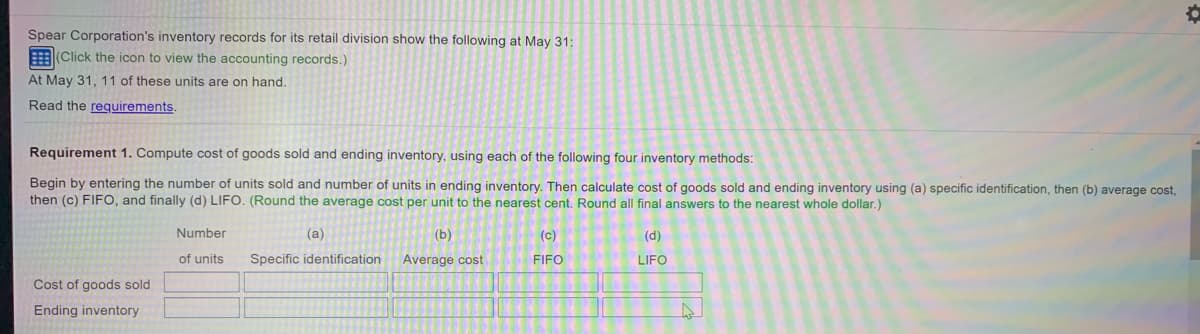

Spear Corporation's inventory records for its retail division show the following at May 31: (Click the icon to view the accounting records.) At May 31, 11 of these units are on hand. Read the requirements. Requirement 1. Compute cost of goods sold and ending inventory, using each of the following four inventory methods: Begin by entering the number of units sold and number of units in ending inventory. Then calculate cost of goods sold and ending inventory using (a) specific identification, then (b) average cost, then (c) FIFO, and finally (d) LIFO. (Round the average cost per unit to the nearest cent. Round all final answers to the nearest whole dollar.) Number (a) (b) (c) (d) of units Specific identification Average cost FIFO LIFO Cost of goods sold Ending inventory

Spear Corporation's inventory records for its retail division show the following at May 31: (Click the icon to view the accounting records.) At May 31, 11 of these units are on hand. Read the requirements. Requirement 1. Compute cost of goods sold and ending inventory, using each of the following four inventory methods: Begin by entering the number of units sold and number of units in ending inventory. Then calculate cost of goods sold and ending inventory using (a) specific identification, then (b) average cost, then (c) FIFO, and finally (d) LIFO. (Round the average cost per unit to the nearest cent. Round all final answers to the nearest whole dollar.) Number (a) (b) (c) (d) of units Specific identification Average cost FIFO LIFO Cost of goods sold Ending inventory

Chapter10: Inventory

Section: Chapter Questions

Problem 2TP: Assume your company uses the periodic inventory costing method, and the inventory count left out an...

Related questions

Topic Video

Question

Transcribed Image Text:Spear Corporation's inventory records for its retail division show the following at May 31:

(Click the icon to view the accounting records.)

At May 31, 11 of these units are on hand.

Read the requirements

Requirement 1. Compute cost of goods sold and ending inventory, using each of the following four inventory methods:

Begin by entering the number of units sold and number of units in ending inventory. Then calculate cost of goods sold and ending inventory using (a) specific identification, then (b) average cost,

then (c) FIFO, and finally (d) LIFO. (Round the average cost per unit to the nearest cent. Round all final answers to the nearest whole dollar.)

Number

(a)

(b)

(c)

(d)

of units

Specific identification

Average cost

FIFO

LIFO

Cost of goods sold

Ending inventory

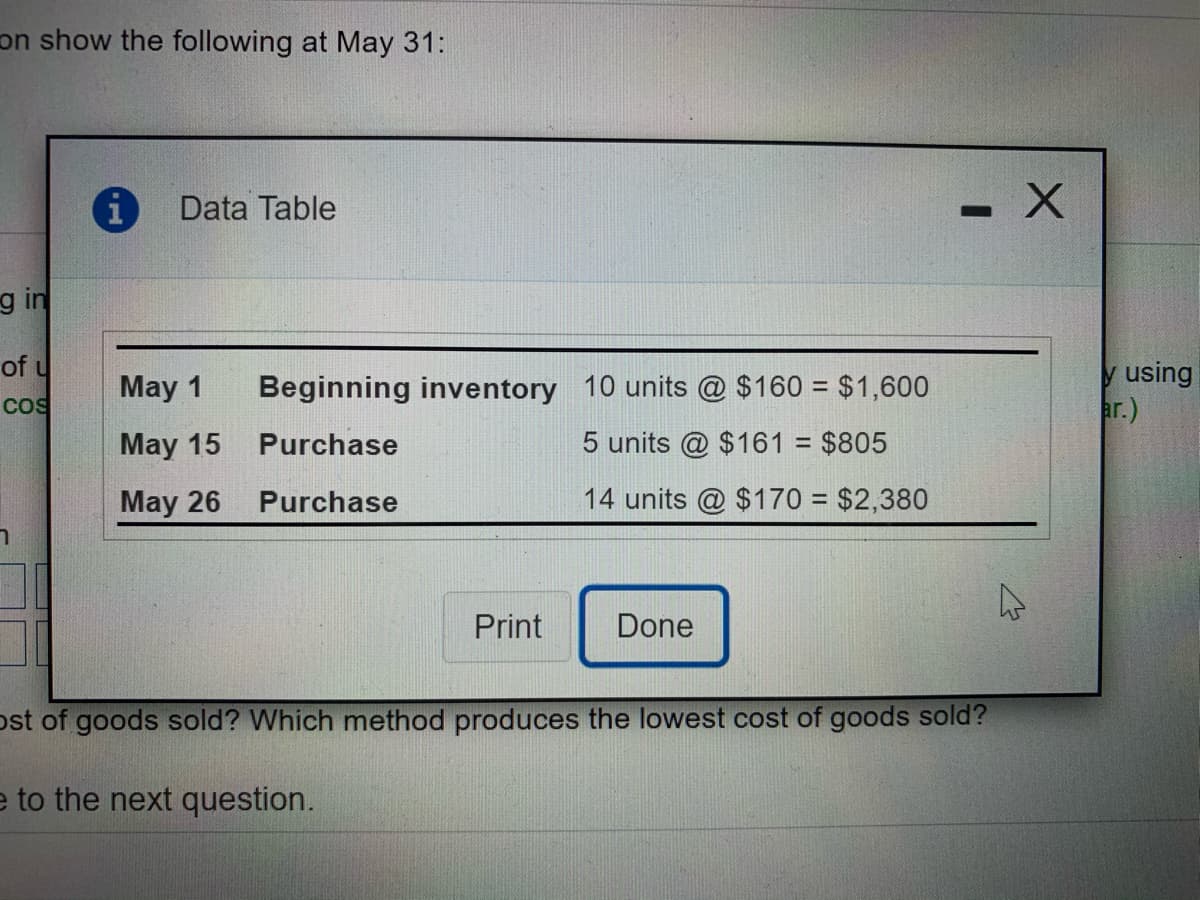

Transcribed Image Text:on show the following at May 31:

Data Table

g in

of u

y using

ar.)

May 1

Beginning inventory 10 units @ $160 = $1,600

Cos

May 15

Purchase

5 units @ $161 = $805

%3D

May 26

Purchase

14 units @ $170 = $2,380

Print

Done

ost of goods sold? Which method produces the lowest cost of goods sold?

e to the next question.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning