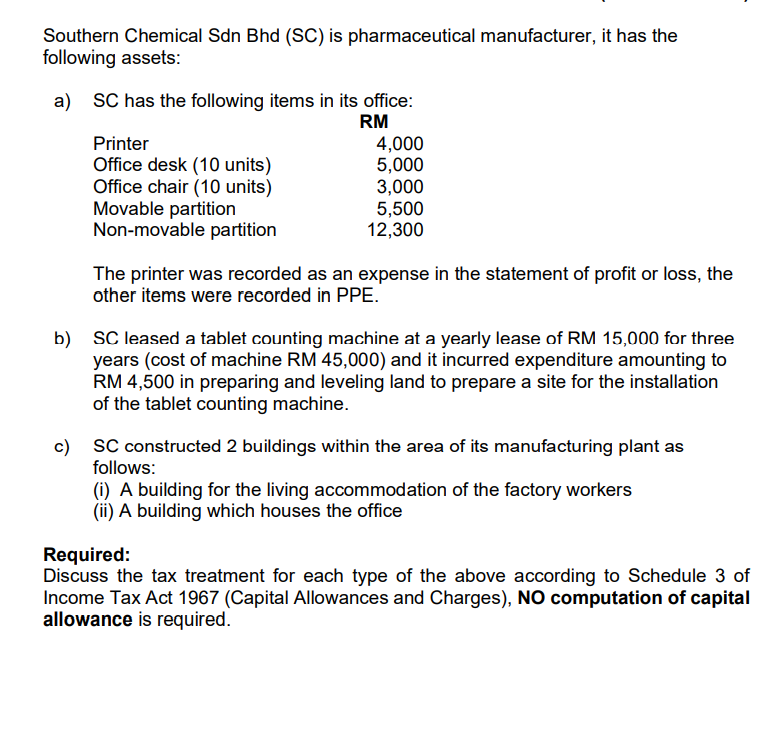

Southern Chemical Sdn Bhd (SC) is pharmaceutical manufacturer, it has the following assets: a) SC has the following items in its office: RM Printer Office desk (10 units) Office chair (10 units) Movable partition Non-movable partition 4,000 5,000 3,000 5,500 12,300 The printer was recorded as an expense in the statement of profit or loss, the other items were recorded in PPE. b) SC leased a tablet counting machine at a yearly lease of RM 15,000 for three years (cost of machine RM 45,000) and it incurred expenditure amounting to RM 4,500 in preparing and leveling land to prepare a site for the installation of the tablet counting machine. c) SC constructed 2 buildings within the area of its manufacturing plant as follows: (i) A building for the living accommodation of the factory workers (ii) A building which houses the office Required: Discuss the tax treatment for each type of the above according to Schedule 3 of Income Tax Act 1967 (Capital Allowances and Charges), NO computation of capital allowance is required.

Southern Chemical Sdn Bhd (SC) is pharmaceutical manufacturer, it has the following assets: a) SC has the following items in its office: RM Printer Office desk (10 units) Office chair (10 units) Movable partition Non-movable partition 4,000 5,000 3,000 5,500 12,300 The printer was recorded as an expense in the statement of profit or loss, the other items were recorded in PPE. b) SC leased a tablet counting machine at a yearly lease of RM 15,000 for three years (cost of machine RM 45,000) and it incurred expenditure amounting to RM 4,500 in preparing and leveling land to prepare a site for the installation of the tablet counting machine. c) SC constructed 2 buildings within the area of its manufacturing plant as follows: (i) A building for the living accommodation of the factory workers (ii) A building which houses the office Required: Discuss the tax treatment for each type of the above according to Schedule 3 of Income Tax Act 1967 (Capital Allowances and Charges), NO computation of capital allowance is required.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:Southern Chemical Sdn Bhd (SC) is pharmaceutical manufacturer, it has the

following assets:

a) SC has the following items in its office:

RM

Printer

Office desk (10 units)

Office chair (10 units)

Movable partition

Non-movable partition

4,000

5,000

3,000

5,500

12,300

The printer was recorded as an expense in the statement of profit or loss, the

other items were recorded in PPE.

b) SC leased a tablet counting machine at a yearly lease of RM 15,000 for three

years (cost of machine RM 45,000) and it incurred expenditure amounting to

RM 4,500 in preparing and leveling land to prepare a site for the installation

of the tablet counting machine.

c) SC constructed 2 buildings within the area of its manufacturing plant as

follows:

(i) A building for the living accommodation of the factory workers

(ii) A building which houses the office

Required:

Discuss the tax treatment for each type of the above according to Schedule 3 of

Income Tax Act 1967 (Capital Allowances and Charges), NO computation of capital

allowance is required.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education