Software Distributors reports net income of $52,000. Included in that number is depreciation expense of $8,500 and a loss on the sale of land of $4,700. A comparison of this year's and last year's balance sheets reveals a decrease in accounts receivable of $22,000, a decrease in inventory of $13,500, and an increase in accounts payable of $42,000. Required: Prepare the operating activities section of the statement of cash flows using the indirect method. (List cash outflows and any lecrease in cash as negative amounts.) SOFTWARE DISTRIBUTORS Statement of Cash Flows (partial) Cash flows from operating activities: Adjustments to reconcile net income to net cash flows from operating activities: Net cash flows from operating activities

Software Distributors reports net income of $52,000. Included in that number is depreciation expense of $8,500 and a loss on the sale of land of $4,700. A comparison of this year's and last year's balance sheets reveals a decrease in accounts receivable of $22,000, a decrease in inventory of $13,500, and an increase in accounts payable of $42,000. Required: Prepare the operating activities section of the statement of cash flows using the indirect method. (List cash outflows and any lecrease in cash as negative amounts.) SOFTWARE DISTRIBUTORS Statement of Cash Flows (partial) Cash flows from operating activities: Adjustments to reconcile net income to net cash flows from operating activities: Net cash flows from operating activities

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter13: Statement Of Cash Flows

Section: Chapter Questions

Problem 13.2BE: Adjustments to net incomeindirect method Ripley Corporations accumulated depreciationequipment...

Related questions

Question

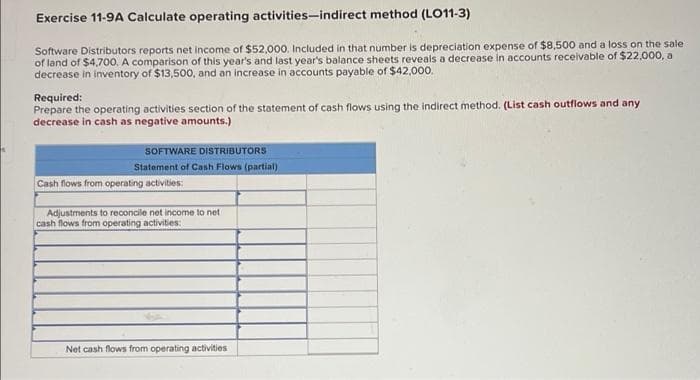

Transcribed Image Text:Exercise 11-9A Calculate operating activities-indirect method (LO11-3)

Software Distributors reports net income of $52,000. Included in that number is depreciation expense of $8,500 and a loss on the sale

of land of $4,700. A comparison of this year's and last year's balance sheets reveals a decrease in accounts receivable of $22,000, a

decrease in inventory of $13,500, and an increase in accounts payable of $42,000.

Required:

Prepare the operating activities section of the statement of cash flows using the indirect method. (List cash outflows and any

decrease in cash as negative amounts.)

SOFTWARE DISTRIBUTORS

Statement of Cash Flows (partial)

Cash flows from operating activities:

Adjustments to reconcile net income to net

cash flows from operating activities:

Net cash flows from operating activities

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning