Sometimes companies pay dividends in the form of additional shares of stock instead of cash. The impact of making distributions in the form of stock dividends is reflected in the statement of stockholders' equity. Consider the case of the Saltwater Logistics Inc.: The pre-stock dividend common stockholders' equity statement for Saltwater Logistics Inc. is as follows: Saltwater Logistics Inc. Pre-Stock Dividend Common Stockholders' Equity Common stock ($8 par, 1,600,000 shares) $12,800,000 Contributed capital in excess of par $1,200,000 $4,000,000 $18,000,000 Retained earnings Total common stockholders' equity Suppose you own 100 shares of Saltwater Logistics's stock. Saltwater Logistics's stock is trading at a market price of $16 per share, and the company

Sometimes companies pay dividends in the form of additional shares of stock instead of cash. The impact of making distributions in the form of stock dividends is reflected in the statement of stockholders' equity. Consider the case of the Saltwater Logistics Inc.: The pre-stock dividend common stockholders' equity statement for Saltwater Logistics Inc. is as follows: Saltwater Logistics Inc. Pre-Stock Dividend Common Stockholders' Equity Common stock ($8 par, 1,600,000 shares) $12,800,000 Contributed capital in excess of par $1,200,000 $4,000,000 $18,000,000 Retained earnings Total common stockholders' equity Suppose you own 100 shares of Saltwater Logistics's stock. Saltwater Logistics's stock is trading at a market price of $16 per share, and the company

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.12E

Related questions

Question

100%

Hello. I need help with verifying if my answers are correct. I have pasted the problem and formula I used.

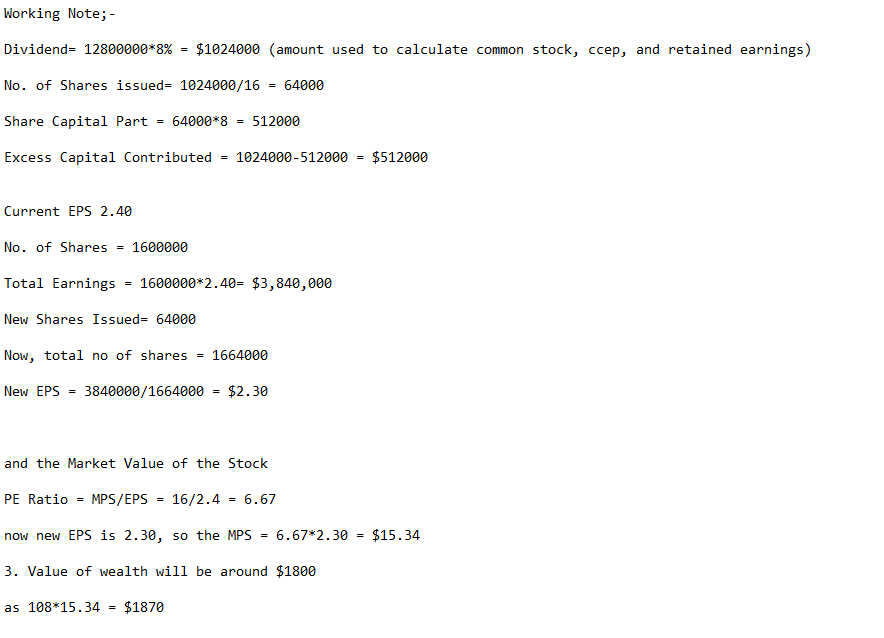

Transcribed Image Text:Working Note; -

Dividend 12800000*8%

Current EPS 2.40

No. of Shares issued= 1024000/16

Share Capital Part

Excess Capital Contributed

No. of Shares

=

=

New EPS =

$1024000 (amount used to calculate common stock, ccep, and retained earnings)

= 1600000

64000*8

New Shares Issued= 64000

=

as 108*15.34 = $1870

Total Earnings = 1600000*2.40= $3,840,000

Now, total no of shares 1664000

=

= 512000

1024000-512000

3840000/1664000 = $2.30

64000

and the Market Value of the Stock

PE Ratio = MPS/EPS = 16/2.4 = 6.67

now new EPS is 2.30, so the MPS

3. Value of wealth will be around $1800

=

=

$512000

6.67*2.30 = $15.34

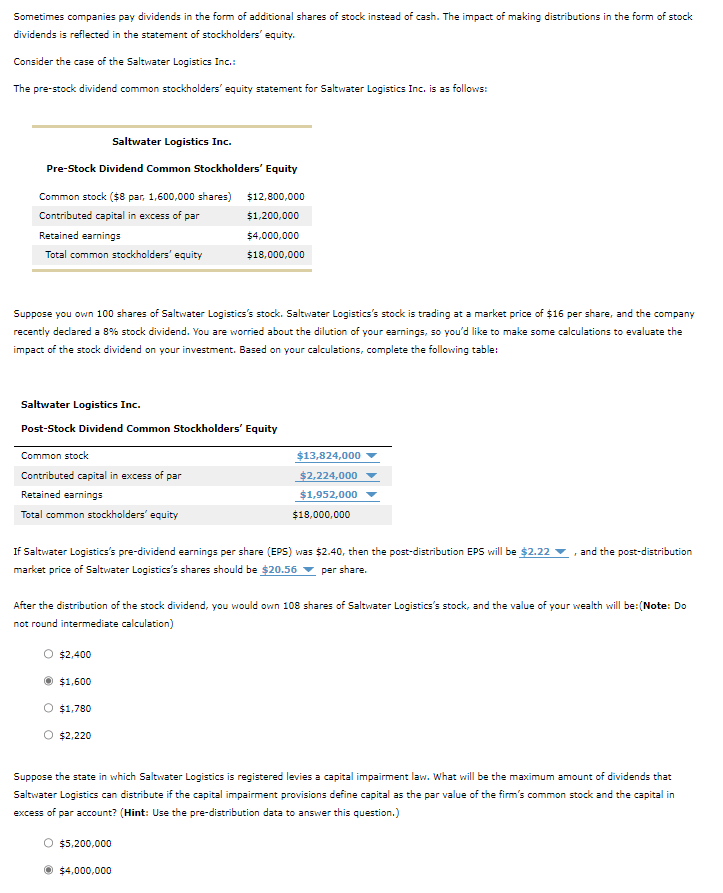

Transcribed Image Text:Sometimes companies pay dividends in the form of additional shares of stock instead of cash. The impact of making distributions in the form of stock

dividends is reflected in the statement of stockholders' equity.

Consider the case of the Saltwater Logistics Inc.:

The pre-stock dividend common stockholders' equity statement for Saltwater Logistics Inc. is as follows:

Saltwater Logistics Inc.

Pre-Stock Dividend Common Stockholders' Equity

Common stock ($8 par, 1,600,000 shares)

$12,800,000

Contributed capital in excess of par

$1,200,000

$4,000,000

$18,000,000

Retained earnings

Total common stockholders' equity

Suppose you own 100 shares of Saltwater Logistics's stock. Saltwater Logistics's stock is trading at a market price of $16 per share, and the company

recently declared a 8% stock dividend. You are worried about the dilution of your earnings, so you'd like to make some calculations to evaluate the

impact of the stock dividend on your investment. Based on your calculations, complete the following table:

Saltwater Logistics Inc.

Post-Stock Dividend Common Stockholders' Equity

Common stock

Contributed capital in excess of par

Retained earnings

Total common stockholders' equity

If Saltwater Logistics's pre-dividend earnings per share (EPS) was $2.40, then the post-distribution EPS will be $2.22

market price of Saltwater Logistics's shares should be $20.56 per share.

$2,400

$1,600

After the distribution of the stock dividend, you would own 108 shares of Saltwater Logistics's stock, and the value of your wealth will be:(Note: Do

not round intermediate calculation)

$1,780

O $2,220

$13,824,000

$2,224,000

$1,952,000

$18,000,000

$5,200,000

$4,000,000

and the post-distribution

Suppose the state in which Saltwater Logistics is registered levies a capital impairment law. What will be the maximum amount of dividends that

Saltwater Logistics can distribute if the capital impairment provisions define capital as the par value of the firm's common stock and the capital in

excess of par account? (Hint: Use the pre-distribution data to answer this question.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning