Smith Winery in Pleasant Valley, New York, has two departments: Fermenting and Packaging. Direct materials are added at the beginning of the fermenting process (grapes) and at the end of the packaging process (bottles). Data from the month of March for the Fermenting Department are as follows: Click the icon to view the data from March.) Smith Winery completed the following production cost report for its Fermenting Department for the month of March: (Click the icon to view the production cost report.) Conversion costs are added evenly throughout each process. The company uses the weighted-average method. Read the requirements. Requirement 1. Prepare the journal entries to record the assignment of direct materials and direct labor and the allocation of manufacturing overhead to the Fermenting Department. Assume labor costs are accrued and not yet paid. Also prepare the journal entry to record the cost of the gallons completed and transferred out to the Packaging Department. Begin with the summary journal entry to record the assignment of direct materials and direct labor and the allocation of manufacturing overhead to the Fermenting Department. (Prepare a single compound journal entry. Record debits first, then credits. Exclude explanations from any journal entries.) Date Accounts Debit Credit Mar. 31

Smith Winery in Pleasant Valley, New York, has two departments: Fermenting and Packaging. Direct materials are added at the beginning of the fermenting process (grapes) and at the end of the packaging process (bottles). Data from the month of March for the Fermenting Department are as follows: Click the icon to view the data from March.) Smith Winery completed the following production cost report for its Fermenting Department for the month of March: (Click the icon to view the production cost report.) Conversion costs are added evenly throughout each process. The company uses the weighted-average method. Read the requirements. Requirement 1. Prepare the journal entries to record the assignment of direct materials and direct labor and the allocation of manufacturing overhead to the Fermenting Department. Assume labor costs are accrued and not yet paid. Also prepare the journal entry to record the cost of the gallons completed and transferred out to the Packaging Department. Begin with the summary journal entry to record the assignment of direct materials and direct labor and the allocation of manufacturing overhead to the Fermenting Department. (Prepare a single compound journal entry. Record debits first, then credits. Exclude explanations from any journal entries.) Date Accounts Debit Credit Mar. 31

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter6: Process Costing

Section: Chapter Questions

Problem 21E: Dama Company produces womens blouses and uses the FIFO method to account for its manufacturing...

Related questions

Question

100%

Gallons

Beginning Work-in-Process Inventory = 400 gallons

Started in production = 8,700 gallons

Completed and transferred out to Packaging in March = 7,900 gallons

Ending Work-in-Process Inventory (80% of the way = 1,200 gallons

through the fermenting process)

Costs

Beginning Work-in-Process Inventory:

Direct materials =$6,370

Direct labor = 250

Manufacturing overhead allocated = 260

Costs added during March:

Direct materials = 4,550

Direct labor = 196

Manufacturing overhead allocated = 4,610

Total costs added during March = $9,356

Transcribed Image Text:Smith Winery in Pleasant Valley, New York, has two departments: Fermenting and Packaging.

Direct materials are added at the beginning of the fermenting process (grapes) and at the end

of the packaging process (bottles). Data from the month of March for the Fermenting

Department are as follows:

(Click the icon to view the data from March.)

Smith Winery completed the following production cost report for its Fermenting Department for

the month of March:

A (Click the icon to view the production cost report.)

Conversion costs are added evenly throughout each process. The company uses the

weighted-average method.

Read the requirements.

Requirement 1. Prepare the journal entries to record the assignment of direct materials and direct labor and the allocation of manufacturing overhead to the Fermenting Department. Assume

labor costs are accrued and not yet paid. Also prepare the journal entry to record the cost of the gallons completed and transferred out to the Packaging Department.

Begin with the summary journal entry to record the assignment of direct materials and direct labor and the allocation of manufacturing overhead to the Fermenting Department. (Prepare a single

compound journal entry. Record debits first, then credits. Exclude explanations from any journal entries.)

Date

Accounts

Debit

Credit

Mar. 31

Choose from any list or enter any number in the input fields and then click Check Answer.

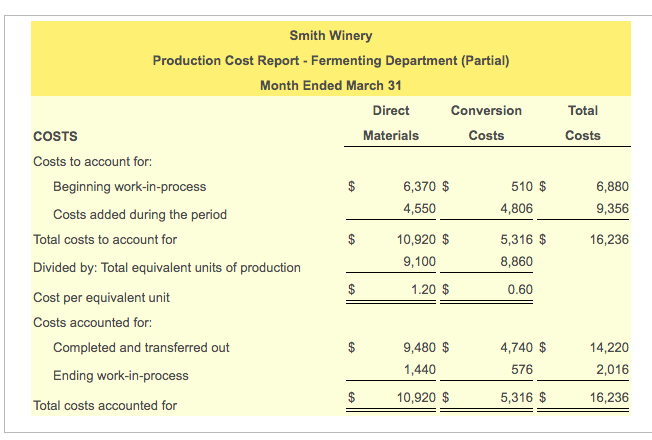

Transcribed Image Text:Smith Winery

Production Cost Report - Fermenting Department (Partial)

Month Ended March 31

Direct

Conversion

Total

COSTS

Materials

Costs

Costs

Costs to account for:

Beginning work-in-process

6,370 $

510 $

6,880

Costs added during the period

4,550

4,806

9,356

Total costs to account for

$

10,920 $

5,316 $

16,236

9,100

8,860

Divided by: Total equivalent units of production

$

1.20 $

0.60

Cost per equivalent unit

Costs accounted for:

Completed and transferred out

$

9,480 $

4,740 $

14,220

1,440

576

2,016

Ending work-in-process

10,920 $

5,316 $

16,236

Total costs accounted for

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning