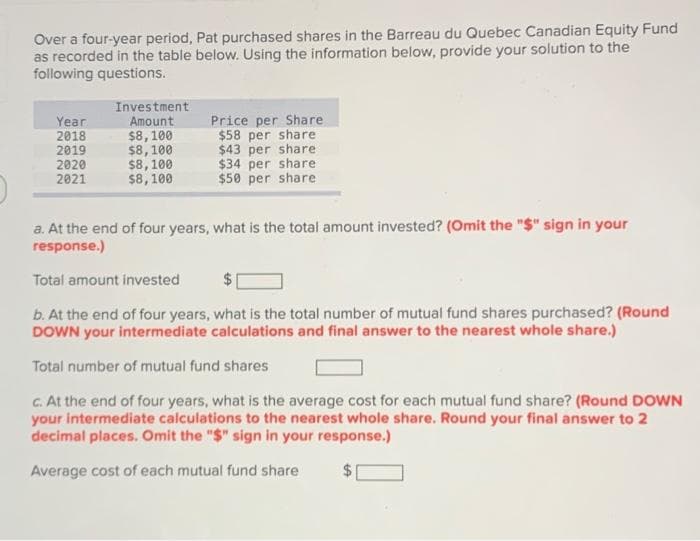

Over a four-year period, Pat purchased shares in the Barreau du Quebec Canadian Equity Fund as recorded in the table below. Using the information below, provide your solution to the following questions. Investment Amount $8,100 $8, 100 $8, 100 $8,100 Price per Share. $58 per share $43 per share $34 per share $50 per share Year 2018 2019 2020 2021 a. At the end of four years, what is the total amount invested? (Omit the "$" sign in your response.) Total amount invested b. At the end of four years, what is the total number of mutual fund shares purchased? (Round DOWN your intermediate calculations and final answer to the nearest whole share.) Total number of mutual fund shares C. At the end of four years, what is the average cost for each mutual fund share? (Round DOWN your intermediate calculations to the nearest whole share. Round your final answer to 2 decimal places. Omit the "$" sign in your response.) Average cost of each mutual fund share

Over a four-year period, Pat purchased shares in the Barreau du Quebec Canadian Equity Fund as recorded in the table below. Using the information below, provide your solution to the following questions. Investment Amount $8,100 $8, 100 $8, 100 $8,100 Price per Share. $58 per share $43 per share $34 per share $50 per share Year 2018 2019 2020 2021 a. At the end of four years, what is the total amount invested? (Omit the "$" sign in your response.) Total amount invested b. At the end of four years, what is the total number of mutual fund shares purchased? (Round DOWN your intermediate calculations and final answer to the nearest whole share.) Total number of mutual fund shares C. At the end of four years, what is the average cost for each mutual fund share? (Round DOWN your intermediate calculations to the nearest whole share. Round your final answer to 2 decimal places. Omit the "$" sign in your response.) Average cost of each mutual fund share

Chapter4: Preparing And Using Financial Statements

Section: Chapter Questions

Problem 1EP

Related questions

Question

Transcribed Image Text:Over a four-year period, Pat purchased shares in the Barreau du Quebec Canadian Equity Fund

as recorded in the table below. Using the information below, provide your solution to the

following questions.

Year

2018

2019

2020

2021

Investment

Amount

$8, 100

$8, 100

$8,100

$8, 100

Price per Share

$58 per share

$43 per share

$34 per share

$50 per share

a. At the end of four years, what is the total amount invested? (Omit the "$" sign in your

response.)

Total amount invested

b. At the end of four years, what is the total number of mutual fund shares purchased? (Round

DOWN your intermediate calculations and final answer to the nearest whole share.)

Total number of mutual fund shares

C. At the end of four years, what is the average cost for each mutual fund share? (Round DOWN

your intermediate calculations to the nearest whole share. Round your final answer to 2

decimal places. Omit the "$" sign in your response.)

Average cost of each mutual fund share

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 2 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning