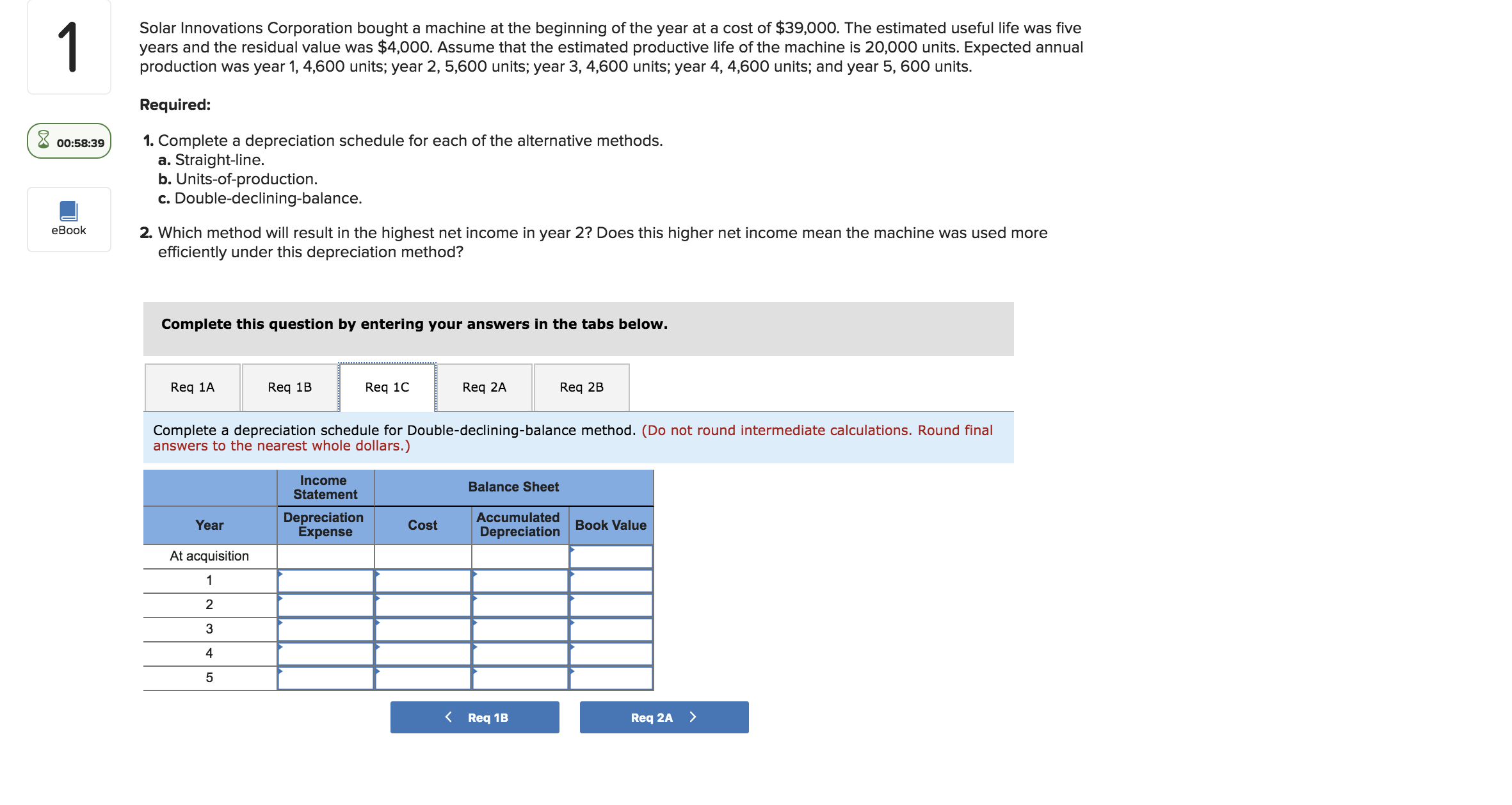

Solar Innovations Corporation bought a machine at the beginning of the year at a cost of $39,000. The estimated useful life was five years and the residual value was $4,000. Assume that the estimated productive life of the machine is 20,000 units. Expected annual production was year 1, 4,600 units; year 2, 5,600 units; year 3, 4,600 units; year 4, 4,600 units; and year 5, 600 units Required: 00:58:39. Complete a depreciation schedule for each of the alternative methods. a. Straight-line. b. Units-of-production. c. Double-declining-balance. eBook 2. Which method will result in the highest net income in year 2? Does this higher net income mean the machine was used more efficiently under this depreciation method? Complete this question by entering your answers in the tabs below Req 1A Req 1B Req 1C Req 2A Req 2B Complete a depreciation schedule for Double-declining-balance method. (Do not round intermediate calculations. Round final answers to the nearest whole dollars.) Income Statement Balance Sheet Depreciation Expense Accumulated Depreciation Book Value Year Cost At acquisition 2 3 4 5 Req 1 Req 2A >

Solar Innovations Corporation bought a machine at the beginning of the year at a cost of $39,000. The estimated useful life was five years and the residual value was $4,000. Assume that the estimated productive life of the machine is 20,000 units. Expected annual production was year 1, 4,600 units; year 2, 5,600 units; year 3, 4,600 units; year 4, 4,600 units; and year 5, 600 units Required: 00:58:39. Complete a depreciation schedule for each of the alternative methods. a. Straight-line. b. Units-of-production. c. Double-declining-balance. eBook 2. Which method will result in the highest net income in year 2? Does this higher net income mean the machine was used more efficiently under this depreciation method? Complete this question by entering your answers in the tabs below Req 1A Req 1B Req 1C Req 2A Req 2B Complete a depreciation schedule for Double-declining-balance method. (Do not round intermediate calculations. Round final answers to the nearest whole dollars.) Income Statement Balance Sheet Depreciation Expense Accumulated Depreciation Book Value Year Cost At acquisition 2 3 4 5 Req 1 Req 2A >

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 13PA: Colquhoun International purchases a warehouse for $300,000. The best estimate of the salvage value...

Related questions

Question

Transcribed Image Text:Solar Innovations Corporation bought a machine at the beginning of the year at a cost of $39,000. The estimated useful life was five

years and the residual value was $4,000. Assume that the estimated productive life of the machine is 20,000 units. Expected annual

production was year 1, 4,600 units; year 2, 5,600 units; year 3, 4,600 units; year 4, 4,600 units; and year 5, 600 units

Required:

00:58:39. Complete a depreciation schedule for each of the alternative methods.

a. Straight-line.

b. Units-of-production.

c. Double-declining-balance.

eBook

2. Which method will result in the highest net income in year 2? Does this higher net income mean the machine was used more

efficiently under this depreciation method?

Complete this question by entering your answers in the tabs below

Req 1A

Req 1B

Req 1C

Req 2A

Req 2B

Complete a depreciation schedule for Double-declining-balance method. (Do not round intermediate calculations. Round final

answers to the nearest whole dollars.)

Income

Statement

Balance Sheet

Depreciation

Expense

Accumulated

Depreciation Book Value

Year

Cost

At acquisition

2

3

4

5

Req 1

Req 2A >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT