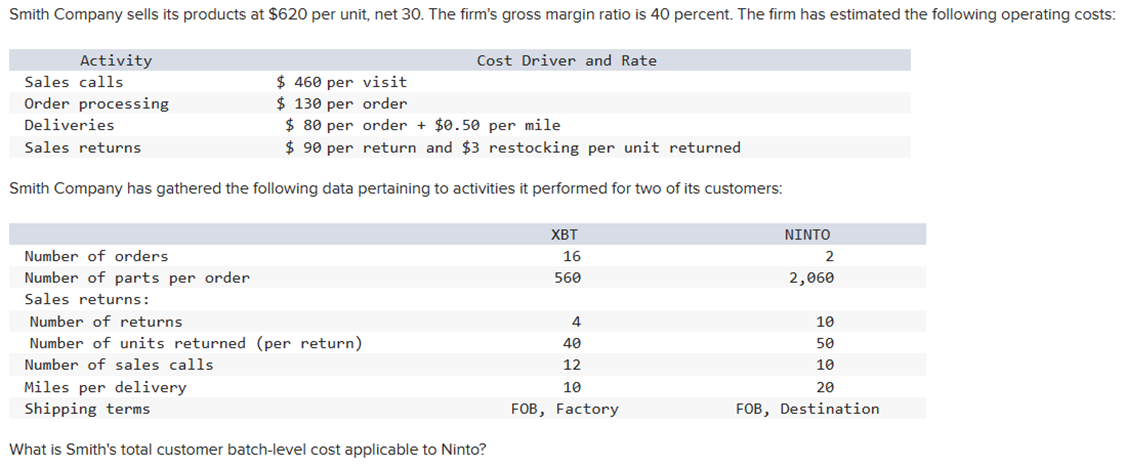

Smith Company sells its products at $620 per unit, net 30. The firm's gross margin ratio is 40 percent. The firm has estimated the following operating costs: Activity Sales calls Order processing Deliveries Sales returns $460 per visit $130 per order $80 per order + $0.50 per mile $90 per return and $3 restocking per unit returned Smith Company has gathered the following data pertaining to activities it performed for two of its customers: Cost Driver and Rate Number of orders Number of parts per order Sales returns: Number of returns Number of units returned (per return) Number of sales calls Miles per delivery Shipping terms What is Smith's total customer batch-level cost applicable to Ninto? XBT 16 560 4 40 12 10 FOB, Factory NINTO 2 2,060 10 50 10 20 FOB, Destination

Smith Company sells its products at $620 per unit, net 30. The firm's gross margin ratio is 40 percent. The firm has estimated the following operating costs: Activity Sales calls Order processing Deliveries Sales returns $460 per visit $130 per order $80 per order + $0.50 per mile $90 per return and $3 restocking per unit returned Smith Company has gathered the following data pertaining to activities it performed for two of its customers: Cost Driver and Rate Number of orders Number of parts per order Sales returns: Number of returns Number of units returned (per return) Number of sales calls Miles per delivery Shipping terms What is Smith's total customer batch-level cost applicable to Ninto? XBT 16 560 4 40 12 10 FOB, Factory NINTO 2 2,060 10 50 10 20 FOB, Destination

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter7: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 46E: Lotts Company produces and sells one product. The selling price is 10, and the unit variable cost is...

Related questions

Question

Transcribed Image Text:Smith Company sells its products at $620 per unit, net 30. The firm's gross margin ratio is 40 percent. The firm has estimated the following operating costs:

Activity

Sales calls

Order processing

Deliveries

Sales returns

Cost Driver and Rate

$460 per visit

$ 130 per order

$80 per order + $0.50 per mile

$ 90 per return and $3 restocking per unit returned

Smith Company has gathered the following data pertaining to activities it performed for two of its customers:

Number of orders

Number of parts per order

Sales returns:

Number of returns.

Number of units returned (per return)

Number of sales calls

Miles per delivery

Shipping terms

What is Smith's total customer batch-level cost applicable to Ninto?

XBT

16

560

4

40

12

10

FOB, Factory

NINTO

2

2,060

10

50

10

20

FOB, Destination

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning